The S&P 500 showed a positive gain yesterday but lacked broad market participation. This, coupled with rising yields and increased short interest, suggests investors are navigating uncertain economic waters.

The S&P 500 rallied by about 75 basis points yesterday, but it remains a market with weak breadth. Breadth was notably weak in the morning, though it improved slightly as the day progressed. According to data from the Bloomberg 500 Index, Nvidia (NASDAQ:NVDA) saw a notable increase in short volume. From a technical perspective, the S&P 500 remains below the intraday highs seen on Friday, hovering around the 61.8% retracement level. The 10-Year Treasury yield rose six basis points to 4.

59%, marking a new high since bottoming out on September 17. This movement steepened the yield curve, with the 2-Year Treasury yield closing at +15 basis points, its highest level since early November 2022. This suggests the market anticipates short-term rates to be higher 18 months from now, potentially reflecting expectations of future Fed rate hikes. The Powell Indicator (3-Month Treasury Forward Spread) - The Powell Indicator refers to the spread between the 3-month Treasury yield 18 months forward and the current 3-month Treasury yield. It’s a tool for gauging market expectations of future interest rates, often reflecting predictions about Federal Reserve policy. A positive spread suggests that the market anticipates higher short-term rates in the future, which could indicate expectations of tighter monetary policy or economic growth. Short Interest Volume - Short interest volume measures the total number of shares sold short (borrowed and sold in anticipation of a price decline) but not yet covered or closed out. It’s a key indicator of market sentiment, as rising short interest may suggest increased bearish expectations or hedging activity

S&P 500 MARKET BREADTH YIELDS SHORT INTEREST FED

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Dow Jones, Nasdaq, S&P 500 weekly preview: Jam packed weak ahead of ThanksgivingDow Jones, Nasdaq, S&P 500 weekly preview: Jam packed weak ahead of Thanksgiving

Dow Jones, Nasdaq, S&P 500 weekly preview: Jam packed weak ahead of ThanksgivingDow Jones, Nasdaq, S&P 500 weekly preview: Jam packed weak ahead of Thanksgiving

Read more »

Dow Jones, Nasdaq, S&P 500 weekly preview: Jam packed weak ahead of ThanksgivingDow Jones, Nasdaq, S&P 500 weekly preview: Jam packed weak ahead of Thanksgiving

Dow Jones, Nasdaq, S&P 500 weekly preview: Jam packed weak ahead of ThanksgivingDow Jones, Nasdaq, S&P 500 weekly preview: Jam packed weak ahead of Thanksgiving

Read more »

Stock market today: S&P 500 closes lower as tech stumbles despite Alphabet jumpStock market today: S&P 500 closes lower as tech stumbles despite Alphabet jump

Stock market today: S&P 500 closes lower as tech stumbles despite Alphabet jumpStock market today: S&P 500 closes lower as tech stumbles despite Alphabet jump

Read more »

Mexican Peso rallies on upbeat market mood, weak US DollarThe Mexican Peso begins the week on the front foot against the US Dollar due to an improvement in risk appetite and overall US Dollar weakness.

Mexican Peso rallies on upbeat market mood, weak US DollarThe Mexican Peso begins the week on the front foot against the US Dollar due to an improvement in risk appetite and overall US Dollar weakness.

Read more »

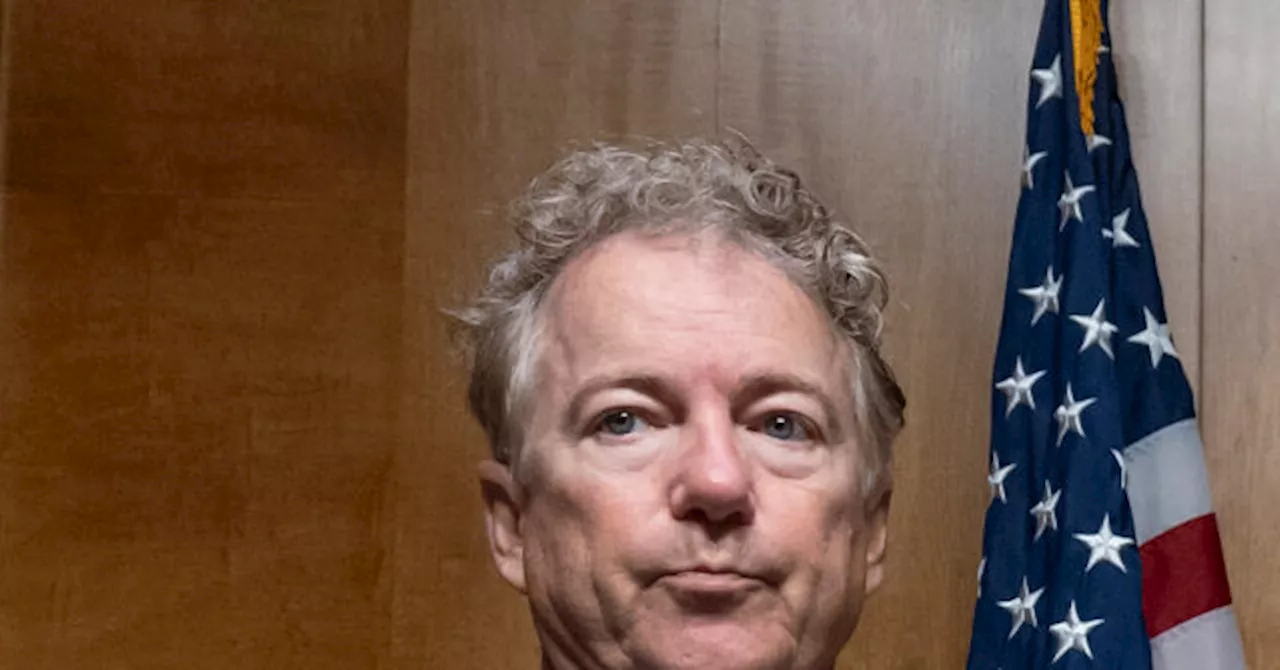

Rand Paul: Bill ‘Full of Pork’ Shows Speaker Johnson Is a ‘Weak, Weak Man’Source of breaking news and analysis, insightful commentary and original reporting, curated and written specifically for the new generation of independent and conservative thinkers.

Rand Paul: Bill ‘Full of Pork’ Shows Speaker Johnson Is a ‘Weak, Weak Man’Source of breaking news and analysis, insightful commentary and original reporting, curated and written specifically for the new generation of independent and conservative thinkers.

Read more »

Micron Shares Drop After Weak Guidance Despite Earnings BeatMicron Technology's stock price fell sharply after the company issued lower-than-anticipated revenue and earnings guidance for the next quarter, despite exceeding earnings expectations for the current quarter.

Micron Shares Drop After Weak Guidance Despite Earnings BeatMicron Technology's stock price fell sharply after the company issued lower-than-anticipated revenue and earnings guidance for the next quarter, despite exceeding earnings expectations for the current quarter.

Read more »