In its 57-page first-half statement, no reason is given for the 100% increase.

But Ayo’s biggest shareholder is African Equity Empowerment Investments and that holder’s parent company is Sekunjalo Investment Holdings. Sekunjalo, which is also Ayo’s third biggest shareholder, was founded and is co-chaired by Iqbal Survé.

Thanks to Sekunjalo and AEEI’s holdings in Ayo, Surve and his companies stand to receive a healthy dividend from an ailing company, which is being sued by the Public Investment Corp and Government Employees Pension Fund for R4.3-billion, plus interest. There are another four court cases over and above the PIC and GEPF’s claim, according to Ayo.

In 2018, the PIC invested R4.3-billion in Ayo to back its initial public offering, valuing the technology company at R14.8-billion even though its assets were estimated at R292-million five years ago. Ayo’s total market value is now R1-billion, with its share price having plunged 93% since it listed. The stock took a battering in 2018 when President Cyril Ramaphosa ordered a probe into whether PIC officials, including its former CEO, Dan Matjila, followed procedure when it backed Ayo’s IPO. Matjila was ousted in 2018 and the probe found the PIC had regularly flouted procedures when making investments with government workers’ pension money.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Mall occupancies near 100%, says Liberty Two DegreesDemand for space remains high with over 100 new retail leases signed

Read more »

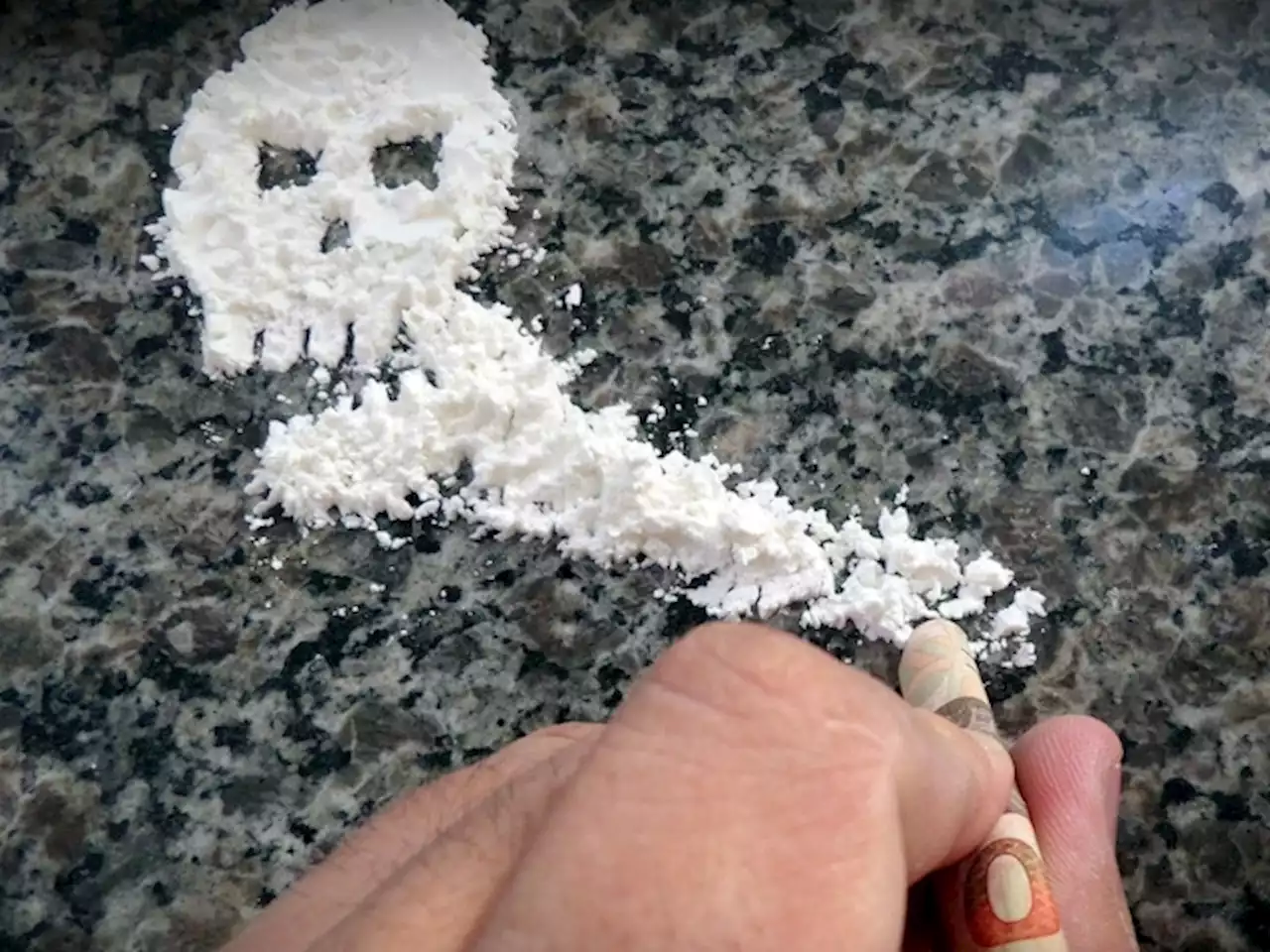

100% Pure Cocaine Is A Hell Of A DrugThe stuff you find at the street level has usually been cut and chopped with all sorts of rubbish before it reaches the consumer.

100% Pure Cocaine Is A Hell Of A DrugThe stuff you find at the street level has usually been cut and chopped with all sorts of rubbish before it reaches the consumer.

Read more »

Once-In-A-Lifetime Auction Of Untouched 100-Island ArchipelagoThe islands have remained uninhabited and totally untouched by human activity, but now Sotheby’s has been entrusted with auctioning off this extraordinary destination.

Once-In-A-Lifetime Auction Of Untouched 100-Island ArchipelagoThe islands have remained uninhabited and totally untouched by human activity, but now Sotheby’s has been entrusted with auctioning off this extraordinary destination.

Read more »

Loss-making Ayo doubles dividendAyoTechnology Solutions is in a court battle over the billions it took from Africa’s largest fund manager, banks are trying to close its accounts and it just reported a first-half net loss that widened 13% to R116 million. Moneyweb BusinessNews

Loss-making Ayo doubles dividendAyoTechnology Solutions is in a court battle over the billions it took from Africa’s largest fund manager, banks are trying to close its accounts and it just reported a first-half net loss that widened 13% to R116 million. Moneyweb BusinessNews

Read more »

JSE fines former Ayo and AEEI executives R250,000 each for breaching listing rulesBourse finds that R870m transferred between Ayo and asset manager 3 Laws Capital between 2017 and 2019 were irregular

Read more »