Economist Roelof Botha says the SARB never had reason to start its “nonsense” of raising rates this high, and the average South African is paying the price.

An economist has warned South Africans that they are paying the cost of an unnecessarily harsh monetary policy, which is closing households at R4,000 a month at least., South Africa’s interest rates do not need to be as high as they currently are.

Since then, the South African Reserve Bank has increased interest rates by a total of 475 basis points. Currently, the repo rate is at a 14-year high of 8.25% and the prime lending rate is at 11.75%. “It was never necessary to raise interest rates to the levels they did. Now, a little bit more than two years later, households are paying 9% of their disposable income on average on servicing debt,” he said.

Botha highlighted that this additional cost could have been spent on goods and services, which could have stimulated the economy and created more jobs. Botha’s sentiment seems to align with that of other Economists within FNB, who warned that if the South African Reserve Bank maintains its high interest rates beyond what is necessary, the country could experience a technical recession.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

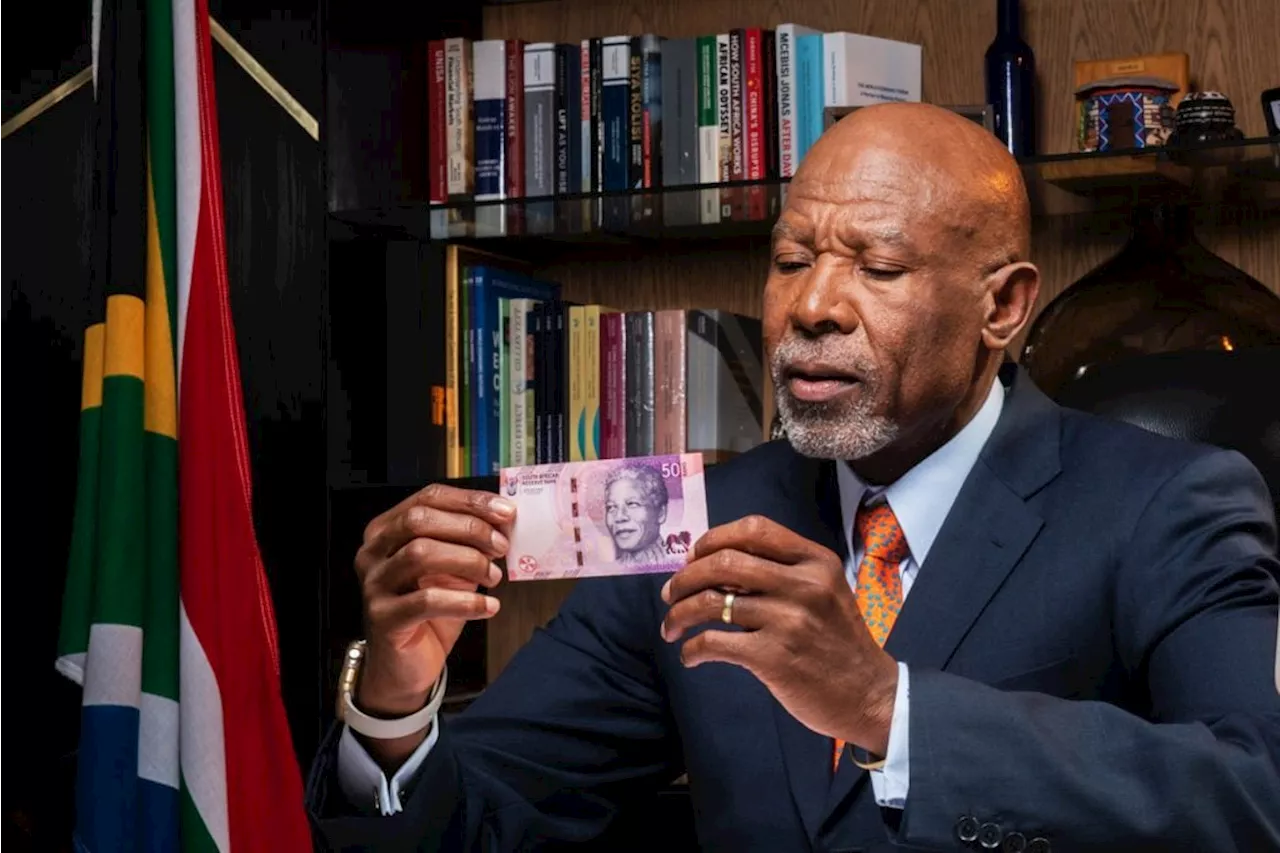

South African Reserve Bank to Expand Monetary Policy CommitteeThe Monetary Policy Committee of the South African Reserve Bank is expected to grow from six to seven members, as Governor Lesetja Kganyago expresses the need for an additional member to prevent deadlock in interest rate decisions.

South African Reserve Bank to Expand Monetary Policy CommitteeThe Monetary Policy Committee of the South African Reserve Bank is expected to grow from six to seven members, as Governor Lesetja Kganyago expresses the need for an additional member to prevent deadlock in interest rate decisions.

Read more »

Big interest rate shift on the cards for South AfricaThe Reserve Bank is looking at changing the goalposts for interest rates in South Africa.

Big interest rate shift on the cards for South AfricaThe Reserve Bank is looking at changing the goalposts for interest rates in South Africa.

Read more »

Reserve Bank preparing to launch strategic plan: Kganyago - SABC News - Breaking news, special reports,Kganyago was speaking to the SABC News earlier today.

Reserve Bank preparing to launch strategic plan: Kganyago - SABC News - Breaking news, special reports,Kganyago was speaking to the SABC News earlier today.

Read more »

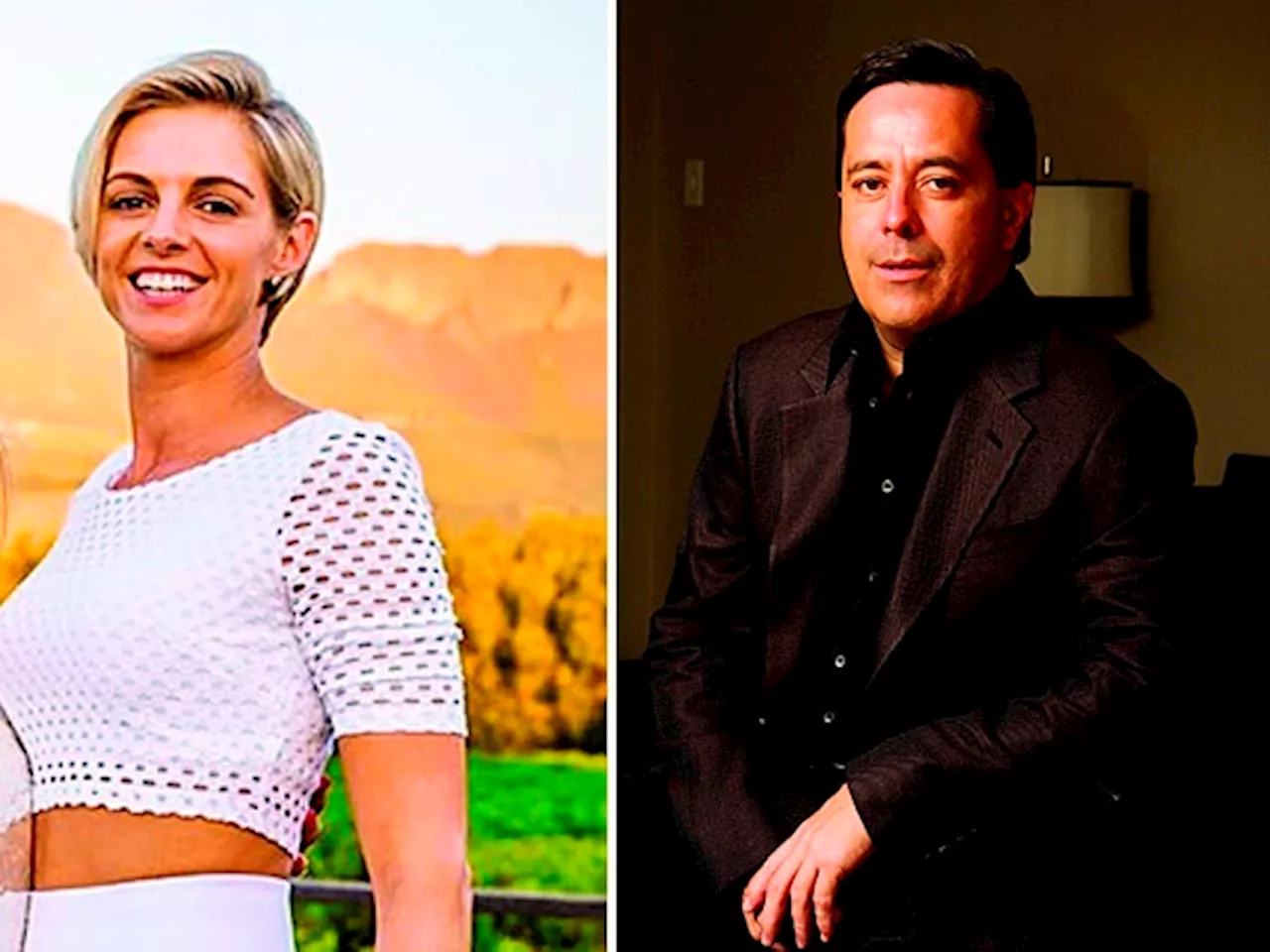

Reserve Bank to Release Funds for Polo Ponies and ExpensesBerdine Odendaal is seeking the release of funds from her blocked accounts to cover her monthly expenses, including the stabling and transportation of her polo ponies. The Reserve Bank may cover costs such as makeup, clothing, and her domestic worker if her court bid is successful.

Reserve Bank to Release Funds for Polo Ponies and ExpensesBerdine Odendaal is seeking the release of funds from her blocked accounts to cover her monthly expenses, including the stabling and transportation of her polo ponies. The Reserve Bank may cover costs such as makeup, clothing, and her domestic worker if her court bid is successful.

Read more »

Reserve Bank of Zimbabwe Cuts Policy Rate to Stabilize Zimbabwe Gold CurrencyThe Reserve Bank of Zimbabwe (RBZ) has reduced the policy rate from 130 percent to 20 percent in an effort to stabilize the newly introduced Zimbabwe Gold (ZiG) currency. The central bank aims to curb inflation and discourage currency speculation by implementing restrictive interest rates. With the new monetary policy framework, authorities are confident that the exchange rate will stabilize and inflation will decrease.

Read more »

Markus Jooste’s alleged former lover escalates bid to access frozen money by Reserve BankBerdine Odendaal wants the court to compel the central bank to continue paying her R150,000 a month for living expenses from her blocked accounts.

Markus Jooste’s alleged former lover escalates bid to access frozen money by Reserve BankBerdine Odendaal wants the court to compel the central bank to continue paying her R150,000 a month for living expenses from her blocked accounts.

Read more »