Activist Starboard took a position in Becton Dickinson, calling for the company to sell its life sciences business. The company aims to do just that.

develops, manufactures and sells medical supplies, devices, laboratory equipment and diagnostic products for health-care institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry and the public worldwide.

The problem here is simple and straightforward: The company operates two distinct businesses that are at different stages with different growth rates and valuation multiples and no real reason to be under the same roof. The MedTech business has a higher growth rate than Life Sciences but a lower valuation multiple than Life Sciences because MedTech is assessed as a rule of 40 company – that is, its growth rate plus its operating margins should equal or exceed 40.

This is not always a problem, but in BDX's case, the entire company is trading at 16.8-times EBITDA, closer to the value of its least valuable part. As Starboard has recommended, spinning off or selling the Life Sciences business is a simple solution to a simple problem. The short-term value creation here is straightforward. If separated, the Medtech Business should get a 13-times to 14-times EBITDA valuation based on its growth, while Life Sciences should get a valuation north of 20-times.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Starboard Pushes for Becton Dickinson Split, Citing Undervalued Life Sciences DivisionActivist investor Starboard Value LP calls for Becton Dickinson to separate its life sciences division, arguing that the two businesses operate at different stages and warrant distinct valuations. Starboard predicts significant value creation through this separation, highlighting the potential for higher valuations for both MedTech and BD Life Sciences.

Starboard Pushes for Becton Dickinson Split, Citing Undervalued Life Sciences DivisionActivist investor Starboard Value LP calls for Becton Dickinson to separate its life sciences division, arguing that the two businesses operate at different stages and warrant distinct valuations. Starboard predicts significant value creation through this separation, highlighting the potential for higher valuations for both MedTech and BD Life Sciences.

Read more »

Starboard Calls for Becton Dickinson SeparationActivist investor Starboard Value urges Becton Dickinson (BDX) to spin off its Life Sciences division, arguing it's undervalued within the larger company. BDX, a global medical technology firm, operates MedTech (infusion pumps, prefilled syringes, etc.) and Life Sciences (diagnostics, lab equipment). Starboard highlights the disparity in growth rates and valuation multiples between the two divisions, suggesting separation would unlock significant value for shareholders.

Starboard Calls for Becton Dickinson SeparationActivist investor Starboard Value urges Becton Dickinson (BDX) to spin off its Life Sciences division, arguing it's undervalued within the larger company. BDX, a global medical technology firm, operates MedTech (infusion pumps, prefilled syringes, etc.) and Life Sciences (diagnostics, lab equipment). Starboard highlights the disparity in growth rates and valuation multiples between the two divisions, suggesting separation would unlock significant value for shareholders.

Read more »

Morgan Stanley Sees 25.9% Upside for Qorvo After Activist Investor Starboard Value Takes StakeMorgan Stanley analyst Joseph Moore upgraded semiconductor and radio frequency chipmaker Qorvo to overweight from equal weight, citing the potential for a renewed earnings recovery path following the involvement of activist investor Starboard Value. Moore raised his price target by $16 to $106, suggesting a 25.9% potential upside for the stock. This upgrade comes after Qorvo shares rallied last week following the news that Starboard Value had unveiled a 7.7% stake in the company.

Morgan Stanley Sees 25.9% Upside for Qorvo After Activist Investor Starboard Value Takes StakeMorgan Stanley analyst Joseph Moore upgraded semiconductor and radio frequency chipmaker Qorvo to overweight from equal weight, citing the potential for a renewed earnings recovery path following the involvement of activist investor Starboard Value. Moore raised his price target by $16 to $106, suggesting a 25.9% potential upside for the stock. This upgrade comes after Qorvo shares rallied last week following the news that Starboard Value had unveiled a 7.7% stake in the company.

Read more »

Activist Investor Starboard Targets Qorvo for Margin ImprovementStarboard Value, a successful activist investor, has taken a 7.71% stake in Qorvo, a leading semiconductor company, and aims to improve the company's operational efficiency and margins. Starboard has a history of success in the semiconductor industry, and its involvement is likely to put pressure on Qorvo's management to address its financial performance.

Activist Investor Starboard Targets Qorvo for Margin ImprovementStarboard Value, a successful activist investor, has taken a 7.71% stake in Qorvo, a leading semiconductor company, and aims to improve the company's operational efficiency and margins. Starboard has a history of success in the semiconductor industry, and its involvement is likely to put pressure on Qorvo's management to address its financial performance.

Read more »

Starboard Value Targets Qorvo for Margin ImprovementStarboard Value, a successful activist investor, has taken a 7.71% stake in Qorvo, a global semiconductor company. Starboard aims to improve Qorvo's operational efficiency and margins, citing the company's underperformance compared to peers despite its strong product portfolio. Starboard has a history of success in the semiconductor industry, with an average return of 85.87% on activist campaigns at 13 previous semiconductor companies.

Starboard Value Targets Qorvo for Margin ImprovementStarboard Value, a successful activist investor, has taken a 7.71% stake in Qorvo, a global semiconductor company. Starboard aims to improve Qorvo's operational efficiency and margins, citing the company's underperformance compared to peers despite its strong product portfolio. Starboard has a history of success in the semiconductor industry, with an average return of 85.87% on activist campaigns at 13 previous semiconductor companies.

Read more »

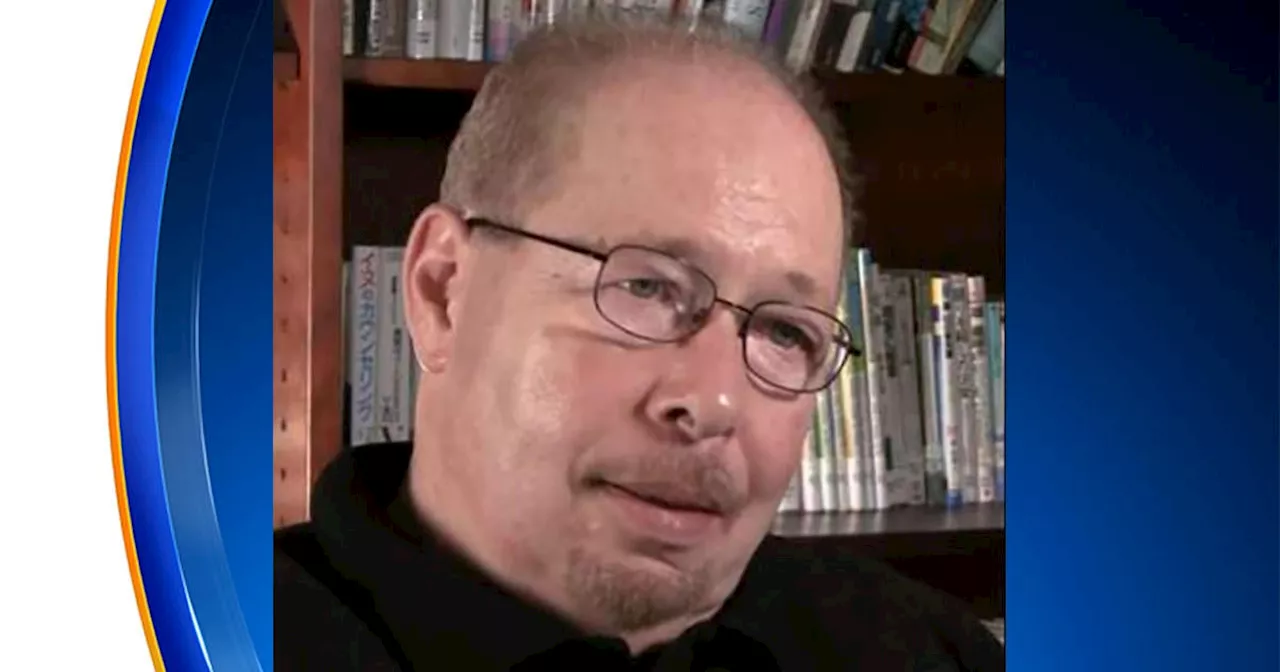

José 'Cha Cha' Jiménez, activist who turned Chicago's Young Lords into human rights activist group, dies at 76José 'Cha Cha' Jiménez, activist who turned Young Lords into activist group, dies at 76

José 'Cha Cha' Jiménez, activist who turned Chicago's Young Lords into human rights activist group, dies at 76José 'Cha Cha' Jiménez, activist who turned Young Lords into activist group, dies at 76

Read more »