Following the collapse of Silicon Valley Bank, the finger pointing started almost immediately in Washington and on Wall Street as fears of a broader fallout mounted. Here are the facts surrounding some of the loudest claims about SVB. blame game

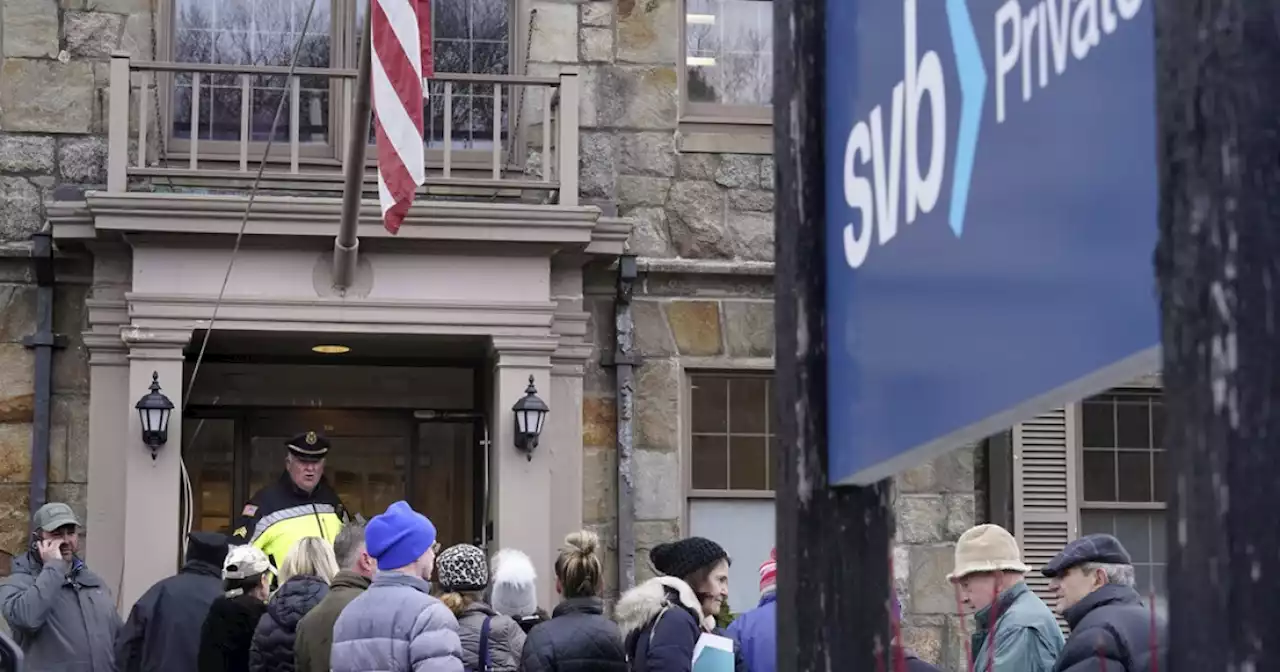

Silicon Valley Bank, a midsized institution that finished last year with nearly $200 billion in deposits, shuttered Friday and reopened on Monday under the direction of federal regulators.The blame game started almost immediately in Washington and on Wall Street as fears of a broader fallout mounted.

SVB arrived at that crossroads recently because the economic downturn caused by inflation, interest rates, and a lack of new investment in the tech industry meant the bank’s clients started pulling out their money at a faster pace than usual just to keep their businesses afloat. “Joe Biden is pretending this isn't a bailout. It is,” Nikki Haley, the former South Carolina governor running for the GOP presidential nomination, said on Monday. “Now depositors at healthy banks are forced to subsidize Silicon Valley Bank's mismanagement.”

Critics of the Biden administration’s approach in this case have questioned whether future failed banks will expect the same treatment from federal regulators. Who will foot the bill for the loan program? Federal officials said the Treasury Department will make $25 billion available as a “backstop” for the loans, which the Biden administration hopes not to use.

The bank also heavily promoted its diversity commitments in leadership, which one Wall Street Journal columnist suggested was a possible factor in why management failed so spectacularly. Signature Bank in New York City also closed its doors on Sunday after the SVB collapse, facing a similar run on deposits from customers who panicked after seeing what happened on the opposite coast.

The cost of compliance, he argued, was disproportionately higher for regional banks than for global firms with legions more staff. Larger banks are also required to keep more cash on hand than smaller ones since the rules were rolled back.In the end, SVB was done in by a bank run, which is a product of human behavior and emotions. Some analysts have speculated that the uniquely plugged-in nature of SVB’s clientele, coming mostly from tech and venture capitalist firms that closely track the financial industry, contributed to the speed of the run on deposits last week.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Can the Government Contain a Banking Crisis? - The Journal. - WSJ PodcastsWhen Silicon Valley Bank imploded last week, it was the second biggest bank failure in U.S. history. Then, over the weekend, another bank, Signature Bank, was also taken over by the government. WSJ financial editor Charles Forelle explains what kicked off this banking crisis and how the government is scrambling to contain it. Further Reading: - How Silicon Valley Turned on Silicon Valley Bank - Silicon Valley Bank Closed by Regulators, FDIC Takes Control - Were SVB and Signature Bank Just Bailed Out by the U.S. Government?

Can the Government Contain a Banking Crisis? - The Journal. - WSJ PodcastsWhen Silicon Valley Bank imploded last week, it was the second biggest bank failure in U.S. history. Then, over the weekend, another bank, Signature Bank, was also taken over by the government. WSJ financial editor Charles Forelle explains what kicked off this banking crisis and how the government is scrambling to contain it. Further Reading: - How Silicon Valley Turned on Silicon Valley Bank - Silicon Valley Bank Closed by Regulators, FDIC Takes Control - Were SVB and Signature Bank Just Bailed Out by the U.S. Government?

Read more »

![]() Silicon Valley Bank Collapse: US Moves to Protect Deposits, HSBC to Buy SVB's UK SubsidiaryGovernments in the U.S. and Britain are taking extraordinary steps to stop a potential banking crisis after the historic failure of Silicon Valley Bank.

Silicon Valley Bank Collapse: US Moves to Protect Deposits, HSBC to Buy SVB's UK SubsidiaryGovernments in the U.S. and Britain are taking extraordinary steps to stop a potential banking crisis after the historic failure of Silicon Valley Bank.

Read more »

![]() Silicon Valley Bank collapse: How SVB stock price performed in 5 yearsSilicon Valley Bank had been rated as one of the top banks in America for five years before its closure by U.S. regulators in March 2023.

Silicon Valley Bank collapse: How SVB stock price performed in 5 yearsSilicon Valley Bank had been rated as one of the top banks in America for five years before its closure by U.S. regulators in March 2023.

Read more »

![]() SVB collapse: HSBC buys Silicon Valley Bank's UK branch for just over $1HSBC acquired the U.K. branch of the failing Silicon Valley Bank for just 1 pound, or $1.21.

SVB collapse: HSBC buys Silicon Valley Bank's UK branch for just over $1HSBC acquired the U.K. branch of the failing Silicon Valley Bank for just 1 pound, or $1.21.

Read more »

![]() SVB collapse: Silicon Valley Bank is not getting a bailoutThe term “bailout” is a dirty word, and rightly so. When taxpayers are forced to pay for the mistakes of corporate executives, and investors who were supposed to be monitoring those executives, bad incentives for risk-taking are created.

SVB collapse: Silicon Valley Bank is not getting a bailoutThe term “bailout” is a dirty word, and rightly so. When taxpayers are forced to pay for the mistakes of corporate executives, and investors who were supposed to be monitoring those executives, bad incentives for risk-taking are created.

Read more »

Ex-Ripple Advisor Appointed by Fed to Watch Over Failed Silicon Valley Bank (SVB)Ex-Ripple official to head Silicon Valley Bank's supervision by Federal Reserve ripple xrp ripplesec xrpsec xrpthestandard siliconvalleybank svb fed bankcrash $xrp $svb

Ex-Ripple Advisor Appointed by Fed to Watch Over Failed Silicon Valley Bank (SVB)Ex-Ripple official to head Silicon Valley Bank's supervision by Federal Reserve ripple xrp ripplesec xrpsec xrpthestandard siliconvalleybank svb fed bankcrash $xrp $svb

Read more »