SMIC sees prolonged chip glut, signals cautious expansion outlook

BEIJING -Semiconductor Manufacturing International Corp, China's largest chipmaker, warned on Friday that overcapacity in mature node chips will persist through 2025 and that it was turning cautious on building new capacity.

"Industry utilisation rates are hovering around 70%, well below the optimal level of 85%, indicating significant overcapacity. This situation is unlikely to improve significantly, if not worsen further," co-CEO Zhao Haijun said in the company's third-quarter earnings call. However, Zhao said this substitution trend would slow in 2025 as domestic suppliers have already captured a substantial portion of the market.

"We have not announced any new projects, and we are not currently discussing any new ones," Zhao said, marking a potential shift in strategy for China's largest contract chipmaker.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

The Chinese chipmaker at the heart of the U.S.-China tech warSemiconductor Manufacturing International Corp., or SMIC, is manufacturing chips with features less than one-15,000th of the thickness of a sheet of paper.

The Chinese chipmaker at the heart of the U.S.-China tech warSemiconductor Manufacturing International Corp., or SMIC, is manufacturing chips with features less than one-15,000th of the thickness of a sheet of paper.

Read more »

Vans owner VFC sees its stock soar 18% on earnings beat, improved outlookVans owner VFC sees its stock soar 18% on earnings beat, improved outlook

Vans owner VFC sees its stock soar 18% on earnings beat, improved outlookVans owner VFC sees its stock soar 18% on earnings beat, improved outlook

Read more »

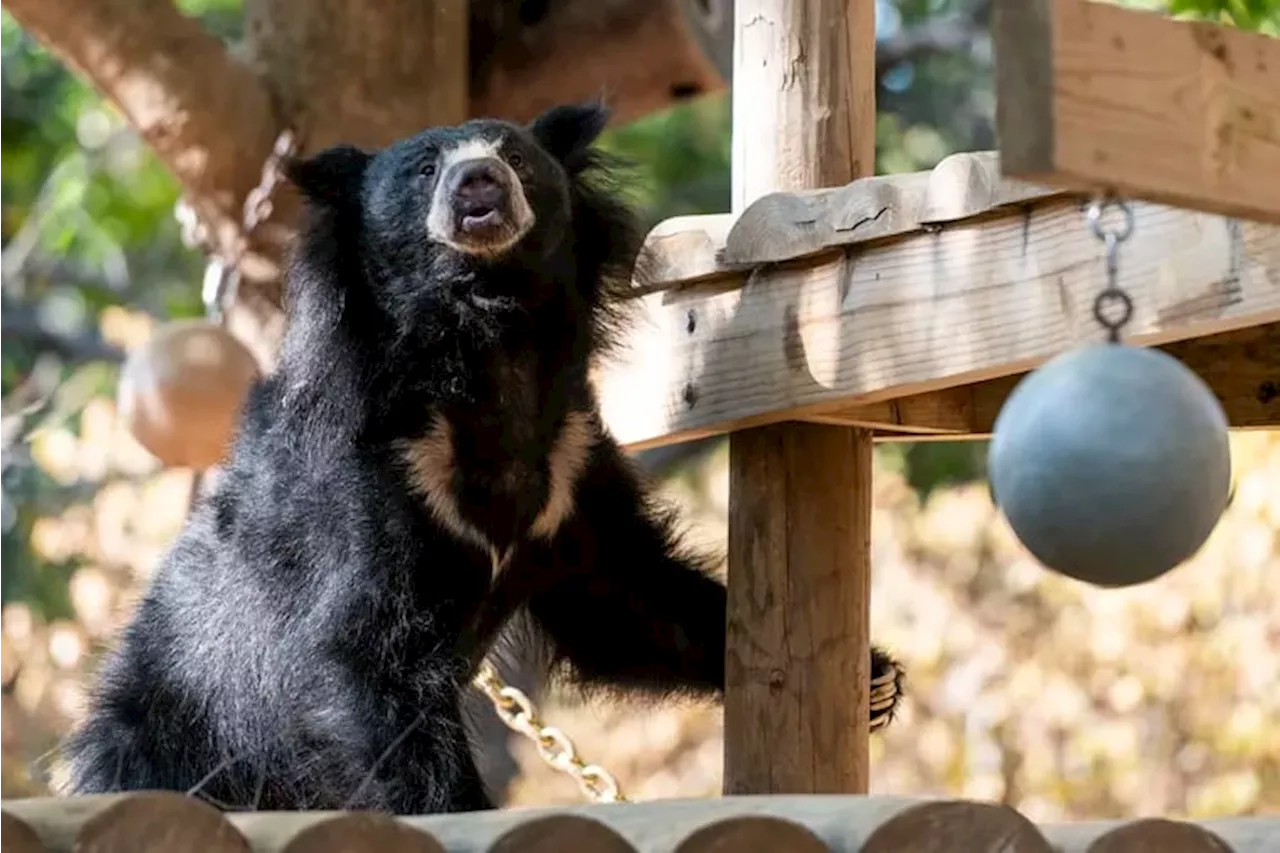

The Philadelphia Zoo announces a $20 million bear exhibit expansionThe Bear Country expansion signals a growth for the Zoo's bear breeding program. Plus the bears get heated pools.

The Philadelphia Zoo announces a $20 million bear exhibit expansionThe Bear Country expansion signals a growth for the Zoo's bear breeding program. Plus the bears get heated pools.

Read more »

IMF hikes UK growth outlook amid lower inflation and interest ratesThe IMF now sees 1.1% growth for the U.K. economy this year, up from its July forecast of 0.7%, and reiterated a forecast for 1.5% expansion in 2025.

IMF hikes UK growth outlook amid lower inflation and interest ratesThe IMF now sees 1.1% growth for the U.K. economy this year, up from its July forecast of 0.7%, and reiterated a forecast for 1.5% expansion in 2025.

Read more »

CEO makes bold prediction on housing market as trend signals positive outlookInter Ikea CEO Jon Abrahamsson Ring believes that the housing market will likely rebound before the end of this year amid rising mortgage rates.

CEO makes bold prediction on housing market as trend signals positive outlookInter Ikea CEO Jon Abrahamsson Ring believes that the housing market will likely rebound before the end of this year amid rising mortgage rates.

Read more »

NZD/USD Price Analysis: Pessimistic technical outlook, RSI in oversold area signals might trigger a correctionIn Wednesday's session, the NZD/USD extended its recent decline, falling by 0.27% to 0.6050.

NZD/USD Price Analysis: Pessimistic technical outlook, RSI in oversold area signals might trigger a correctionIn Wednesday's session, the NZD/USD extended its recent decline, falling by 0.27% to 0.6050.

Read more »