This article details the author's experience navigating the current economic climate of rising prices and stagnant wages. She shares practical tips and strategies she's implementing to manage her family's budget and make ends meet.

This week, our mail brought more news of bills and rising prices. Our auto insurance premiums increased by several hundred dollars, and our dental insurance is not covering our daughter's braces. The basic Netflix account we've had forever also jumped in price, and our accountant told us he was increasing his fee by hundreds.It seems like everywhere I turn, we are gobsmacked by a new rising cost that we have no control over.

As I gathered paperwork for our taxes this year, seeing my husband's take-home pay and my measly freelancer income made me want to cry. Prices of literally everything are rising all around us with no end in sight and yet, we both make less than ever, especially with healthcare insurance costs rising each year too.Some days, it truly feels like a losing battle. There's only so much I can do. My husband is a public school teacher, so his salary won't increase anytime soon.That said, I am trying. After all, I graduated from college in 2008, straight into a recession and I am a true millennial who, if nothing else, knows how to endure. Here are some things I am doing to manage rising prices for my five kids — three of whom are very hungry teens.I admit I've been guilty of letting leftovers rot in my fridge, but now, I am forcing myself to eat them. This morning for breakfast, I ate sauerkraut, cottage cheese, and leftover pot roast with joy because it saved me money. I have no rules about meals anymore. If it's available, I'm eating it.We travel nearly every weekend for sporting tournaments, and in the past, I have been lax about packing food and just buying snacks and meals while out. That time is over. Sorry, kids, but your soggy PB&J will have to do. I did invest in some fancy salad containers, so I can at least pack nice meals once in a while, too.Much to my husband's dismay, we have always had backyard chickens, but now that a case with 15 dozen eggs costs $120 here in Michigan, we are treating our girls like the queens they are. The freedom of having your own eggs in your backyard can be worth buying chickens if you have the space and ability.We live on a farm, so we've always raised our own beef, chicken, and pork, but now, it feels more important than ever. I've also become more passionate about selling our beef and keeping the prices affordable for local families.We also garden, and while I've always considered gardening a fun hobby, this year, I see it as essential. I plan on planting and preserving more food this year, including jam, vegetables, and potatoes. We also asked our butcher to give us more pieces of our meat chickens that are normally thrown out, like the necks, so I could make them into homemade broth.I grew up on cereal. Cereal is a staple meal in my family of origin — my mom still regularly eats it for dinner. I do buy the bulk bags of Rice Krispies because that's somewhat affordable, and my 5-year-old especially will eat them, but these days, our pantry is bare of cereal.I've been on a weight loss journey for over a year now, so I have slowly changed my eating habits. But these days, I admit I try to eat less to save money, especially away from home. Maybe not the greatest idea, but there you have it. Focusing on higher protein also helps me stay fuller longer.Regarding my kids, I'm embracing the simplicity of basic staples. Freezer meat, pasta, rice, and potatoes are on rotation here instead of trying to eat new, more expensive foods.I previously shopped at a big-box store that let me buy other things in my app for convenience, like clothes and even shoes for the kids. But those little non-grocery purchases add up, so I recently switched to a local grocery store that doesn't offer the 'extras,' so I am forced to just buy my food and re-think all those other purchases.I wasn't a huge Starbucks drinker, but when I ran my errands, I treated myself occasionally. But those days are over. If I get a sweet treat, it's cheaper, like a McDonald's iced coffee, or I bring something from home.Our school offered free lunch for all students this year, but I often tried to still pack them their own so they had some healthier choices. But with grocery prices and the doubt that free lunches will be around much longer, I encourage them to eat at school for free rather than trying to pack five lunches every day. It actually saves a lot of money.My husband works three jobs now and recently took on even more work. I know it's dangerous for his health because he basically doesn't sleep and works late every night before getting up at 5 a.m. to go to his day job, but it's the only way we are managing at all right now. I also took on a new job last month that I really don't have time for either, but again, we need the money. I don't know what the future holds, so it feels like if there's work available to us, we have to take it.This is a privileged one, but with a daughter who will be a senior next year, I dreamed of taking our family on a nice family vacation soo

Inflation Rising Costs Budgeting Saving Money Family Finances Millennial Recession Economic Hardship

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

California Homeowners Face Rising Insurance Costs and Coverage CrisisDue to an increasing threat of wildfires, insurance companies are canceling policies and leaving many Californians without fire insurance. The state is implementing new regulations aimed at addressing the crisis, but these measures are facing criticism for potentially increasing premiums and leaving vulnerable homeowners without adequate coverage.

California Homeowners Face Rising Insurance Costs and Coverage CrisisDue to an increasing threat of wildfires, insurance companies are canceling policies and leaving many Californians without fire insurance. The state is implementing new regulations aimed at addressing the crisis, but these measures are facing criticism for potentially increasing premiums and leaving vulnerable homeowners without adequate coverage.

Read more »

Pharmacist Forced to Use Savings to Keep Business Afloat Due to Rising Drug CostsA pharmacist in Essex is having to use his personal savings to keep his pharmacy open due to the rising cost of medications and inadequate NHS reimbursement. Dipak Pau, owner of Pillbox Pharmacy in Great Baddow, says the increasing prices he pays for drugs are not matched by the NHS, leaving him to cover the difference.

Pharmacist Forced to Use Savings to Keep Business Afloat Due to Rising Drug CostsA pharmacist in Essex is having to use his personal savings to keep his pharmacy open due to the rising cost of medications and inadequate NHS reimbursement. Dipak Pau, owner of Pillbox Pharmacy in Great Baddow, says the increasing prices he pays for drugs are not matched by the NHS, leaving him to cover the difference.

Read more »

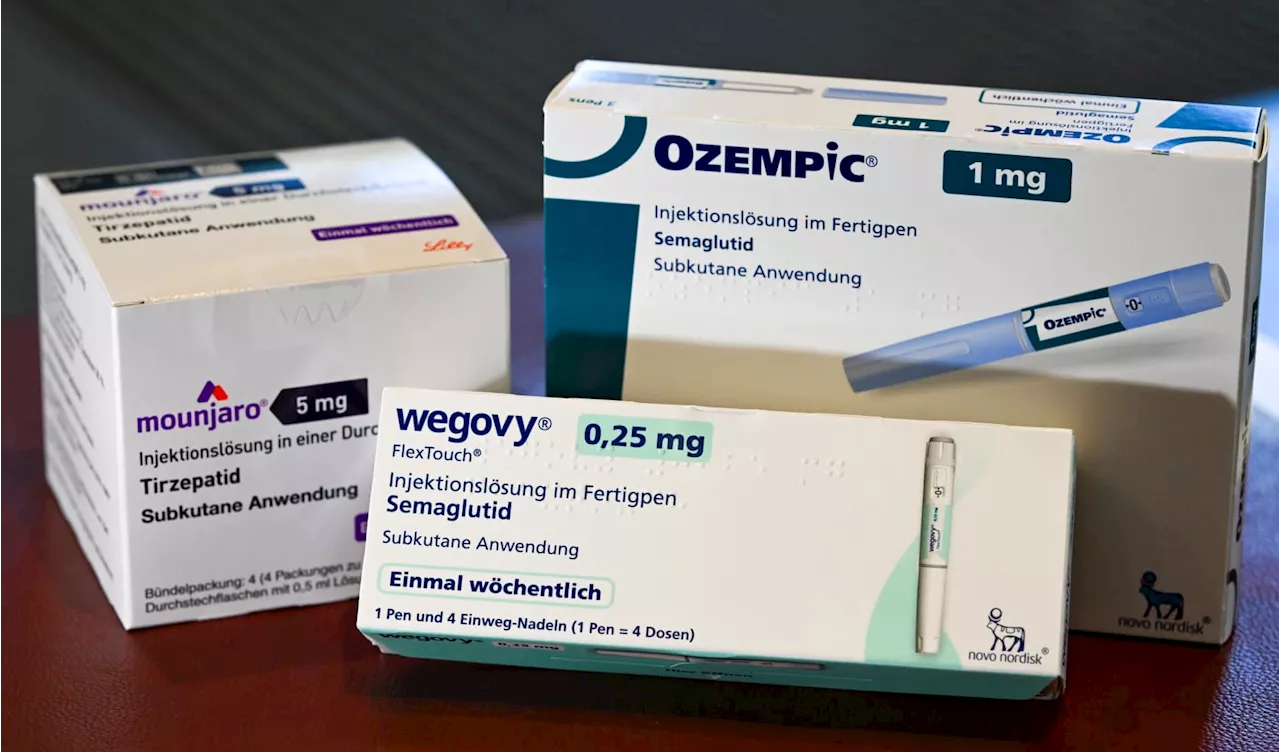

Employers Embrace Nutrition Coaching Amid Rising Costs of GLP-1 DrugsMore employers are requiring workers on GLP-1 medications to participate in nutrition and lifestyle coaching programs to manage costs associated with these drugs. Startups like Virta Health and Omada Health are experiencing significant growth in demand for their weight loss management programs.

Employers Embrace Nutrition Coaching Amid Rising Costs of GLP-1 DrugsMore employers are requiring workers on GLP-1 medications to participate in nutrition and lifestyle coaching programs to manage costs associated with these drugs. Startups like Virta Health and Omada Health are experiencing significant growth in demand for their weight loss management programs.

Read more »

Rising concerns over CA FAIR Plan's financial capability due to LA wildfire costs'The reason it is worrying people is because the FAIR Plan claims may exceed the amount of money they have in the bank,' explains Carmen Balber with Consumer Watchdog.

Rising concerns over CA FAIR Plan's financial capability due to LA wildfire costs'The reason it is worrying people is because the FAIR Plan claims may exceed the amount of money they have in the bank,' explains Carmen Balber with Consumer Watchdog.

Read more »

American Car Buyers Downsize Amid Rising CostsAs interest rates and fuel costs continue to climb, American car buyers are opting for smaller, more affordable vehicles. Sales of entry-level models and compact cars are surging, while larger vehicles experience declines.

American Car Buyers Downsize Amid Rising CostsAs interest rates and fuel costs continue to climb, American car buyers are opting for smaller, more affordable vehicles. Sales of entry-level models and compact cars are surging, while larger vehicles experience declines.

Read more »

Florida Housing Market Slows Amid Rising Insurance Costs and Storm FearsThe once-hot Florida housing market is cooling down, with homes taking longer to sell and inventory increasing. Rising insurance costs and concerns about hurricanes are cited as key factors contributing to the slowdown.

Florida Housing Market Slows Amid Rising Insurance Costs and Storm FearsThe once-hot Florida housing market is cooling down, with homes taking longer to sell and inventory increasing. Rising insurance costs and concerns about hurricanes are cited as key factors contributing to the slowdown.

Read more »