Stocks may be in for a turbulent week ahead amid escalating Russia-Ukraine tensions. Investors’ premonitions about a weaker growth outlook from the IMF may amplify risk-off sentiment. Get your market update from DimitriZabelin here:

Equity markets in Europe and the United States may be in for a rough ride ahead of a packed week of economic data and geopolitical stress. This includes the French presidential runoff, the ongoing Russia-Ukraine war, the IMF growth outlook, Fed commentary, and a cascade of economic data. This constellation of narratives suggests volatility ahead.before the Easter holiday weekend.

amplified volatility and revealed a downside disposition of investors’ sentiment. Given the current fundamental circumstances, it is likely this downward trend may continue throughout the week, barring a surge of optimism.Russian forces continue to move in from the east, with the latest source of tension coming from the city of Mariupol. The Kremlin notified the remaining Ukrainian soldiers that should they lay down their arms, they will be offered safe passage.

Russia’s invasion has also led Sweden and Finland to consider joining the North Atlantic Treaty Organization , with public opinion in the latter country jumping from just 30% in support of joining to now over 60%. Sweden has historically remained neutral vis-à-vis NATO and Russia, but the invasion has notably strengthened the case for membership.

The two Nordic countries have moved in lockstep on the matter, and their recent pivot has prompted a sharp response from Russia. Moscow warned that it would deploy nuclear weapons in the Baltic Sea if either country joined. Looking ahead, investors and policymakers alike will be watching very closely how Stockholm and Helsinki respond.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

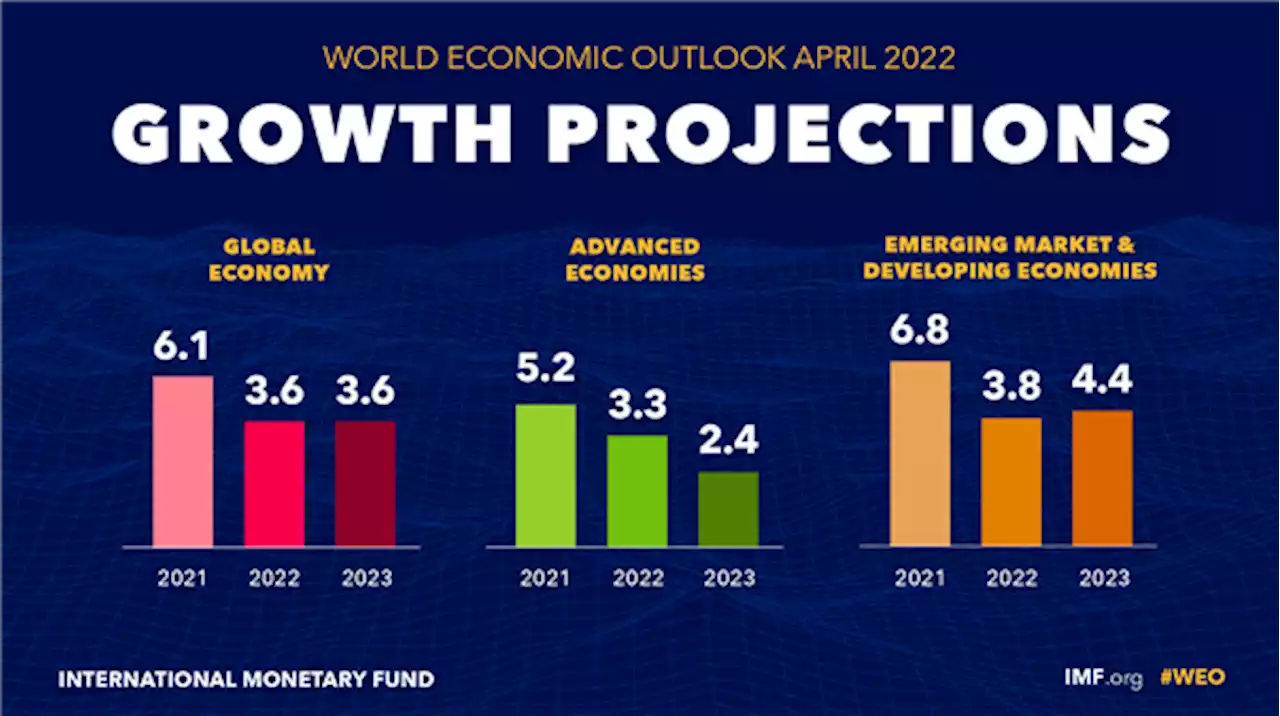

IMF Lowers Growth for 2022 and 2023, Cites Risks to Ukraine Conflict, InflationThe IMF cited the war in Ukraine as “economic damage from the conflict will contribute to a significant slowdown in global growth in 2022 and to add to inflation.” Get your market update from RichardSnowFX here:

IMF Lowers Growth for 2022 and 2023, Cites Risks to Ukraine Conflict, InflationThe IMF cited the war in Ukraine as “economic damage from the conflict will contribute to a significant slowdown in global growth in 2022 and to add to inflation.” Get your market update from RichardSnowFX here:

Read more »

IMF says Russia's war in Ukraine will 'severely set back' global economyThe International Monetary Fund has slashed its expectations for global economic growth over the next two years because of Russia's invasion of Ukraine, comparing the ripple effects from the conflict to an 'earthquake.'

IMF says Russia's war in Ukraine will 'severely set back' global economyThe International Monetary Fund has slashed its expectations for global economic growth over the next two years because of Russia's invasion of Ukraine, comparing the ripple effects from the conflict to an 'earthquake.'

Read more »

CoinDesk Podcast Network: BREAKDOWN: IMF Financial Stability Report Highlights Crypto on Apple PodcastsThe IMF’s latest financial stability report sends mixed messages on crypto. Dive into the analysis of the report with NLW on “The Breakdown.”

CoinDesk Podcast Network: BREAKDOWN: IMF Financial Stability Report Highlights Crypto on Apple PodcastsThe IMF’s latest financial stability report sends mixed messages on crypto. Dive into the analysis of the report with NLW on “The Breakdown.”

Read more »

IMF global financial stability report sees complex roles for cryptocurrency, DeFiA new IMF report on global financial stability says cryptocurrencies not very useful for evading sanctions, decentralized finance offers a balance of risk and benefit.

IMF global financial stability report sees complex roles for cryptocurrency, DeFiA new IMF report on global financial stability says cryptocurrencies not very useful for evading sanctions, decentralized finance offers a balance of risk and benefit.

Read more »

'Impractical' to Move Russian Rubles into Crypto Because of Low Liquidity, IMF Concedes | CoinMarketCapNonetheless, the institution says the crypto ecosystem could still be used to sidestep economic sanctions — especially if due diligence checks are inadequate, or anonymizing tools are used.

'Impractical' to Move Russian Rubles into Crypto Because of Low Liquidity, IMF Concedes | CoinMarketCapNonetheless, the institution says the crypto ecosystem could still be used to sidestep economic sanctions — especially if due diligence checks are inadequate, or anonymizing tools are used.

Read more »

IMF Says Capital Control Powers Should Include CryptoCapital control measures should cover crypto, IMFnews said as it warns of a loophole in Russia sanctions. jackschickler reports

IMF Says Capital Control Powers Should Include CryptoCapital control measures should cover crypto, IMFnews said as it warns of a loophole in Russia sanctions. jackschickler reports

Read more »