KUALA LUMPUR, May 24 — SP Setia Bhd’s shares on Bursa Malaysia went down in the early trading session today after it posted a weaker-than-expected revenue for the first quarter...

KUALA LUMPUR, May 24 — SP Setia Bhd’s shares on Bursa Malaysia went down in the early trading session today after it posted a weaker-than-expected revenue for the first quarter ended March 31, 2022 due to supply chain disruptions which also affected margins.The group posted a lower net profit of RM67.50 million in Q1 2022 compared with RM75.23 million in Q1 2021, while revenue declined to RM867.10 million from RM1.

In a research note today, Kenanga Research said SP Setia’s Q1 sales of RM670 million were within its RM3.3 billion target for 2022. “We expect the second half of 2022 would see lumpy earnings for SP Setia from the completion of Australian projects and land sale gains,” it said. — Bernama

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Global gloom hits UK stocks, Royal Mail slides on broker downgradeNEW YORK, May 24 — UK’s FTSE 100 slipped yesterday as the global mood soured due to bleak results from social media firm Snap Inc, while shares in Royal Mail slid after a...

Global gloom hits UK stocks, Royal Mail slides on broker downgradeNEW YORK, May 24 — UK’s FTSE 100 slipped yesterday as the global mood soured due to bleak results from social media firm Snap Inc, while shares in Royal Mail slid after a...

Read more »

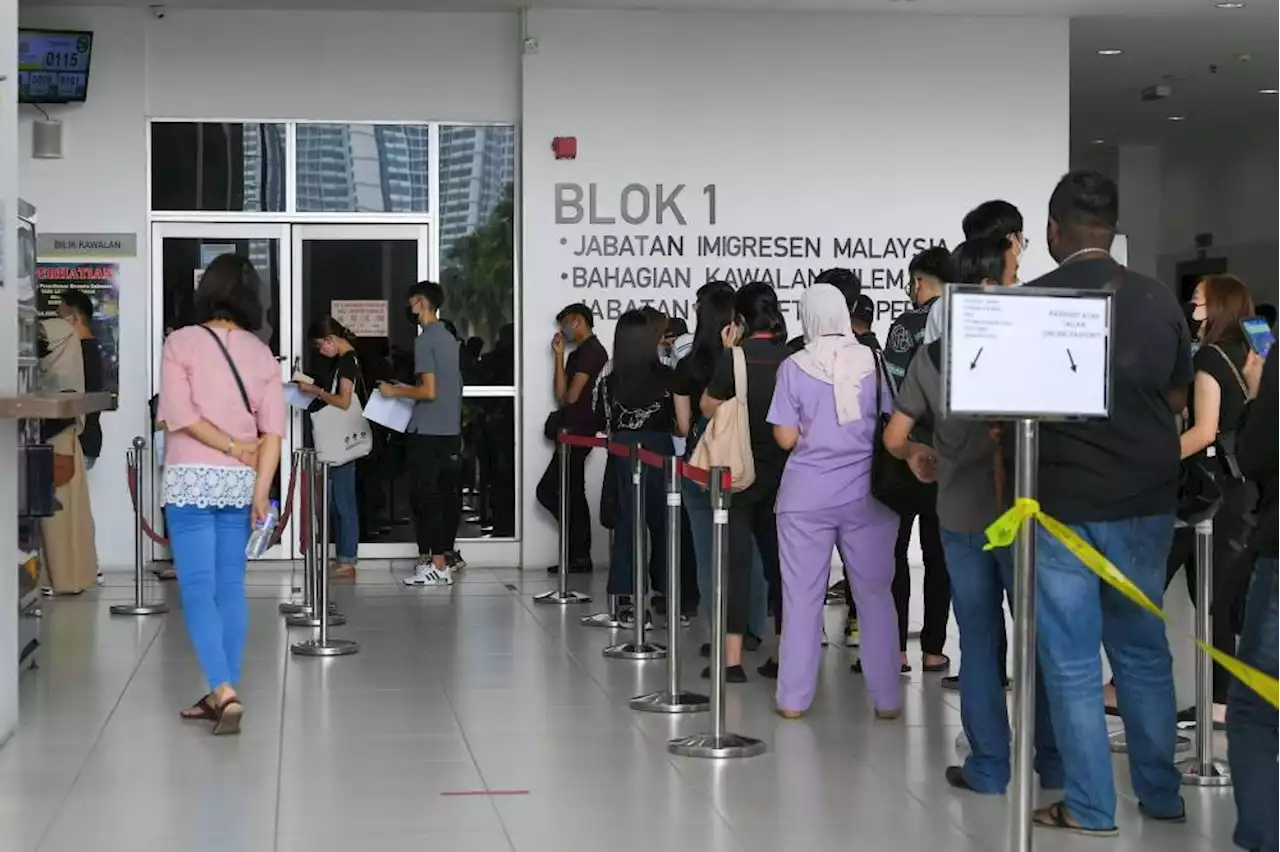

In Johor, long queues await visitors to immigration office at Home Ministry Complex in Setia TropikaJOHOR BARU, May 23 — Having to endure several hours in long queues since early morning just to get the waiting number is among the challenges faced by the public when obtaining...

In Johor, long queues await visitors to immigration office at Home Ministry Complex in Setia TropikaJOHOR BARU, May 23 — Having to endure several hours in long queues since early morning just to get the waiting number is among the challenges faced by the public when obtaining...

Read more »

Bursa Malaysia turns slightly lower at mid-morningKUALA LUMPUR, May 24 — Bursa Malaysia turned slightly lower at mid-morning as mild selling in selected heavyweights offset earlier gains, as well as in line with the weaker...

Bursa Malaysia turns slightly lower at mid-morningKUALA LUMPUR, May 24 — Bursa Malaysia turned slightly lower at mid-morning as mild selling in selected heavyweights offset earlier gains, as well as in line with the weaker...

Read more »

Ringgit opens weaker against greenback as US equities rallyKUALA LUMPUR: The ringgit opened slightly lower against the US dollar today as sentiment for the greenback strengthened in tandem with positive development for the equity market in the United States, an analyst said.

Ringgit opens weaker against greenback as US equities rallyKUALA LUMPUR: The ringgit opened slightly lower against the US dollar today as sentiment for the greenback strengthened in tandem with positive development for the equity market in the United States, an analyst said.

Read more »