ICYMI 🔊 SVB’s collapse sparked a mass selloff in bank stocks. peter_tl, johnsfoley and LiamWardProud join aimeedonnellan to debate the causes of investor jitters, the implications of intervention by governments and regulators, and more. Listen 👉

Breakingviews columnists talk about the big numbers, crunchy deals and nasty spats in global business and economics, .

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

SVB’s collapse casts long and global shadow by ViewsroomThe US bank’s failure sparked a mass selloff in bank stocks. In this Viewsroom podcast, Breakingviews columnists debate the causes of investor jitters, the long-term implications of intervention by governments and regulators, and the latest concerns about Credit Suisse.

SVB’s collapse casts long and global shadow by ViewsroomThe US bank’s failure sparked a mass selloff in bank stocks. In this Viewsroom podcast, Breakingviews columnists debate the causes of investor jitters, the long-term implications of intervention by governments and regulators, and the latest concerns about Credit Suisse.

Read more »

SVB’s collapse casts long and global shadow by ViewsroomThe US bank’s failure sparked a mass selloff in bank stocks. In this Viewsroom podcast, Breakingviews columnists debate the causes of investor jitters, the long-term implications of intervention by governments and regulators, and the latest concerns about Credit Suisse.

SVB’s collapse casts long and global shadow by ViewsroomThe US bank’s failure sparked a mass selloff in bank stocks. In this Viewsroom podcast, Breakingviews columnists debate the causes of investor jitters, the long-term implications of intervention by governments and regulators, and the latest concerns about Credit Suisse.

Read more »

Breakingviews - China-Swiss stock link has flimsy foundationsA stock scheme linking China and Switzerland has attracted ire from an unexpected source: Beijing. The Chinese securities regulator is halting applications from mainland-listed firms seeking to sell global depositary receipts in Zurich, Bloomberg reported on Thursday. Concerns that Chinese investors are buying overseas to make a quick profit at home are valid. Yet in the absence of interest from international institutions, such cross-border stock links serve little purpose.

Breakingviews - China-Swiss stock link has flimsy foundationsA stock scheme linking China and Switzerland has attracted ire from an unexpected source: Beijing. The Chinese securities regulator is halting applications from mainland-listed firms seeking to sell global depositary receipts in Zurich, Bloomberg reported on Thursday. Concerns that Chinese investors are buying overseas to make a quick profit at home are valid. Yet in the absence of interest from international institutions, such cross-border stock links serve little purpose.

Read more »

Breakingviews - Larry Fink finds way to dodge ESG crosshairsSeismic events elsewhere are making it easier for BlackRock to inch away from the environmental, social and governance crosshairs. The $8 trillion asset manager’s chair Larry Fink used his annual investor letter to theorise that inflation might stay around 4%, predict stricter bank capital requirements, and namecheck his favourite 80’s band, Talk Talk. Less front and centre than in previous years was a preoccupation with climate change.

Breakingviews - Larry Fink finds way to dodge ESG crosshairsSeismic events elsewhere are making it easier for BlackRock to inch away from the environmental, social and governance crosshairs. The $8 trillion asset manager’s chair Larry Fink used his annual investor letter to theorise that inflation might stay around 4%, predict stricter bank capital requirements, and namecheck his favourite 80’s band, Talk Talk. Less front and centre than in previous years was a preoccupation with climate change.

Read more »

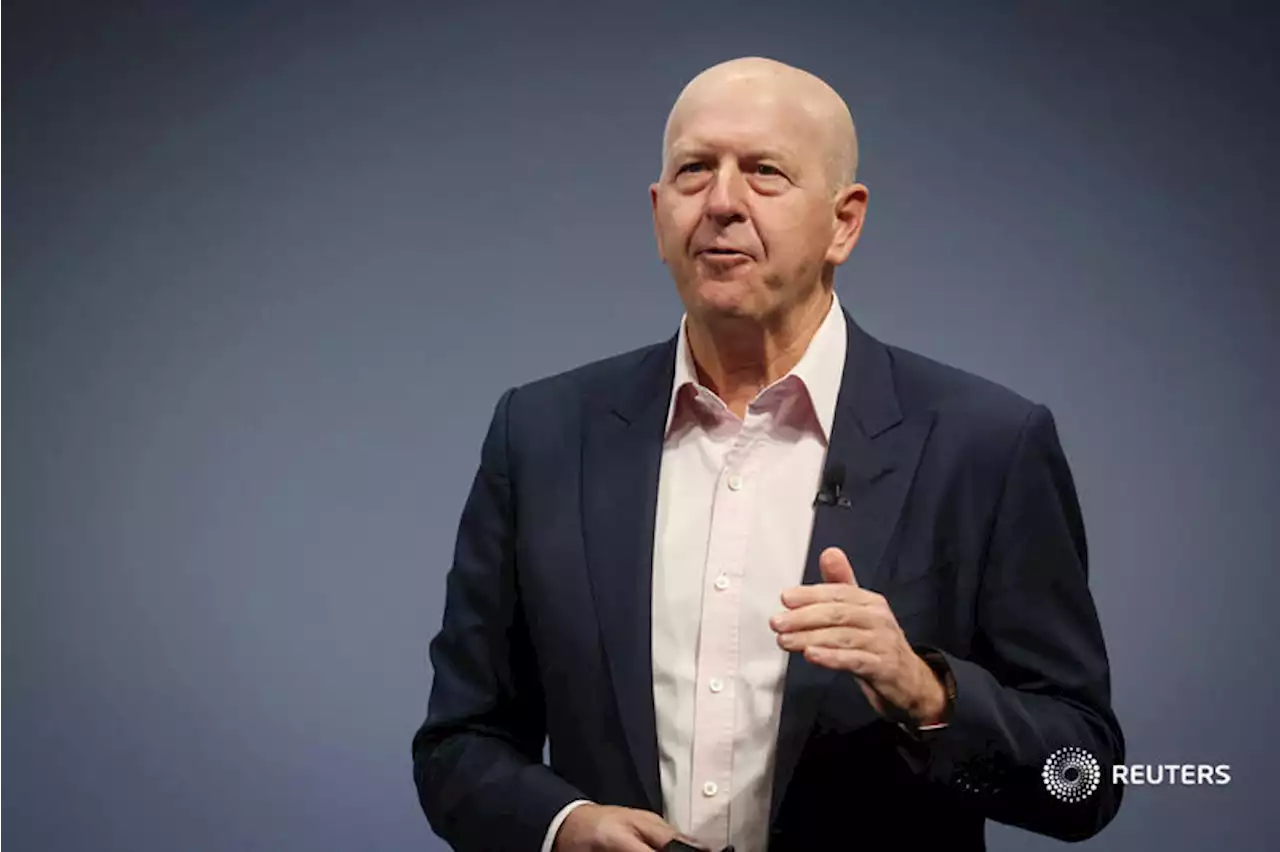

Breakingviews - Goldman’s new strategy gets baptism of fireThe collapse of Silicon Valley Bank is providing a slightly awkward showcase for Goldman Sachs’ manifold talents. The Wall Street firm’s traders bought bonds from the technology-focused lender as its bankers attempted to help plug the resulting hole the sale left in SVB’s balance sheet. And it is in position to scoop up troubled assets elsewhere. It’s true to the new unified “One Goldman Sachs” strategy expounded by Chief Executive David Solomon, dampened by the client not living to tell the tale.

Breakingviews - Goldman’s new strategy gets baptism of fireThe collapse of Silicon Valley Bank is providing a slightly awkward showcase for Goldman Sachs’ manifold talents. The Wall Street firm’s traders bought bonds from the technology-focused lender as its bankers attempted to help plug the resulting hole the sale left in SVB’s balance sheet. And it is in position to scoop up troubled assets elsewhere. It’s true to the new unified “One Goldman Sachs” strategy expounded by Chief Executive David Solomon, dampened by the client not living to tell the tale.

Read more »

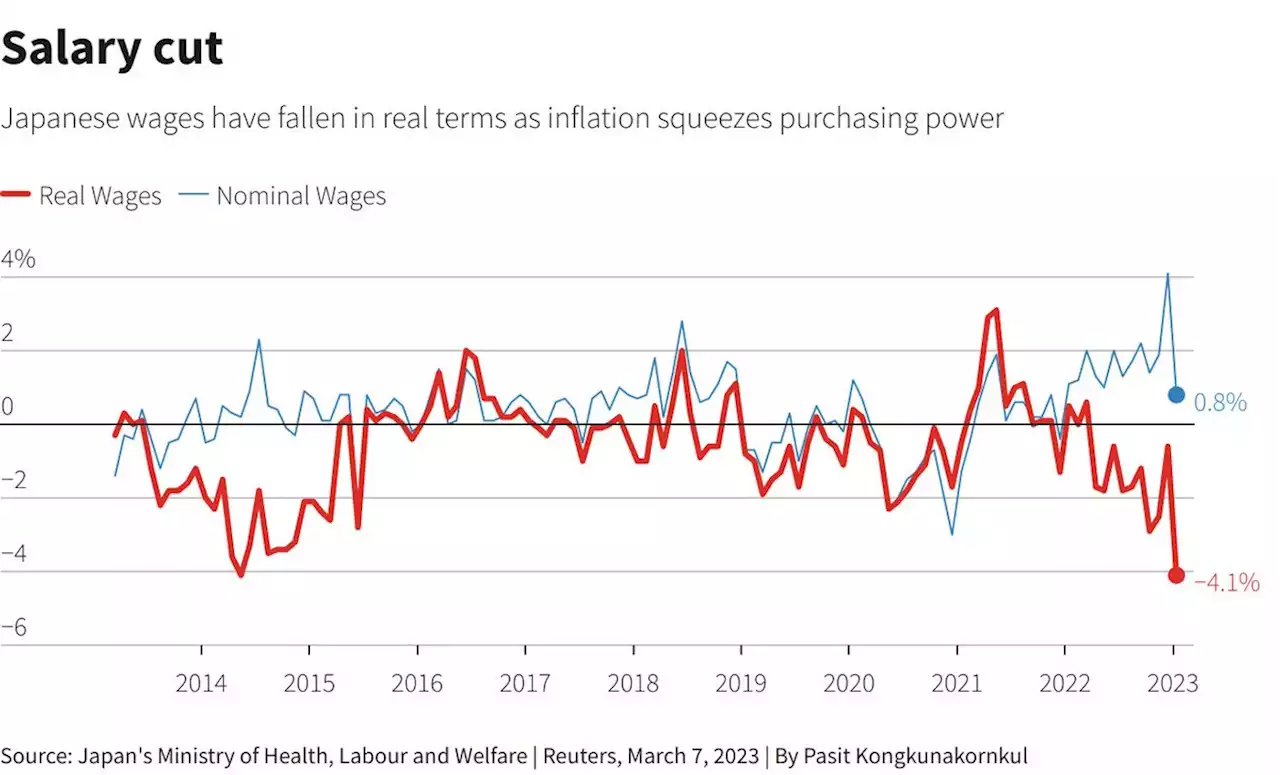

Breakingviews - Bad news salvo gives Bank of Japan some coverIncoming Bank of Japan Governor Kazuo Ueda can breathe a sigh of relief; things aren’t going very well. The conclusion of annual wage negotiations between major industrial unions and employers resulted in average salary rises of around 3%, the highest since 1997 but still slower than consumer prices. Ripples from the collapse of Silicon Valley Bank have shoved down sovereign bond yields, inadvertently driving off an attack by traders who believed global inflation made rate hikes unavoidable. Avoidable is now the precise word.

Breakingviews - Bad news salvo gives Bank of Japan some coverIncoming Bank of Japan Governor Kazuo Ueda can breathe a sigh of relief; things aren’t going very well. The conclusion of annual wage negotiations between major industrial unions and employers resulted in average salary rises of around 3%, the highest since 1997 but still slower than consumer prices. Ripples from the collapse of Silicon Valley Bank have shoved down sovereign bond yields, inadvertently driving off an attack by traders who believed global inflation made rate hikes unavoidable. Avoidable is now the precise word.

Read more »