Soft start to 2022 for equities as Fed hawks bring QT back into the equation. Get your weekly equities forecast from JMcQueenFX here:

US equities are off to a soft start to the year, with the benchmarkslipping some 1.6%. As we stated in our Q1 equity forecast, now that we have seen a hawkish Fed pivot similar to that of 2018, Fed policy is now a bigger threat to equities than Omicron. This week saw a much more hawkish than expected minutes release from the Federal Reserve, whereby the central bank has quickly brought back quantitative tightening into the equation.

Looking at the chart, key support is situated at the rising trendline , which held at the back end of 2021. Remember that markets continue to display a buy the dip mentality and should we see a notably softer close Friday and Monday, there is a good chance of a turnaround Tuesday (much like Dec 20

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Omicron Cancellations Signal a Rough Start to 2022 for Veteran Acts, Drag Queens & More“It’s been pretty devastating,” says one nightclub booking manager

Omicron Cancellations Signal a Rough Start to 2022 for Veteran Acts, Drag Queens & More“It’s been pretty devastating,” says one nightclub booking manager

Read more »

Celebrity deaths in 2022: Famous faces lost from Sidney Poitier to George RossiIt's never easy to say goodbye - here we remember those who have sadly died in 2022, celebrating their achievements, bodies of work and the legacies they left behind

Celebrity deaths in 2022: Famous faces lost from Sidney Poitier to George RossiIt's never easy to say goodbye - here we remember those who have sadly died in 2022, celebrating their achievements, bodies of work and the legacies they left behind

Read more »

Best electric toothbrushes 2022Fight plaque and gum disease with the best electric toothbrushes.

Best electric toothbrushes 2022Fight plaque and gum disease with the best electric toothbrushes.

Read more »

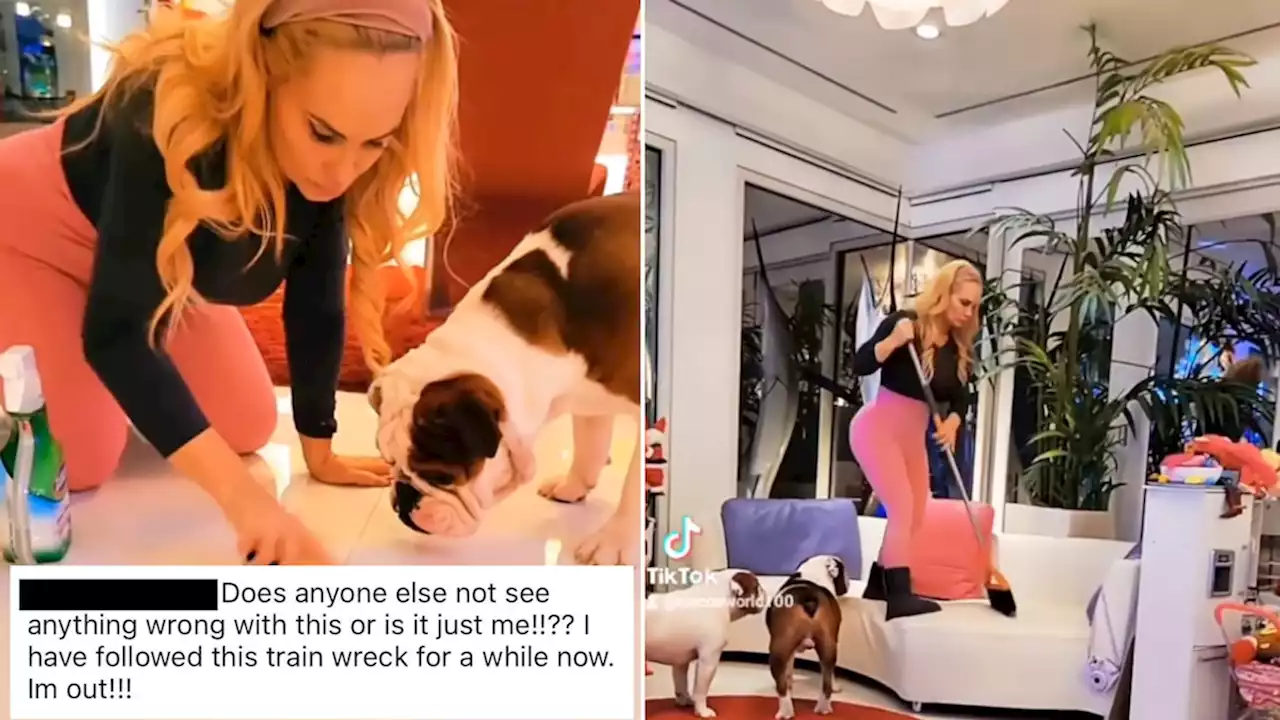

The Best Celebrity Clapbacks of 2022Coco Austin claps back at troll calling her a “train wreck” for posting THIS (via toofab)

The Best Celebrity Clapbacks of 2022Coco Austin claps back at troll calling her a “train wreck” for posting THIS (via toofab)

Read more »

Best treadmills 2022Looking for the best treadmills? We reveal the most popular running machines that can help you reach your health and fitness goals.

Best treadmills 2022Looking for the best treadmills? We reveal the most popular running machines that can help you reach your health and fitness goals.

Read more »

Why 2022 is the year virtual and augmented reality will come to lifeSony, Panasonic, HTC and other consumer electronics companies are releasing new VR and metaverse products at CES.

Why 2022 is the year virtual and augmented reality will come to lifeSony, Panasonic, HTC and other consumer electronics companies are releasing new VR and metaverse products at CES.

Read more »