A new WalletHub report reveals that student loan delinquency rates are surging in several states, with Maine experiencing the most significant increase. The report highlights the potential consequences of delinquency, including damaged credit scores and wage garnishment, amidst ongoing legal challenges to President Biden's student loan forgiveness plans.

With student loan payments having resumed over the past year following a pause during the pandemic, many people have struggled to keep up.A new report from WalletHub, published on Thursday, analyzed where student loan delinquency, or letting the loans become past due, is increasing the most by state.It found that Maine , Louisiana and Michigan have experienced some of the biggest increases in student loan delinquency between the first and second quarters of 2024.

This includes the entire unpaid balance becoming immediately due, damaged credit rating and ability to buy a car or house becoming impacted, and even tax refunds and federal benefit payments possibly being withheld and applied toward repayment of the defaulted loan. Wages can even be withheld and sent to the loan holder, the Education Department explains. The point when a loan is considered to be "in default" varies based on the type of loan it is, the department adds.

Student Loans Delinquency Maine Louisiana Michigan Credit Score Forgiveness

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Student Loan Delinquency Rises Most in Maine, Louisiana and MichiganA new WalletHub report reveals that student loan delinquency is on the rise, with Maine experiencing the largest increase. The report highlights the growing financial strain on borrowers as payments resume after pandemic-era pauses.

Student Loan Delinquency Rises Most in Maine, Louisiana and MichiganA new WalletHub report reveals that student loan delinquency is on the rise, with Maine experiencing the largest increase. The report highlights the growing financial strain on borrowers as payments resume after pandemic-era pauses.

Read more »

Here are the states where student loan delinquency is increasing the mostWith student loan payments having resumed over the past year, many people have struggled to keep up.

Here are the states where student loan delinquency is increasing the mostWith student loan payments having resumed over the past year, many people have struggled to keep up.

Read more »

Student loan forgiveness expectations may fuel more borrowing, expert saysCollege students may be borrowing more for the coming year in part because of debt cancellation expectations, recent research suggests.

Student loan forgiveness expectations may fuel more borrowing, expert saysCollege students may be borrowing more for the coming year in part because of debt cancellation expectations, recent research suggests.

Read more »

Student loan forgiveness expectations may fuel more borrowing, expert saysCollege students may be borrowing more for the coming year in part because of debt cancellation expectations, recent research suggests.

Student loan forgiveness expectations may fuel more borrowing, expert saysCollege students may be borrowing more for the coming year in part because of debt cancellation expectations, recent research suggests.

Read more »

Student Loan Update: Forgiveness Program Ends This MonthIDR account adjustments have allowed a substantial number of borrowers to make payments based on their income and family size.

Student Loan Update: Forgiveness Program Ends This MonthIDR account adjustments have allowed a substantial number of borrowers to make payments based on their income and family size.

Read more »

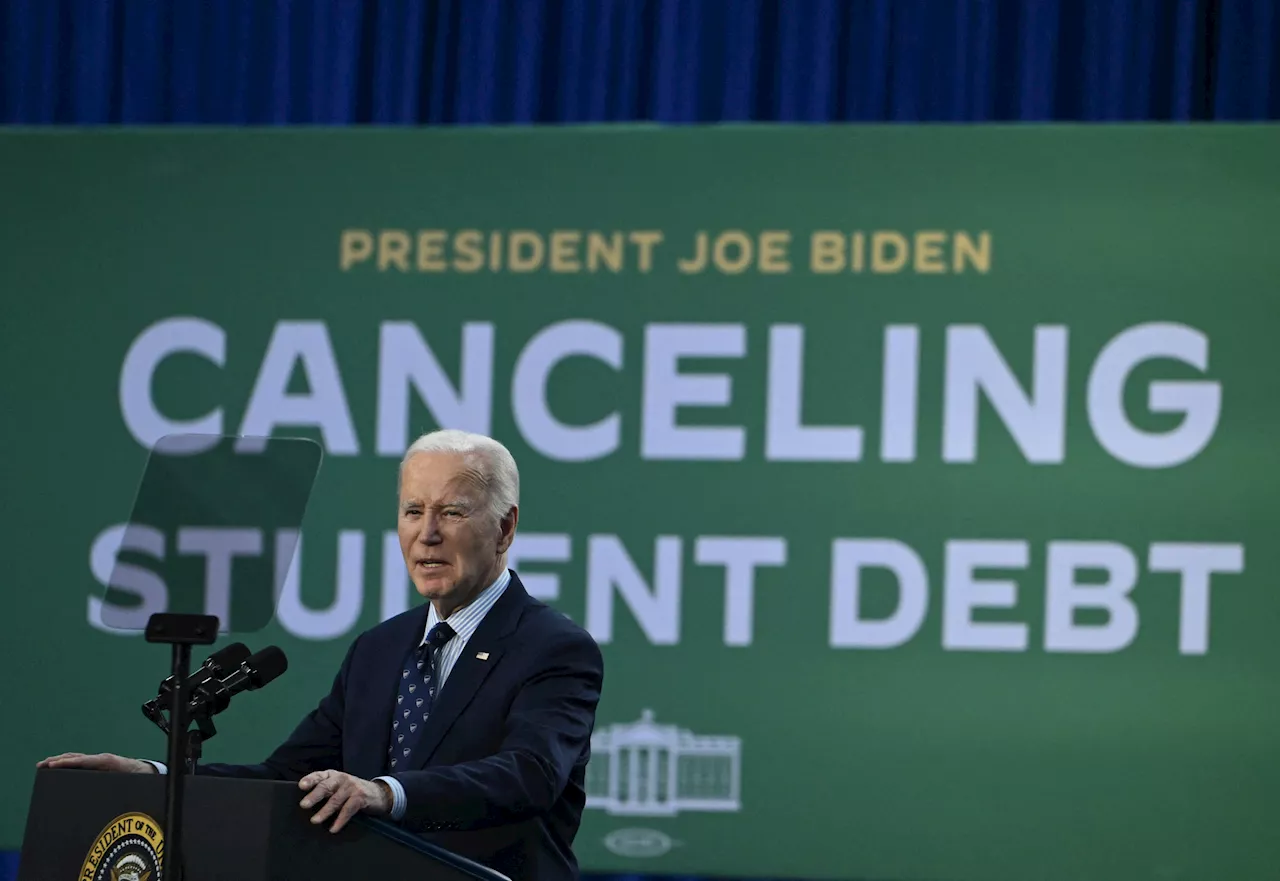

Student Loan Plan Put on Hold for Supreme CourtThe fate of President Joe Biden's SAVE student loan repayment plan could ultimately be decided by the Supreme Court.

Student Loan Plan Put on Hold for Supreme CourtThe fate of President Joe Biden's SAVE student loan repayment plan could ultimately be decided by the Supreme Court.

Read more »