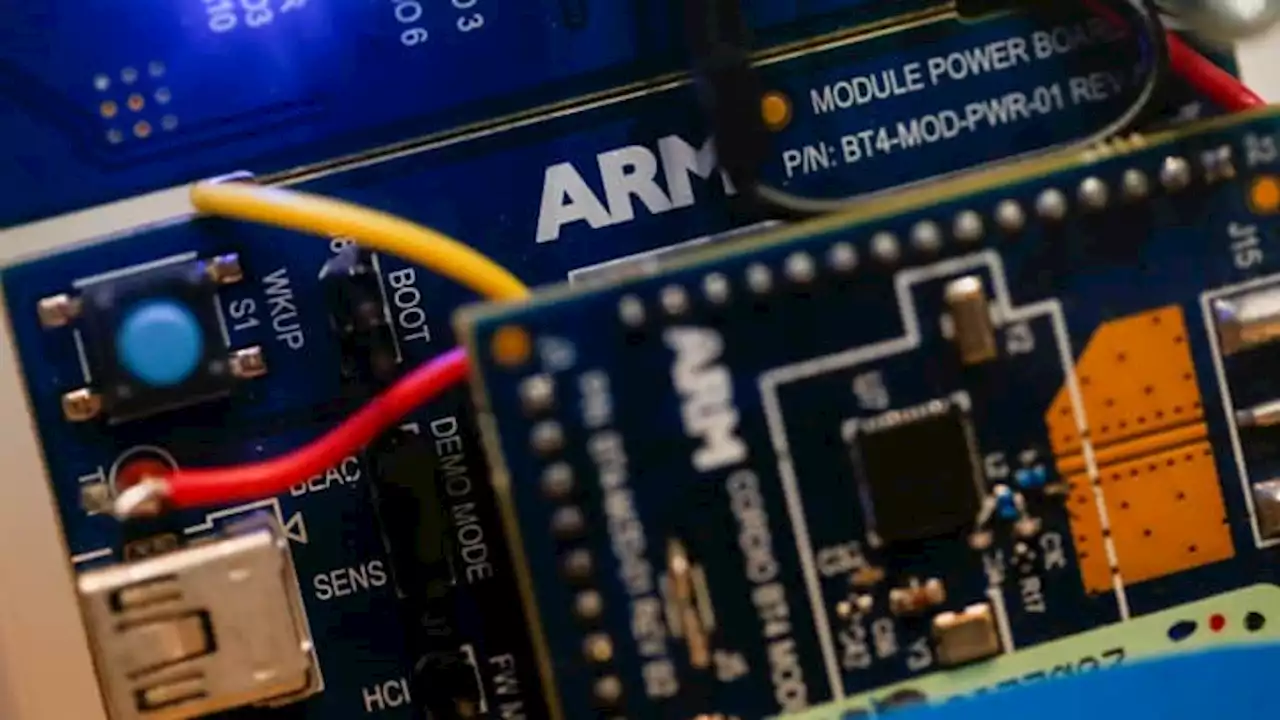

SoftBank Group's Arm is seeking a valuation of more than $52 billion in its initial public offering, the chip designer said on Tuesday as it begins marketing for the biggest U.S. stock market flotation of the year.

on SoftBank's proposed price range for the IPO on Saturday. Sources also said it could possibly raise this range before the IPO prices, should investor demand prove strong.

Unlike most loss-making but high-growth tech companies that debut with lofty valuations but later plummet below list price, Arm is profitable. This is expected to significantly reduce investor anxieties, analysts have said.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Chip design firm Arm seeks up to $52 billion valuation in blockbuster U.S. IPOArm was previously dually listed in London and New York, before SoftBank acquired it for $32 billion in 2016.

Chip design firm Arm seeks up to $52 billion valuation in blockbuster U.S. IPOArm was previously dually listed in London and New York, before SoftBank acquired it for $32 billion in 2016.

Read more »

Arm Targets More Than $52 Billion Valuation in Largest IPO of the YearApple, Intel and Nvidia are among the companies that plan to buy shares in the British chip maker’s initial public offering.

Arm Targets More Than $52 Billion Valuation in Largest IPO of the YearApple, Intel and Nvidia are among the companies that plan to buy shares in the British chip maker’s initial public offering.

Read more »

SoftBank’s Arm targets $52B valuation in 2023's biggest IPOSoftBank is offering 95.5 million American depository shares of Arm for $47 to $51 each and is aiming to pull in $4.87 billion on the high end, according to a regulatory filing.

SoftBank’s Arm targets $52B valuation in 2023's biggest IPOSoftBank is offering 95.5 million American depository shares of Arm for $47 to $51 each and is aiming to pull in $4.87 billion on the high end, according to a regulatory filing.

Read more »

SoftBank's chip designer Arm aims to raise up to $4.87 billion in US IPO By ReutersSoftBank's chip designer Arm aims to raise up to $4.87 billion in US IPO

SoftBank's chip designer Arm aims to raise up to $4.87 billion in US IPO By ReutersSoftBank's chip designer Arm aims to raise up to $4.87 billion in US IPO

Read more »

Arm IPO Valuation Shows It Won’t Be Nvidia. It’s Still Set to Be the Biggest of the Year.British chip designer Arm is targeting a valuation of around $52 billion for its IPO, according to a filing on Tuesday.

Arm IPO Valuation Shows It Won’t Be Nvidia. It’s Still Set to Be the Biggest of the Year.British chip designer Arm is targeting a valuation of around $52 billion for its IPO, according to a filing on Tuesday.

Read more »