Shropshire tax consultancy Reclaim Tax Ltd is urging dairy farmers to explore research tax credits amid forecasts of declining farm business income.

The recently released Dairy Farm Business Income Forecasts for 2024 by Defrathe Department for Environment, Food & Rural Affairs have raised concerns within the dairy farming community.

The substantial decrease in FBI is primarily attributed to a drastic fall in livestock output, with output from milk and milk products expected to decrease by approximately 19 per cent. This downturn is chiefly driven by a decline in farmgate prices for milk, which began to falter in early 2023 following the volatility of the previous year.

Now Reclaim Tax Ltd is advising stakeholders in the dairy sector on the importance of claiming research tax credits as a means to alleviate financial burdens and support dairy farming operations.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Over 1.6 Million Pensioners to Pay Income Tax Due to Government Tax PlansMore than 1.6 million pensioners will be forced into paying income tax over the next four years, as a result of a Government stealth tax raid. The state pension rise will push up to 600,000 people over their personal allowance threshold, while the freeze on tax allowances will affect an additional 1.2 million pensioners. By 2028, it is estimated that 9.3 million people over the age of 66 will be paying income tax.

Over 1.6 Million Pensioners to Pay Income Tax Due to Government Tax PlansMore than 1.6 million pensioners will be forced into paying income tax over the next four years, as a result of a Government stealth tax raid. The state pension rise will push up to 600,000 people over their personal allowance threshold, while the freeze on tax allowances will affect an additional 1.2 million pensioners. By 2028, it is estimated that 9.3 million people over the age of 66 will be paying income tax.

Read more »

The Unfairness of Council Tax: A New Version of the Poll TaxThe replacement of the Poll Tax, Council Tax, is criticized for its unfairness and failure to properly compensate for differences in income and wealth.

The Unfairness of Council Tax: A New Version of the Poll TaxThe replacement of the Poll Tax, Council Tax, is criticized for its unfairness and failure to properly compensate for differences in income and wealth.

Read more »

Tax Changes and Maximizing ISA Allowance Before End of Tax YearHere's what you need to do TODAY before the end of the tax year ends to avoid missing out on money you're owed.

Tax Changes and Maximizing ISA Allowance Before End of Tax YearHere's what you need to do TODAY before the end of the tax year ends to avoid missing out on money you're owed.

Read more »

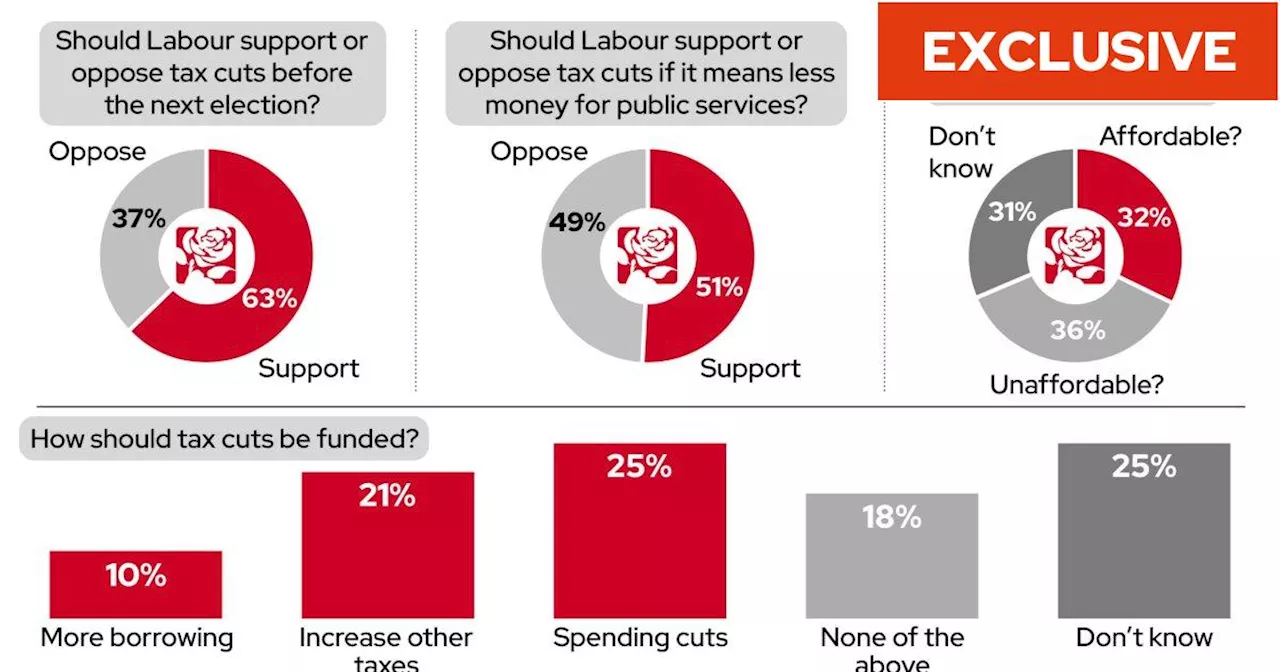

Starmer’s tax dilemma: Voters split on whether Labour should back more tax cutsLabour voters say party should oppose further tax cuts to free up cash for public services, but Tory target voters say the opposite

Starmer’s tax dilemma: Voters split on whether Labour should back more tax cutsLabour voters say party should oppose further tax cuts to free up cash for public services, but Tory target voters say the opposite

Read more »

Council Tax changes from next week including higher bills and double tax ruleCouncil tax bills are set to rise significantly in a matter of days

Council Tax changes from next week including higher bills and double tax ruleCouncil tax bills are set to rise significantly in a matter of days

Read more »

How to claim a tax refund in the UK and check your tax codeThe most common tax code is 1257L, which is based on the Personal Tax Allowance of £12,570

Read more »