While both RTX and Lockheed Martin are strong companies, analysts suggest that RTX is a better buy for 2025. This is due to RTX's strong financial performance, analyst upgrades, and potential for share price growth. Lockheed Martin, on the other hand, is expected to experience a period of consolidation until later in the year.

Both RTX and Lockheed Martin are high-quality companies with the potential to deliver long-term shareholder value and propel their share price s upward. However, current business trends and analyst sentiment suggest that RTX presents a compelling buy opportunity for 2025, while Lockheed Martin might experience a period of consolidation until later in the year. RTX 's share price is projected to climb in 2025, potentially reaching a 25% gain before peaking.

Conversely, Lockheed Martin's share price is likely to remain near its early February levels until market conditions improve. Several factors are driving these divergent trajectories. Lockheed Martin had a respectable 2024 and a solid fourth quarter, but its performance was hampered by softness in two of its four segments. The company's net revenue of $18.62 billion also fell short of the previous year's figures, contrasting with the growth witnessed by competitor RTX. A critical concern for Lockheed Martin is the mounting losses incurred on classified projects. The company holds numerous contracts for producing classified results across various segments, and these losses are escalating. Worryingly, these classified project losses are encroaching on profits and guidance, and are anticipated to worsen further. While Lockheed Martin executives project a decent year in 2025, sufficient to maintain capital returns and a healthy balance sheet, it falls short of analyst expectations. The potential for underperformance looms large if these losses persist. In contrast, RTX demonstrated robust growth, with an 8.5% revenue increase surpassing MarketBeat's reported consensus by a significant margin. Growth was observed across all operating segments, including both commercial and government businesses. The company's organic growth stood at 11%, accompanied by margin expansion. This margin expansion resulted in substantial, double-digit gains at the bottom line, rising 19% on an adjusted basis and nearly 1200 basis points better than forecasted. The analysts' response further differentiates RTX's trajectory from Lockheed Martin's. Analyst sentiment for LMT remains moderately bullish, with a consensus forecast predicting a 20% upside by early February. However, price targets are trending downwards. MarketBeat tracked six revisions from 15 analysts following Q4 earnings, with all six revisions resulting in lower price targets. While they still anticipate substantial upside, it falls below the initial consensus, and estimates may continue to decline, posing a headwind for the market. RTX, on the other hand, enjoys tailwinds from its analysts. Within days of the earnings release, MarketBeat tracked nine revisions, including a 100% increase in price targets and an upgrade to buy. These revisions suggest the market is likely to move towards the higher end of analyst targets, achieving a 25% upside from critical resistance levels.

Technology RTX Lockheed Martin Defense Stocks Share Price Analyst Sentiment Capital Returns Financial Performance

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Frankencar 2025: The best of the Motor Authority Best Car To Buy 2025 finalistsTaking the best bits from our award finalists this year, this latest creation is electric with power, style, and three rows of seats.

Frankencar 2025: The best of the Motor Authority Best Car To Buy 2025 finalistsTaking the best bits from our award finalists this year, this latest creation is electric with power, style, and three rows of seats.

Read more »

AIMA Tech Unveils 2025 eBike Lineup at CES 2025AIMA Tech, a global leader in sustainable mobility, unveils its groundbreaking 2025 eBike lineup at CES 2025. The new lineup features eight new models and three upgraded designs, each tailored to meet diverse rider needs.

AIMA Tech Unveils 2025 eBike Lineup at CES 2025AIMA Tech, a global leader in sustainable mobility, unveils its groundbreaking 2025 eBike lineup at CES 2025. The new lineup features eight new models and three upgraded designs, each tailored to meet diverse rider needs.

Read more »

GQ Bowl 2025: Bode Aujla's Spring 2025 Collection Takes Center Stage in New OrleansGQ will partner with American designer Emily Adams Bode Aujla to present the inaugural GQ Bowl fashion show on February 7th at Hotel Peter & Paul in New Orleans. The event will showcase Bode Aujla's Spring 2025 Bode Rec. collection, inspired by her father's football past and the vibrant festival culture of New Orleans. The show will be livestreamed on GQ.com and feature a VIP party and all-access coverage.

GQ Bowl 2025: Bode Aujla's Spring 2025 Collection Takes Center Stage in New OrleansGQ will partner with American designer Emily Adams Bode Aujla to present the inaugural GQ Bowl fashion show on February 7th at Hotel Peter & Paul in New Orleans. The event will showcase Bode Aujla's Spring 2025 Bode Rec. collection, inspired by her father's football past and the vibrant festival culture of New Orleans. The show will be livestreamed on GQ.com and feature a VIP party and all-access coverage.

Read more »

Ten Fall 2025 Menswear Trends for Your 2025 MoodboardThese fall 2025 menswear trends paint a portrait of a fashion industry in flux as this year shapes up as one of transition.

Ten Fall 2025 Menswear Trends for Your 2025 MoodboardThese fall 2025 menswear trends paint a portrait of a fashion industry in flux as this year shapes up as one of transition.

Read more »

Edmunds' hybrid SUV test: 2025 Hyundai Tucson Hybrid vs 2025 Toyota RAV4 HybridIf you’re in the market for a hybrid SUV, don’t miss out on this comparison.

Edmunds' hybrid SUV test: 2025 Hyundai Tucson Hybrid vs 2025 Toyota RAV4 HybridIf you’re in the market for a hybrid SUV, don’t miss out on this comparison.

Read more »

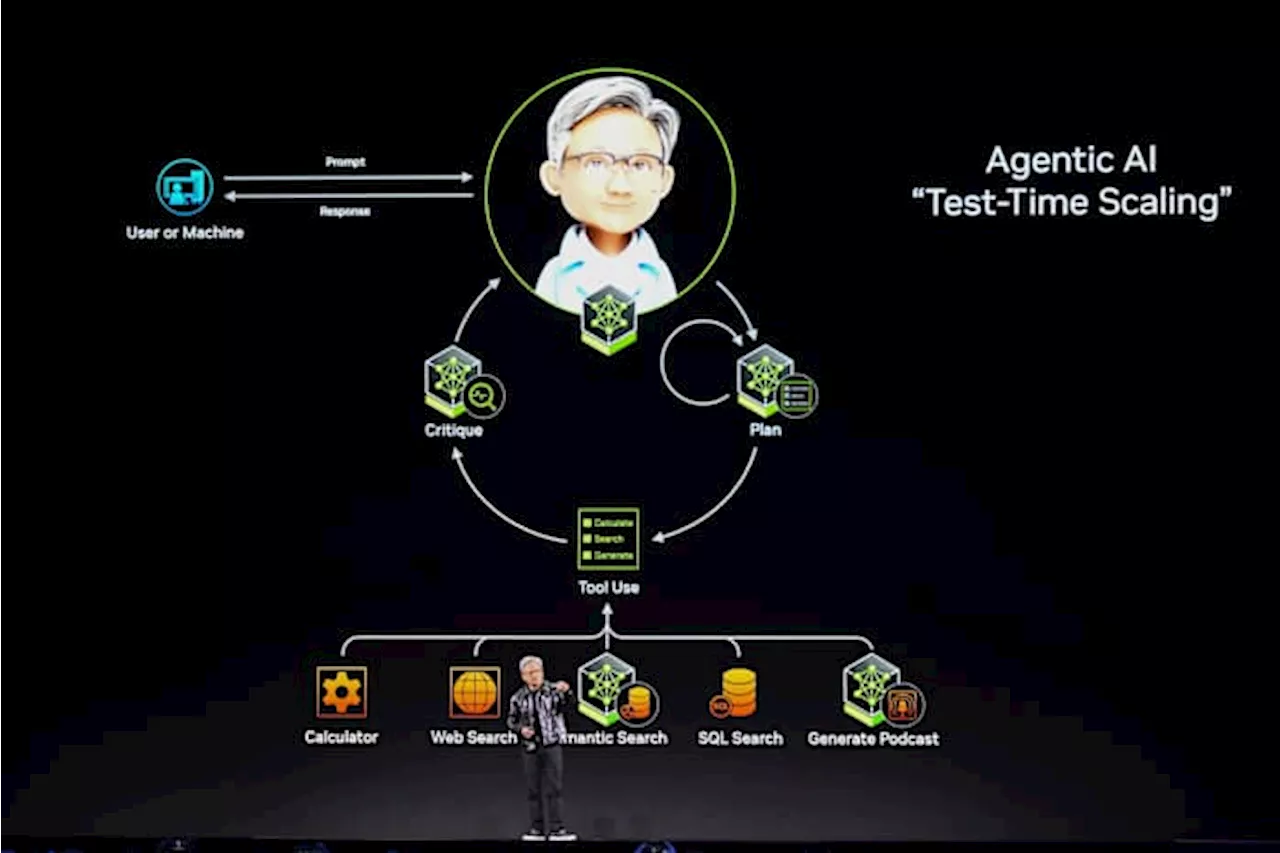

Nvidia Unveils RTX 50 Series GPUs at CES 2025Nvidia CEO Jensen Huang presented the company's new GeForce RTX 50 Series GPUs at CES 2025, highlighting their advancements in AI-driven rendering and capabilities for gaming, content creation, and development.

Nvidia Unveils RTX 50 Series GPUs at CES 2025Nvidia CEO Jensen Huang presented the company's new GeForce RTX 50 Series GPUs at CES 2025, highlighting their advancements in AI-driven rendering and capabilities for gaming, content creation, and development.

Read more »