Silver price (XAG/USD) faces an immense sell-off as the United States Institute of Supply Management (ISM) reported a higher-than-anticipated Manufact

The US Dollar eyes more upside as the US Manufacturing PMI outperformed expectations but remained below the 50.0 threshold.Institute of Supply Management reported a higher-than-anticipated Manufacturing PMI for September. The economic data landed at 49.0, much higher than estimates and the former release of 47.7 and 47.6 respectively.

In spite of upbeat factory activities, the Manufacturing PMI remained below the 50.0 threshold for the 10th time in a row. The New Orders Index for the US factory also outperformed expectations and jumped to 49.2 from the August reading of 46.8. recovered its entire gains, and jumped to near 106.80, as the market mood dampened after weak Caixin Manufacturing PMI data for September. China’s factory activities missed estimates by a wide margin but managed to remain above the 50.0 threshold.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.EUR/USD came under renewed bearish pressure and declined toward 1.0500 in the second half of the day on Monday. After the data from the US showed that the ISM Manufacturing PMI came in better than expected in September, the US Dollar extended its rally and weighed on the pair.GBP/USD turned south and retreated to a fresh daily low below 1.2150 in the American session.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

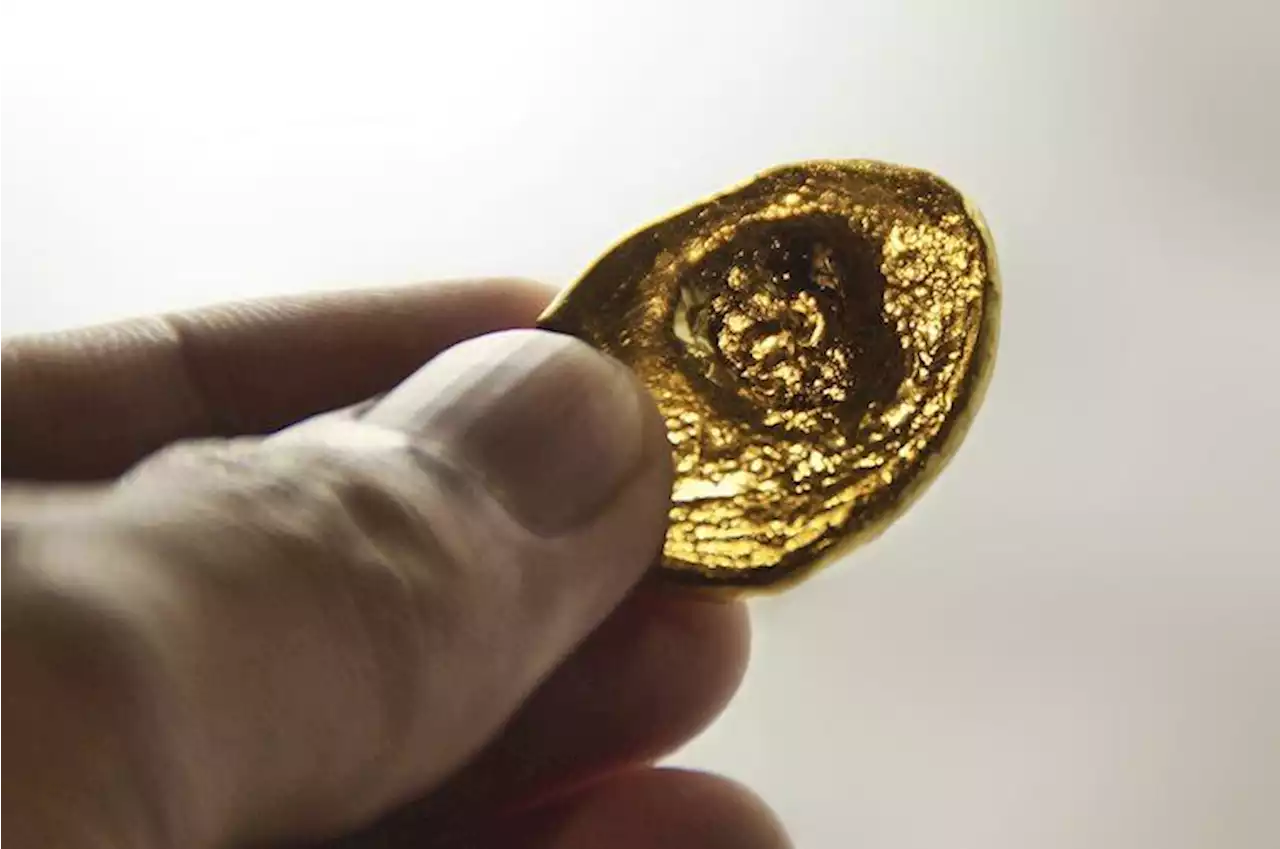

Gold/Silver Q4 Technical Forecast: Tide Remains Against XAU/USD & XAG/USDDevelopments on longer-term charts suggest that rally since late 2022 in gold and silver was corrective, and not the start of a new bull market. And now precious metals appear to be breaking lower. What is the outlook and the key levels to watch?

Read more »

XAG/USD Price Analysis: Extends losses toward support at $21.50 psychological levelSilver price continues to follow its downward trajectory, trading lower around $21.80 during the Asian session on Monday. The prices of non-yielding a

XAG/USD Price Analysis: Extends losses toward support at $21.50 psychological levelSilver price continues to follow its downward trajectory, trading lower around $21.80 during the Asian session on Monday. The prices of non-yielding a

Read more »

AUD Price Forecast: Aussie Dollar Slips on Weak PMI’s Ahead of RBAAUD prices weakened against the USD on sluggish PMI data alongside a likely rate pause by the RBA at tomorrow’s interest rate announcement.

Read more »

Gold Price Forecast: Will Fed Chair Jerome Powell rescue XAU/USD buyers?Gold price is trading below $1,840, at its lowest level since March 10, setting off the final quarter of this year on a negative note. The United Stat

Gold Price Forecast: Will Fed Chair Jerome Powell rescue XAU/USD buyers?Gold price is trading below $1,840, at its lowest level since March 10, setting off the final quarter of this year on a negative note. The United Stat

Read more »

Pound Sterling Price News and Forecast: GBP/USD remains under selling pressure near 1.2180The GBP/USD pair remains on the defensive below the 1.2200 barrier and trades in negative territory for the fifth consecutive week during the early Eu

Pound Sterling Price News and Forecast: GBP/USD remains under selling pressure near 1.2180The GBP/USD pair remains on the defensive below the 1.2200 barrier and trades in negative territory for the fifth consecutive week during the early Eu

Read more »

Gold Price Forecast: XAU/USD moves below $1,850 on market caution, Fed Powell speech eyedGold price extends its losing streak that began on September 25, trading lower around $1,840 per troy ounce during the Asian session on Monday. China’

Gold Price Forecast: XAU/USD moves below $1,850 on market caution, Fed Powell speech eyedGold price extends its losing streak that began on September 25, trading lower around $1,840 per troy ounce during the Asian session on Monday. China’

Read more »