Senate GOP candidate Blake Masters suggests diversity at Federal Reserve is harming the economy.

Masters, of Arizona, defended the remarks in a video and lashed out at what he called President Joe Biden's "affirmative action regime."

"Finally a compelling explanation for why our economy is doing so well," Master, who has been endorsed by for President Donald Trump, wrote Sunday in retweeting anwith the headline:"Fed tackles inflation with its most diverse leadership ever." Of affirmative action, Masters said,"I can't think of a single policy since the end of Jim Crow that's been worse or more divisive for race relations in this country."

Masters has frequently invoked race and drawn on culture wars in one of the most closely watched Senate races.were responsible for America’s gun violence problem.versions of the “great replacement theory” — a conspiracy theory that claims there is a plot to weaken the influence of white Americans — by saying Democrats want to give amnesty to thousands of immigrants to claim them as voters.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

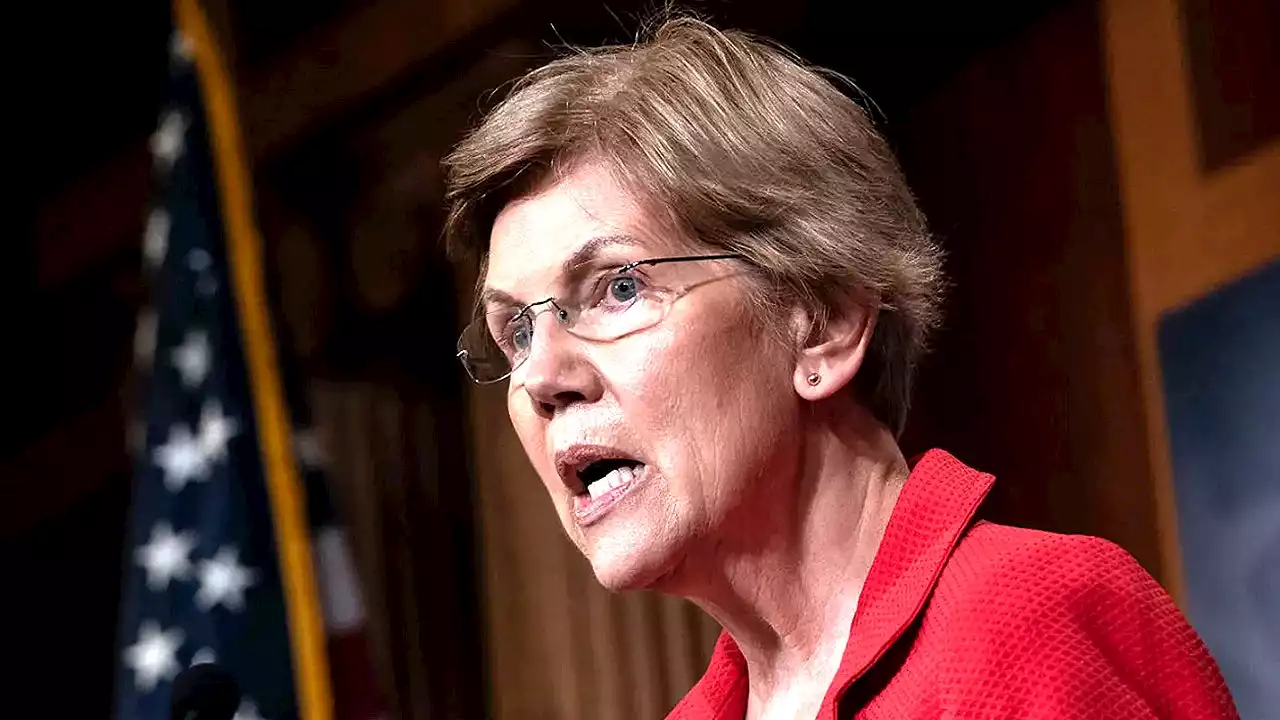

Senator Warren 'Very Worried' About Federal Reserve Raising Interest Rates, Tipping US Economy Into Recession – Economics Bitcoin NewsU.S. Senator Elizabeth Warren says she is 'very worried' that the Federal Reserve will tip the economy into recession. inflation

Senator Warren 'Very Worried' About Federal Reserve Raising Interest Rates, Tipping US Economy Into Recession – Economics Bitcoin NewsU.S. Senator Elizabeth Warren says she is 'very worried' that the Federal Reserve will tip the economy into recession. inflation

Read more »

Sen. Warren ‘very worried’ the Federal Reserve ‘is going to tip this economy into recession’Sen. Elizabeth Warren, D-Mass., said on CNN Sunday she’s 'very worried' that the Federal Reserve's continued raising of interest rates could force the U.S. into a recession.

Sen. Warren ‘very worried’ the Federal Reserve ‘is going to tip this economy into recession’Sen. Elizabeth Warren, D-Mass., said on CNN Sunday she’s 'very worried' that the Federal Reserve's continued raising of interest rates could force the U.S. into a recession.

Read more »

OPEC chatter, EU energy crisis to tug at oil pricesConcerns about the Federal Reserve’s inflation fighting posture, OPEC’s next move and...

OPEC chatter, EU energy crisis to tug at oil pricesConcerns about the Federal Reserve’s inflation fighting posture, OPEC’s next move and...

Read more »

Dow Falls 200 Points—Market Selloff Continues As Investors Worry About Higher Interest RatesMARKET ALERT: The market moves lower once again this morning—following a sharp selloff Friday—as investors continue to worry about ongoing interest rate hikes and tighter monetary policy from the Fed potentially throwing the economy into a recession

Dow Falls 200 Points—Market Selloff Continues As Investors Worry About Higher Interest RatesMARKET ALERT: The market moves lower once again this morning—following a sharp selloff Friday—as investors continue to worry about ongoing interest rate hikes and tighter monetary policy from the Fed potentially throwing the economy into a recession

Read more »