Your investments may not be winning this year, but at least you might be able to win on your taxes.

after the collapse of his cryptocurrency exchange, which is more than just a moral victory for the exchange’s roughly 1 million individual investors. While not locked in yet, things appear to be on track for these investors to take a more favorable tax position as SBF’s fate continues to unravel.Earlier this fall, it appeared that assets lost in the FTX collapse would be considered a capital loss under the United States tax code for the tax year 2022.

The charges the SEC leveled against SBF focus on equity investors, not retail investors. But the SEC does specifically mention “the undisclosed diversion of FTX customers’ funds to Alameda Research.” While not an official green light for the safe harbor, it’s very close — closer than we may have expected we’d see in 2022.

The IRS may also weigh in on if the existing charges are enough to trigger the safe harbor, and hopefully, 2022 is the year to take it. The theft loss could also be claimed in a future year, but most FTX investors will likely be eager to recoup some of their losses by offsetting income on their taxes as soon as possible.For investors who lost assets on FTX, planning on claiming the capital loss at this point would likely be unwise.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

FTX wants permission to sell FTX Japan and FTX Europe as well as LedgerXFTX has asked the Delaware Bankruptcy Court for permission to sell LedgerX, Embed, FTX Japan and FTX Europe, after CFTC Chairman Rostin Bernham noted that LedgerX has more cash than the rest of the debtors combined.

FTX wants permission to sell FTX Japan and FTX Europe as well as LedgerXFTX has asked the Delaware Bankruptcy Court for permission to sell LedgerX, Embed, FTX Japan and FTX Europe, after CFTC Chairman Rostin Bernham noted that LedgerX has more cash than the rest of the debtors combined.

Read more »

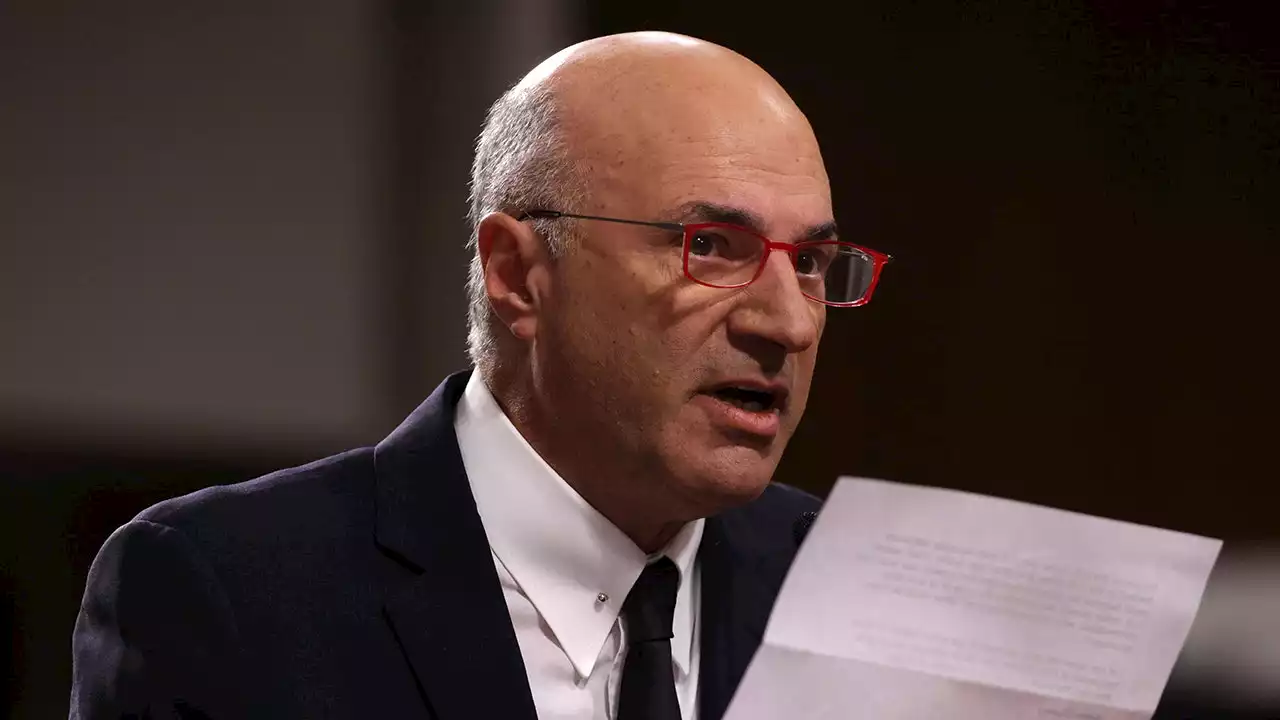

Former FTX spokesman Kevin O'Leary says he believes Binance put FTX 'out of business intentionally'Ex-FTX spokesman Kevin O'Leary told a Senate committee Wednesday he believes FTX rival Binance put the fallen crypto exchange 'out of business intentionally.'

Former FTX spokesman Kevin O'Leary says he believes Binance put FTX 'out of business intentionally'Ex-FTX spokesman Kevin O'Leary told a Senate committee Wednesday he believes FTX rival Binance put the fallen crypto exchange 'out of business intentionally.'

Read more »

FTX Bahamas co-CEO Ryan Salame blew the whistle on FTX and Sam Bankman-FriedFTX Digital Markets co-CEO alerted the securities regulator in the Bahamas to the fraud being committed at the exchange, telling the authorities that FTX was sending customer funds to Alameda Research.

FTX Bahamas co-CEO Ryan Salame blew the whistle on FTX and Sam Bankman-FriedFTX Digital Markets co-CEO alerted the securities regulator in the Bahamas to the fraud being committed at the exchange, telling the authorities that FTX was sending customer funds to Alameda Research.

Read more »

Silvergate faces class-action lawsuit over FTX and Alameda dealingsThe plaintiff Joewy Gonzalez invested his savings in crypto through the FTX exchange as the platform promised investors that they were able to store assets securely.

Silvergate faces class-action lawsuit over FTX and Alameda dealingsThe plaintiff Joewy Gonzalez invested his savings in crypto through the FTX exchange as the platform promised investors that they were able to store assets securely.

Read more »

Senators voice broader concerns around crypto, including BinanceSenate lawmakers are also eyeing Binance after fellow off-shore crypto exchange FTX imploded.

Senators voice broader concerns around crypto, including BinanceSenate lawmakers are also eyeing Binance after fellow off-shore crypto exchange FTX imploded.

Read more »

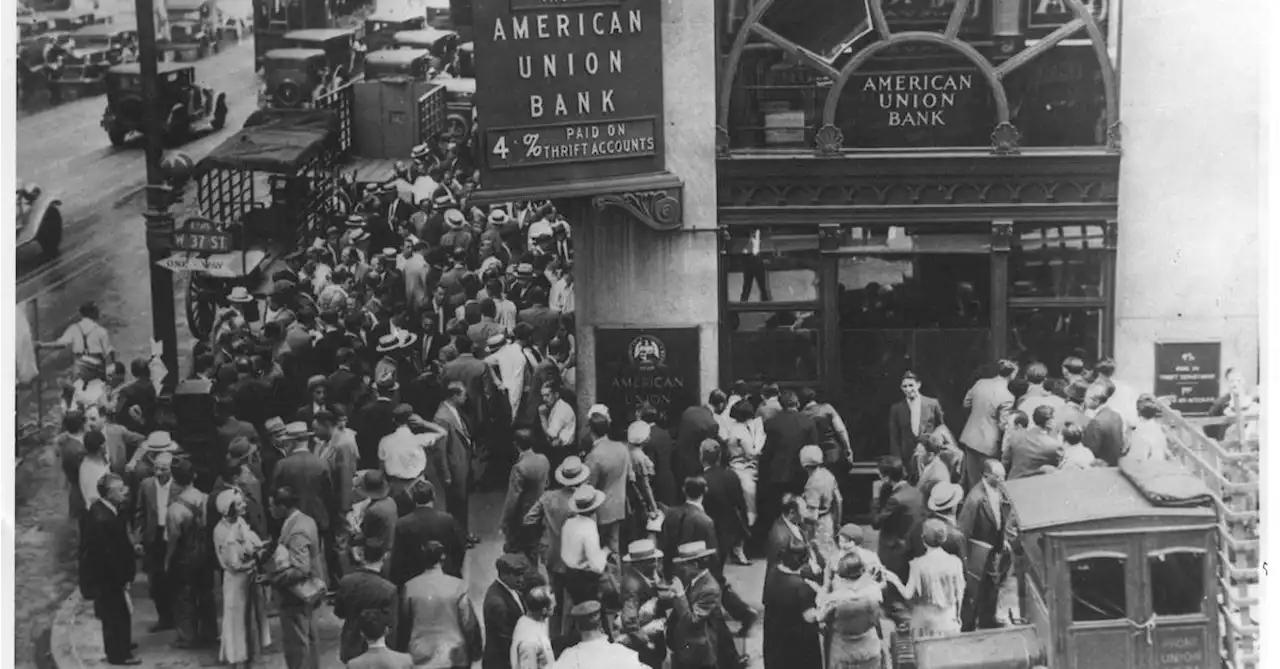

After FTX: Explaining the Difference Between Liquidity and Insolvency'A company can recover from liquidity problems, if the business is sound and the assets valuable. Watering can get it through a dry spell. But if it is diseased, no amount of water will save it.' Opinion Frances_Coppola FTX bitcoin crypto web3

After FTX: Explaining the Difference Between Liquidity and Insolvency'A company can recover from liquidity problems, if the business is sound and the assets valuable. Watering can get it through a dry spell. But if it is diseased, no amount of water will save it.' Opinion Frances_Coppola FTX bitcoin crypto web3

Read more »