Health insurance premiums continue to increase while CEOs of top health insurance companies receive millions in compensation.

Health insurance premiums keep rising and many employees carry high-deductible plans that mean bills of $100 or more for a visit to the doctor. Meanwhile, the CEOs of the top 10 health insurance companies were paid between $13 million and $22 million in total compensation in 2022, including salary, bonuses and other pay, according to a ConnecticutOpinion: Dropping essential hospital services harms East San Jose community, covering almost 18% of market share, the report states.

That’s 53 million people covered. Its CEO, Andrew Witty, took home $20,865,106 in 2022.UnitedHealth Group had $324 billion in revenues in 2022. Molina Healthcare had just under $32 billion, the report states. “I’m not an expert in executive compensation. I don’t know how this compares to executive compensation, but it certainly doesn’t seem fair,” said Sean King, acting state healthcare advocat

Health Insurance Premiums High-Deductible Plans CEO Compensation Rising Costs

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

New Illinois health insurance proposal would ban 'junk insurance' and 'step therapy'The Healthcare Protection Act (HPA) seeks to prohibit step therapy, eliminate prior authorization for crisis mental health care, enhance network adequacy and curb unchecked rate hikes for large group insurance companies.

New Illinois health insurance proposal would ban 'junk insurance' and 'step therapy'The Healthcare Protection Act (HPA) seeks to prohibit step therapy, eliminate prior authorization for crisis mental health care, enhance network adequacy and curb unchecked rate hikes for large group insurance companies.

Read more »

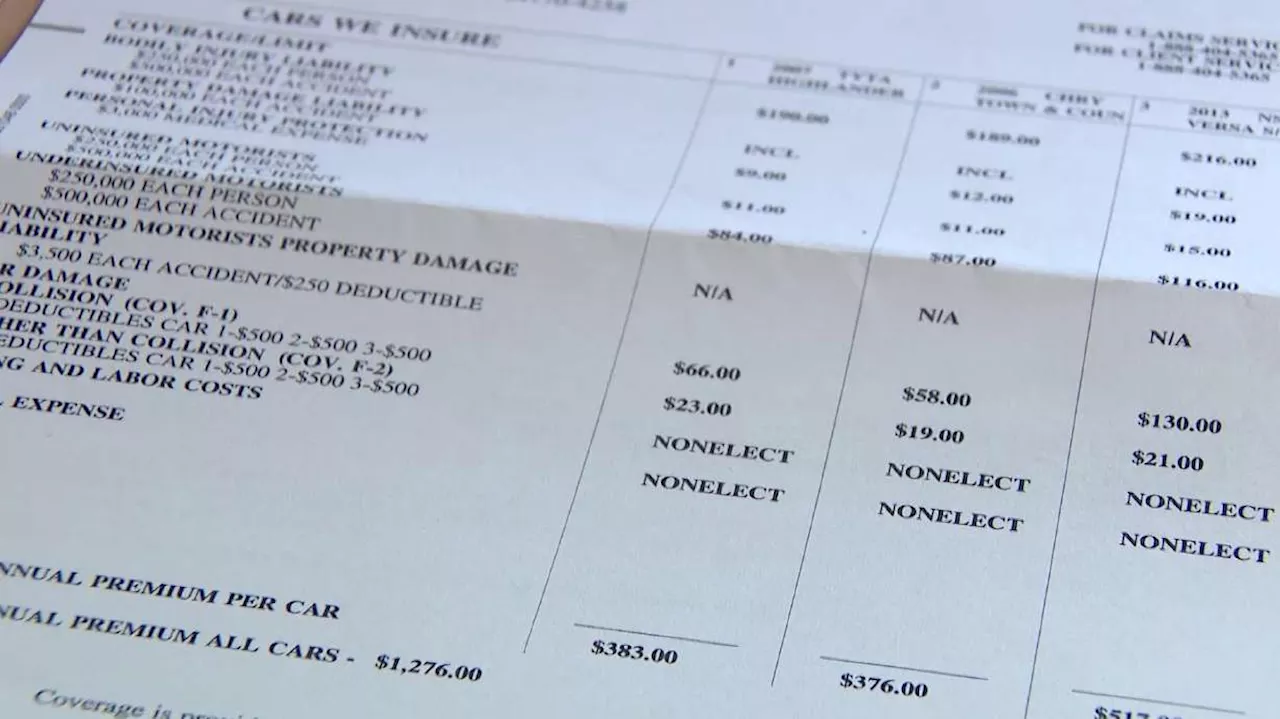

Get Gephardt: What's fueling the dramatic increases in auto insurance premiums?If you were in a car crash, you would expect your insurance rates to go up. But the call came to Get Gephardt from a St. George woman who says her rate skyrocketed, even though she's been a perfect driver.

Get Gephardt: What's fueling the dramatic increases in auto insurance premiums?If you were in a car crash, you would expect your insurance rates to go up. But the call came to Get Gephardt from a St. George woman who says her rate skyrocketed, even though she's been a perfect driver.

Read more »

Home Insurance Rules Could Change as State Grapples With CrisisAmid skyrocketing premiums, Louisiana's insurance commissioner proposes reforms to entice more insurers, targeting an overhaul.

Home Insurance Rules Could Change as State Grapples With CrisisAmid skyrocketing premiums, Louisiana's insurance commissioner proposes reforms to entice more insurers, targeting an overhaul.

Read more »

Climate change may be part of rising homeowner's insurance rates in HoustonHave you noticed your homeowner's insurance rates go up? ABC13 dives into how weather plays a role.

Climate change may be part of rising homeowner's insurance rates in HoustonHave you noticed your homeowner's insurance rates go up? ABC13 dives into how weather plays a role.

Read more »

Illinois auto and home insurance rates keep rising as Allstate, State Farm plan double-digit hikesAllstate is hiking homeowners insurance rates by 12.7% this week, while State Farm is planning a 12.3% increase in May, according to company filings.

Illinois auto and home insurance rates keep rising as Allstate, State Farm plan double-digit hikesAllstate is hiking homeowners insurance rates by 12.7% this week, while State Farm is planning a 12.3% increase in May, according to company filings.

Read more »

Colorado car insurance rates among fastest rising in country and more increases expectedAuto insurances rates in Colorado have risen 53% over the last 10 years and are projected to be among the highest in the country over the decade.

Colorado car insurance rates among fastest rising in country and more increases expectedAuto insurances rates in Colorado have risen 53% over the last 10 years and are projected to be among the highest in the country over the decade.

Read more »