Taiwan’s Central Bank President Yang Jinlong emphasizes a cautious approach to CBDC development, focusing on innovation and efficiency over speed. Plans include a digital New Taiwan Dollar and applying tokenization technology.

The central bank mentioned handling government tenders through special purpose tokens to improve operational efficiency using smart contracts for bids and performance bonds.

Yang stated that being the first to introduce a CBDC does not guarantee success, as countries that have already issued or tested CBDCs have not seen the desired outcomes, according to a July 7 newsIn his written report released today, before his presentation to the Finance Committee of the Legislative Yuan on Wednesday, Yang outlined the central bank’s plans for the digital New Taiwan Dollar.

One significant development is the CBDC prototype platform designed for retail payments. According to Yang, this platform can already support the cash flow operation of digital coupons, with transaction processing speeds reaching 20,000 transactions per second .

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

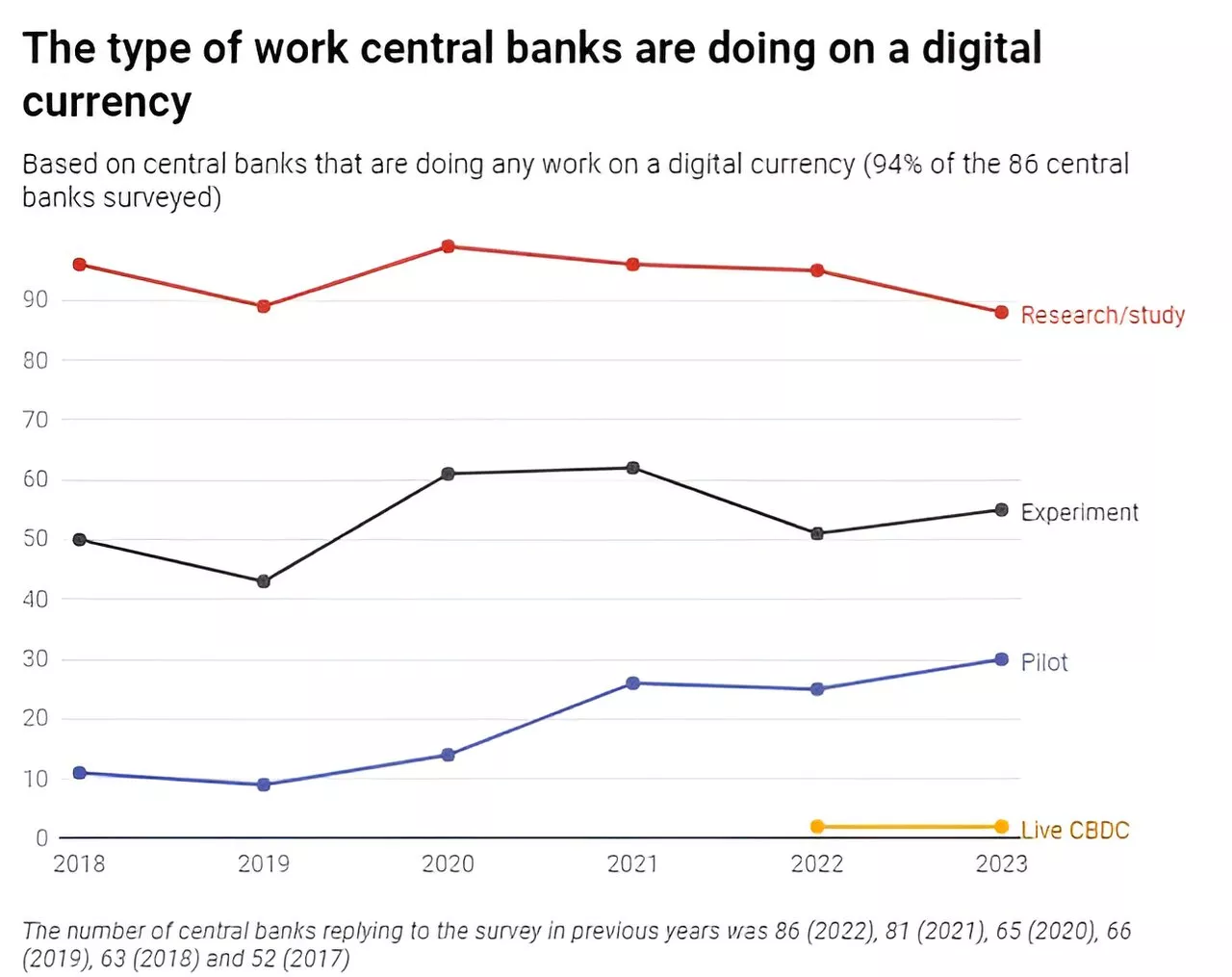

More Central Banks Are Exploring a CBDC, BIS Survey FindsCamomile Shumba is a CoinDesk regulatory reporter based in the UK. She previously worked as an intern for Business Insider and Bloomberg News. She does not currently hold value in any digital currencies or projects.

More Central Banks Are Exploring a CBDC, BIS Survey FindsCamomile Shumba is a CoinDesk regulatory reporter based in the UK. She previously worked as an intern for Business Insider and Bloomberg News. She does not currently hold value in any digital currencies or projects.

Read more »

European Central Bank releases first CBDC progress updateIn the first official progress update, the European Central Bank touched on features it is exploring for its proposed central bank digital currency.

Read more »

China views Taiwan's 'elimination' as national cause, Taiwan president saysChina views Taiwan's 'elimination' as national cause, Taiwan president says

China views Taiwan's 'elimination' as national cause, Taiwan president saysChina views Taiwan's 'elimination' as national cause, Taiwan president says

Read more »

China views Taiwan’s ‘elimination’ as national cause, Taiwan president saysReuters

China views Taiwan’s ‘elimination’ as national cause, Taiwan president saysReuters

Read more »

Will digital currencies become the norm as the world moves towards a cashless society?More than 90% of the world's central banks are looking at introducing a central bank digital currency (CBDC), to complement existing banknotes.

Will digital currencies become the norm as the world moves towards a cashless society?More than 90% of the world's central banks are looking at introducing a central bank digital currency (CBDC), to complement existing banknotes.

Read more »

Bahamas wants to force banks to support its ‘Sand dollar’ CBDCAmid poor adoption of The Bahamas’ “Sand Dollar” CBDC, the government is preparing regulations that will force commercial banks to distribute the nation’s digital currency.

Read more »