There are whispers on Capitol Hill of a rare bipartisan effort to overhaul Social Security as the program is set to go broke in less than 10 years

But a group of bipartisan lawmakers may have come up with a compromise in the form of a sovereign wealth fund — something that the United States does not currently have at the federal level. SWFs are typically investment funds owned by the government, according to theThat's according to Semafor's Joseph Zeballos-Roig, whothis week that a group of senators led by Sen. Angus King, an Independent from Maine, and Sen.

Given that the potential of such a fund depends on its stock market success, Zeballos-Roig reports that senators are amenable to an increase in the payroll tax rate and the amount of income subject to those taxes if the fund's returns fall short of expectations. The goal is, members of the group told Semafor, for Social Security to be solvent for 75 more years, at least. The Hill's Aris Folley this week that a SWF would allow the US"to be able to borrow at low interest rates and invest in the growth of our economy, and perhaps economies of other nations as well."

"That's what other retirement funds do around the world, in corporations and in the railway world, and it creates a substantial source of revenue," he said, adding that if the investments"didn't do terribly well, we would kick in through other sources and make sure that we don't threaten in any way the benefits of recipients."

Semafor reported that a federal SWF would potentially receive an initial investment of $1.5 trillion or more; if that initial influx of cash doesn't see at least an 8% return, the plan would allow raising the maximum taxable income and payroll tax rate ceilings. The current system taxes workers' first $160,200 in earnings, and many Democrats have called for changing that cap. Sens.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Politically courageous senators merit praise for reform talks on Social SecurityThe good news is that a bipartisan group of senators is considering tough but wise choices to extend the life of the Social Security system. The bad news is there’s no mention yet of applying their top idea to Medicare as well.

Politically courageous senators merit praise for reform talks on Social SecurityThe good news is that a bipartisan group of senators is considering tough but wise choices to extend the life of the Social Security system. The bad news is there’s no mention yet of applying their top idea to Medicare as well.

Read more »

Will you receive Social Security checks after you retire?Time is running out for Congress to solve the massive program's solvency problem.

Will you receive Social Security checks after you retire?Time is running out for Congress to solve the massive program's solvency problem.

Read more »

There are only two ways to fix Social Security: cut benefits or raise revenues'Progressive price indexing' is not a third way. It’s a benefit cut.

There are only two ways to fix Social Security: cut benefits or raise revenues'Progressive price indexing' is not a third way. It’s a benefit cut.

Read more »

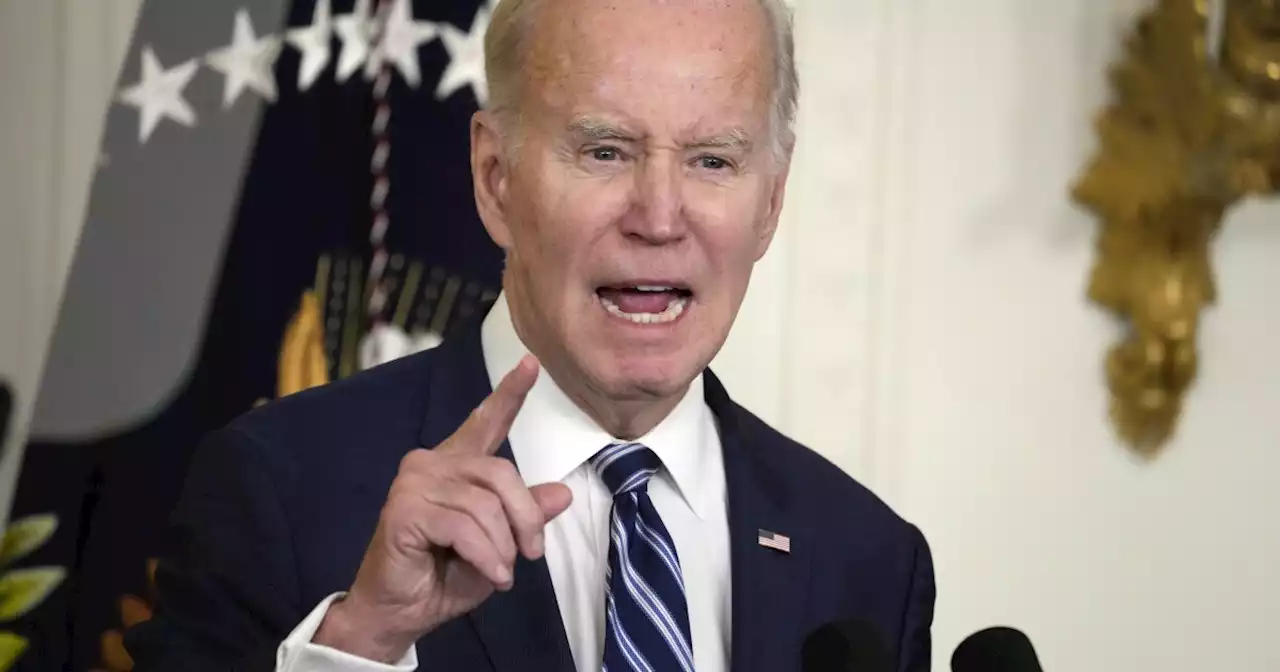

Republicans start to hit back against Biden's Social Security and Medicare attacks.POTUS has attacked the GOP for trying to dismantle Social Security, Medicare, and -- most recently -- Obamacare and Medicaid. The GOP looks to push back against the claims before Biden announces a 2024 bid for the White House.

Republicans start to hit back against Biden's Social Security and Medicare attacks.POTUS has attacked the GOP for trying to dismantle Social Security, Medicare, and -- most recently -- Obamacare and Medicaid. The GOP looks to push back against the claims before Biden announces a 2024 bid for the White House.

Read more »

A Simple Choice: Social Security or Billionaire Greed'One thing is clear: any politician who expresses concern about Social Security's finances without being willing to tax the rich is a phony,' writes RJEskow. 'Nothing but a phony.' ScrapTheCap

Read more »

Calls to 'Scrap the Cap' Grow as Millionaires Stop Paying Into Social Security for the Year'Despite earning much more than the average worker, a millionaire's effective tax rate is far lower than the average worker's,' noted one researcher. ScrapTheCap

Read more »