The S&P 500 will surf a tidal wave of government spending – but other parts of the US economy are in pain, Kevin O'Leary says

in spending and tax breaks to support clean energy and bring down healthcare costs."So if you're an S&P 500 company, yippee-ya-yoo-ka-yey," he continued."You've got clear sailing for the next three to four years, and the market knows that."

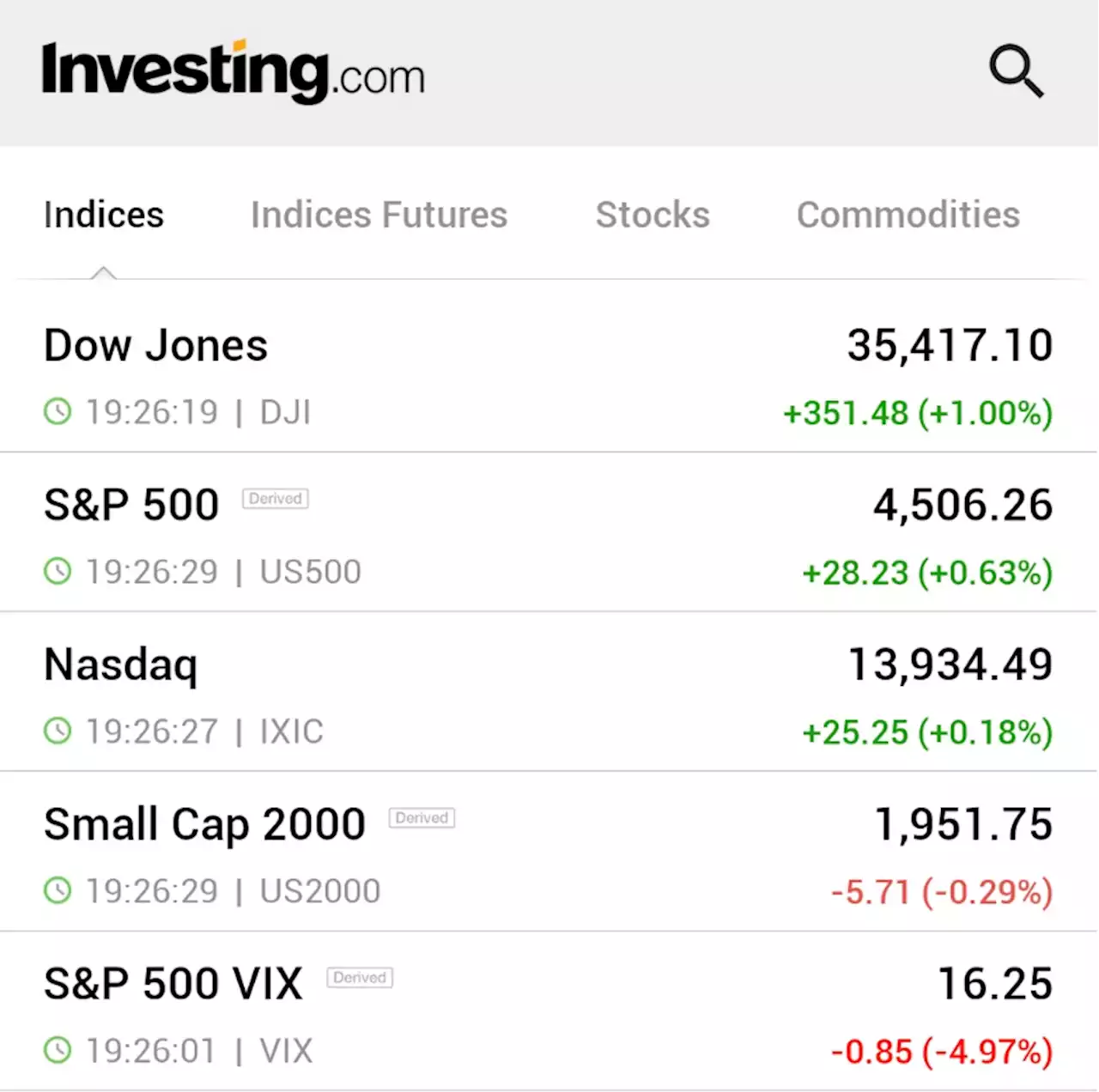

The O'Leary Funds chief — whose nickname is"Mr Wonderful" — touted the benchmark stock index's appeal, even after its 17% rally this year.However, O'Leary underlined the stark contrast between the booming stock market, and the likes of regional banks and small businesses where"the cracks are starting to show."

He predicted the Federal Reserve would keep raising interest rates, driving the cost of car loans and other debts even higher. He also highlighted stubborn increases in food and energy prices, and poorer access to credit as many smaller banks have

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Kevin O'Leary warns about downgraded US credit ratingKevin O'Leary, Chairman of O'Leary Ventures, expresses concern over the decision to downgrade the U.S. credit rating by Fitch Ratings and discusses the potential consequences on the U.S. dollar, Treasury bill, and overall faith in the government's ability to repay its debts.

Kevin O'Leary warns about downgraded US credit ratingKevin O'Leary, Chairman of O'Leary Ventures, expresses concern over the decision to downgrade the U.S. credit rating by Fitch Ratings and discusses the potential consequences on the U.S. dollar, Treasury bill, and overall faith in the government's ability to repay its debts.

Read more »

Stock-index futures advance after worst week for the S&P 500 since MarchBuyers are reasserting their dominance early Monday, after the S&P 500 shed 2.3% last week, its biggest weekly decline since March.

Stock-index futures advance after worst week for the S&P 500 since MarchBuyers are reasserting their dominance early Monday, after the S&P 500 shed 2.3% last week, its biggest weekly decline since March.

Read more »

S&P 500 in danger of breaching support as tech momentum wanes, says analystA change of tone in the stock market leaves the S&P 500 eyeing important support levels, and energy will have to pick up the baton as tech momentum wanes.

S&P 500 in danger of breaching support as tech momentum wanes, says analystA change of tone in the stock market leaves the S&P 500 eyeing important support levels, and energy will have to pick up the baton as tech momentum wanes.

Read more »

S&P 500 quarterly earnings have been upbeat; revenue not so muchS&P 500 companies have been reporting upbeat bottom lines for the June quarter, but not such impressive increases in their revenue.

S&P 500 quarterly earnings have been upbeat; revenue not so muchS&P 500 companies have been reporting upbeat bottom lines for the June quarter, but not such impressive increases in their revenue.

Read more »

S&P 500, Dow kick off week higher; U.S. inflation in focusThe benchmark S&P 500 and the Dow climbed higher on Monday as investors anticipate a highly awaited U.S. inflation report that could impact the market's recovery.

S&P 500, Dow kick off week higher; U.S. inflation in focusThe benchmark S&P 500 and the Dow climbed higher on Monday as investors anticipate a highly awaited U.S. inflation report that could impact the market's recovery.

Read more »

S&P500 Futures Retreat as Central Bank Signals and Light Calendar Cause Mixed Market SentimentS&P500 Futures experience mild losses as traders await second-tier statistics from China and the US. Mixed signals from major central bankers and a lack of major data/events contribute to the cautious market sentiment. The futures retreat towards the monthly low after a brief bounce off.

S&P500 Futures Retreat as Central Bank Signals and Light Calendar Cause Mixed Market SentimentS&P500 Futures experience mild losses as traders await second-tier statistics from China and the US. Mixed signals from major central bankers and a lack of major data/events contribute to the cautious market sentiment. The futures retreat towards the monthly low after a brief bounce off.

Read more »