Oil services stocks faced a downturn in 2024, but signs point towards a potential reversal in SLB stock, the largest player in the industry.

Oil services stocks experienced a bear market cycle in 2024, with the VanEck Oil Services ETF (OIH) losing roughly 12% compared to a 23% gain for the S&P 500. This weakness was mainly driven by a 26% decline in SLB ( SLB ), the largest stock in the oil services industry group, which holds about 20% of the ETF.

SLB has been in a cyclical downtrend since late 2023, returning to support from the monthly cloud (shown by the shaded area on the chart) after surpassing it in 2022 following a bullish secular shift. There are indications of downside exhaustion, according to the DeMARK Indicators, which enhance long-term oversold conditions in the monthly stochastics. This suggests stabilization and a potential reversal of the cyclical downtrend in 2025. Zooming in on SLB's weekly chart reveals counter-trend signals from both the TD Combo and TD Sequential models (denoted by the '13s'), indicating bullish intermediate-term implications. The downtrend has lost momentum, as indicated by the weekly MACD, which reflects notable improvement in momentum and further supports the latest counter-trend signal.An initial upward target for SLB is resistance from the 200-day (~40-week) moving average, around $43.70. The 200-day has been a significant level, repelling multiple relief rallies over the past year, including last month. If SLB clears the 200-day, it would confirm a bullish shift in the stock's primary trend. We believe this is probable, and if a breakout occurs, it would support a larger upmove towards resistance from the weekly cloud model. The cloud is currently near $48.00 but declining over time. SLB and most oil services stocks maintain a positive correlation with the price of WTI crude oil. Considering this, they would benefit from a breakout in WTI crude oil, which is currently in a neutral long-term triangle formation that would resolve higher above $76/bbl. (Our views on crude oil can be followed here.) Counter-trend positions carry inherent risks, so a stop-loss level should be considered for a position in SLB. Support from the December low, near $36.50, exists, but that level might be too distant for some. A tighter level to manage risk could be support from the daily cloud model (not shown), near $39.20

SLB Oil Services Stock Market Technical Analysis Demark Indicators TD Combo TD Sequential Crude Oil WTI

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

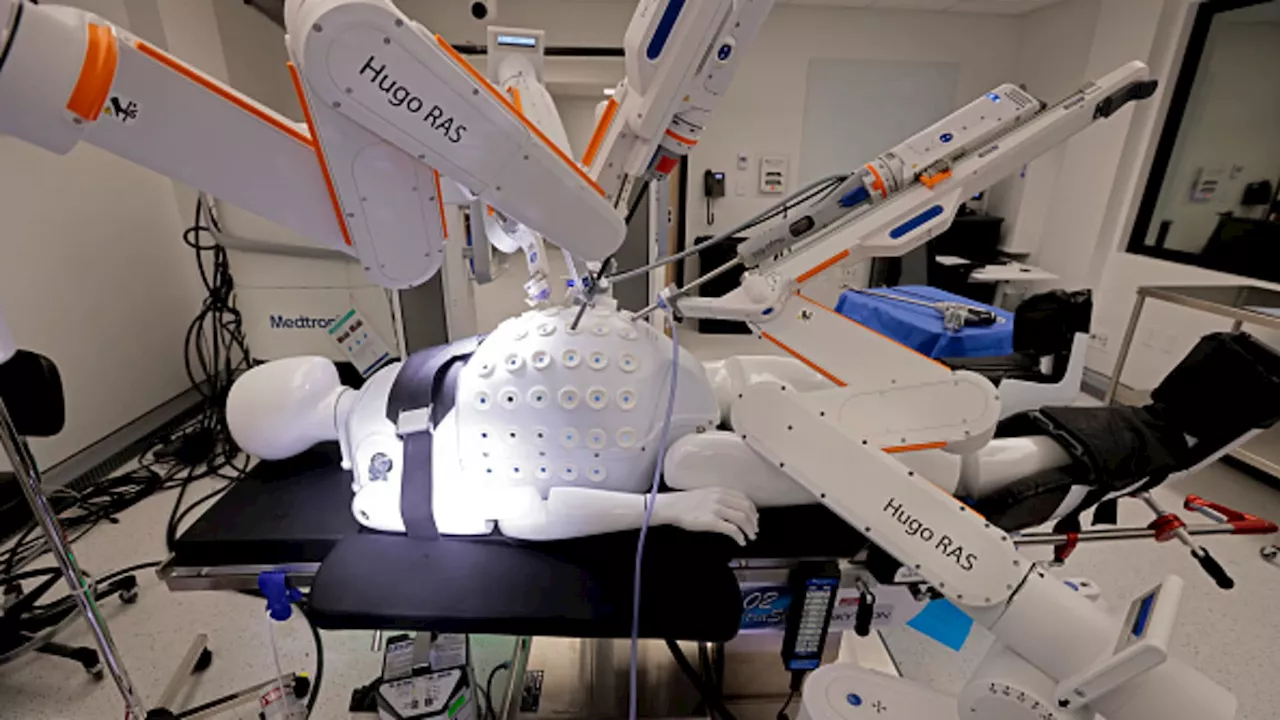

Medtronic Stock Showing Signs of Reversal, Analyst SaysCarter Braxton Worth, a contributor to CNBC Pro, believes that the medical devices manufacturer Medtronic (MDT) is showing signs of a bullish reversal after a prolonged period of underperformance. Worth points to the stock's recent recovery from its 2023 lows as evidence of this shift in momentum. He anticipates that MDT will continue to climb, reaching the $105 level in the coming weeks or months.

Medtronic Stock Showing Signs of Reversal, Analyst SaysCarter Braxton Worth, a contributor to CNBC Pro, believes that the medical devices manufacturer Medtronic (MDT) is showing signs of a bullish reversal after a prolonged period of underperformance. Worth points to the stock's recent recovery from its 2023 lows as evidence of this shift in momentum. He anticipates that MDT will continue to climb, reaching the $105 level in the coming weeks or months.

Read more »

XRP Price Showing Encouraging Signs of Bullish MomentumXRP price is exhibiting encouraging trends, breaking through descending trendline resistance and forming crucial support at $2.34. On-chain metrics show increasing daily new account creation and activated accounts, suggesting renewed interest from both institutional and retail investors. Network activity and transaction demand are also rising, indicating a healthy level of usage. While the psychological resistance level at $3 remains a hurdle, the current bullish sentiment and improving on-chain activity suggest potential for further growth.

XRP Price Showing Encouraging Signs of Bullish MomentumXRP price is exhibiting encouraging trends, breaking through descending trendline resistance and forming crucial support at $2.34. On-chain metrics show increasing daily new account creation and activated accounts, suggesting renewed interest from both institutional and retail investors. Network activity and transaction demand are also rising, indicating a healthy level of usage. While the psychological resistance level at $3 remains a hurdle, the current bullish sentiment and improving on-chain activity suggest potential for further growth.

Read more »

Islanders' woeful penalty kill finally showing signs of improvementIf this is a sign of the penalty kill being pulled back from the abyss, it is most welcome.

Islanders' woeful penalty kill finally showing signs of improvementIf this is a sign of the penalty kill being pulled back from the abyss, it is most welcome.

Read more »

1 Stock to Buy, 1 Stock to Sell This Week: Goldman Sachs, CitigroupStocks Analysis by Investing.com (Jesse Cohen) covering: Nasdaq 100, S&P 500, Dow Jones Industrial Average, Citigroup Inc. Read Investing.com (Jesse Cohen)'s latest article on Investing.com

1 Stock to Buy, 1 Stock to Sell This Week: Goldman Sachs, CitigroupStocks Analysis by Investing.com (Jesse Cohen) covering: Nasdaq 100, S&P 500, Dow Jones Industrial Average, Citigroup Inc. Read Investing.com (Jesse Cohen)'s latest article on Investing.com

Read more »

1 Stock to Buy, 1 Stock to Sell This Week: Netflix, Procter & GambleStocks Analysis by Investing.com (Jesse Cohen) covering: Nasdaq 100, Dow Jones Industrial Average, Verizon Communications Inc, American Express Company. Read Investing.com (Jesse Cohen)'s latest article on Investing.com

1 Stock to Buy, 1 Stock to Sell This Week: Netflix, Procter & GambleStocks Analysis by Investing.com (Jesse Cohen) covering: Nasdaq 100, Dow Jones Industrial Average, Verizon Communications Inc, American Express Company. Read Investing.com (Jesse Cohen)'s latest article on Investing.com

Read more »

UFC 311 Results: Stock Up, Stock Down After First PPV Of 2025UFC 311 was a fun event. With everything that happened on Saturday night, here is a look a whose stock is up and down.

UFC 311 Results: Stock Up, Stock Down After First PPV Of 2025UFC 311 was a fun event. With everything that happened on Saturday night, here is a look a whose stock is up and down.

Read more »