Financial planner Liz Weston addresses the complications of rolling over a 401K account for a woman who is switching jobs at age 73.

Dear Liz: My wife, who turned 73 this year, worked for a company until Aug. 31. She started a new job with another company the following day. She plans to roll the 401 from the previous company into the 401 of the new company.

She could avoid the penalties by withdrawing the RMD amount, along with any earnings or losses associated with the excess contribution, by Oct. 15 of the year after the rollover, Luscombe says. A tax pro can help with those calculations. Dear Liz: A while back, you responded to a letter writer that Social Security’s estimates of the amount a person will receive assumes the person will continue working until they apply for benefits.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

IRS increases 401(k), other retirement plan contribution limits for 2025The IRS released its updated contribution limits and adjustments to eligibility thresholds for 401(k) plans, IRAs and other retirement plans to account for inflation.

IRS increases 401(k), other retirement plan contribution limits for 2025The IRS released its updated contribution limits and adjustments to eligibility thresholds for 401(k) plans, IRAs and other retirement plans to account for inflation.

Read more »

Star Jesse Lee Soffer Discusses The Impact Of FBI: International's Season 4 Premiere DeathFBI: International 401 Post-Mortem Interview Jesse Lee Soffer Featured Image

Star Jesse Lee Soffer Discusses The Impact Of FBI: International's Season 4 Premiere DeathFBI: International 401 Post-Mortem Interview Jesse Lee Soffer Featured Image

Read more »

IRS announces 401(k) contribution limits for 2025The IRS has announced higher 401(k) contribution limits for 2025. Here’s what savers need to know.

IRS announces 401(k) contribution limits for 2025The IRS has announced higher 401(k) contribution limits for 2025. Here’s what savers need to know.

Read more »

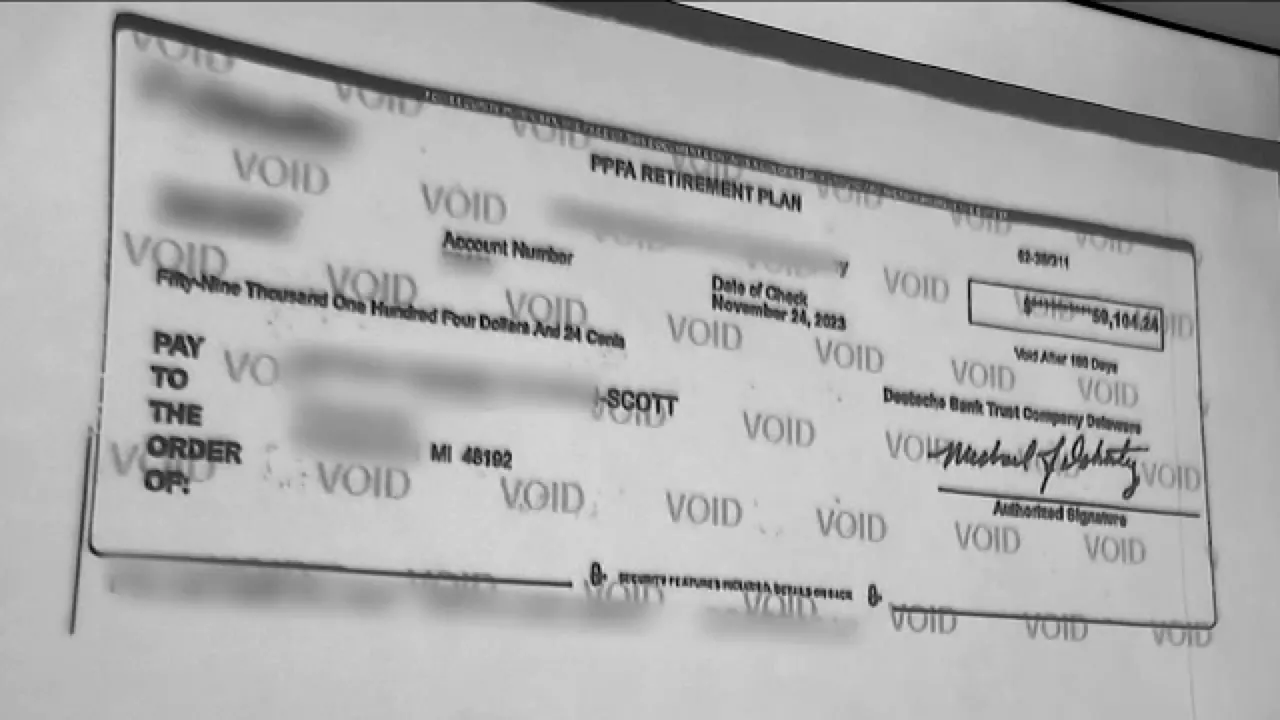

7 On Your Side helps get man's stolen 401(k) reimbursed after check fraudA man contributed to his 401(k) for almost a decade and ended up having all of his money, including the employee match, get stolen in a case of check fraud.

7 On Your Side helps get man's stolen 401(k) reimbursed after check fraudA man contributed to his 401(k) for almost a decade and ended up having all of his money, including the employee match, get stolen in a case of check fraud.

Read more »

Why 401(k) plans are the ‘final frontier' for exchange-traded fundsExchange-traded funds have made little headway in 401(k) plans even as they’ve steadily gained market share in other accounts.

Why 401(k) plans are the ‘final frontier' for exchange-traded fundsExchange-traded funds have made little headway in 401(k) plans even as they’ve steadily gained market share in other accounts.

Read more »

You can contribute even more to your 401(k) in 2025—here's what to knowIndividuals under age 50 can contribute up to $23,500 to their 401(k) or other employer-sponsored retirement account in 2025.

You can contribute even more to your 401(k) in 2025—here's what to knowIndividuals under age 50 can contribute up to $23,500 to their 401(k) or other employer-sponsored retirement account in 2025.

Read more »