As Republicans in Congress seek spending reductions, proposals targeting higher education are gaining traction, raising concerns among advocates. Ideas include new taxes on college scholarships, ending student loan repayment plans, and a significant increase in taxes on university endowments. While these recommendations are still under discussion, their potential impact on access to education and affordability has ignited alarm within the higher education community.

Trump is trying to halt the EV charger buildout.

“It’s shocking to me because this amount of cuts is not happening in reaction to like a budget crisis, like a recession. This really feels different in the sense that it is not something that there is an external push or a need for. So, it feels more ideological in a way,” said Jessica Thompson, a higher education policy expert with The Institute for College Access and Success.The U.S.

The timing is uncertain on when any of these proposals could surface. They could be considered as soon as this spring in a process known as budget reconciliation that would allow Republicans to squeeze proposals through Congress purely on party-line votes. That would not be easy in the House, where Republicans hold the majority by just a few seats.Scholarships and fellowships have been exempt from taxes as long as they are used for tuition and related expenses.

HIGHER EDUCATION REPUBLICANS CONGRESS COLLEGE FUNDING STUDENT LOANS

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Trump Republicans Eye Tax Cuts and Benefit Cuts for Single Mothers, PoorPresident Donald Trump's campaign promised sweeping tax cuts. Now House Republicans are considering those cuts and how to pay for them. Potential targets include cutting benefits for single mothers and low-income people who rely on government healthcare programs like Medicaid.

Trump Republicans Eye Tax Cuts and Benefit Cuts for Single Mothers, PoorPresident Donald Trump's campaign promised sweeping tax cuts. Now House Republicans are considering those cuts and how to pay for them. Potential targets include cutting benefits for single mothers and low-income people who rely on government healthcare programs like Medicaid.

Read more »

House Republicans Eye Taxing Employee Perks to Fund Trump Tax CutsTo offset the cost of President Trump's proposed tax cuts, House Republicans are exploring the idea of taxing employer-provided benefits such as transportation, free food, and on-site gyms. This controversial proposal faces political challenges and could impact worker morale and productivity.

House Republicans Eye Taxing Employee Perks to Fund Trump Tax CutsTo offset the cost of President Trump's proposed tax cuts, House Republicans are exploring the idea of taxing employer-provided benefits such as transportation, free food, and on-site gyms. This controversial proposal faces political challenges and could impact worker morale and productivity.

Read more »

Republicans Eye Major Medicaid Cuts if Trump Returns to White HouseFollowing record-high enrollment and a record-low uninsured rate under President Biden, Republicans are planning significant cuts to Medicaid, the government health insurance program, if Donald Trump returns to the presidency. GOP lawmakers propose rolling back the Affordable Care Act's Medicaid expansion, implementing work requirements, and shifting to block grants for states, potentially impacting millions of Americans' access to healthcare.

Republicans Eye Major Medicaid Cuts if Trump Returns to White HouseFollowing record-high enrollment and a record-low uninsured rate under President Biden, Republicans are planning significant cuts to Medicaid, the government health insurance program, if Donald Trump returns to the presidency. GOP lawmakers propose rolling back the Affordable Care Act's Medicaid expansion, implementing work requirements, and shifting to block grants for states, potentially impacting millions of Americans' access to healthcare.

Read more »

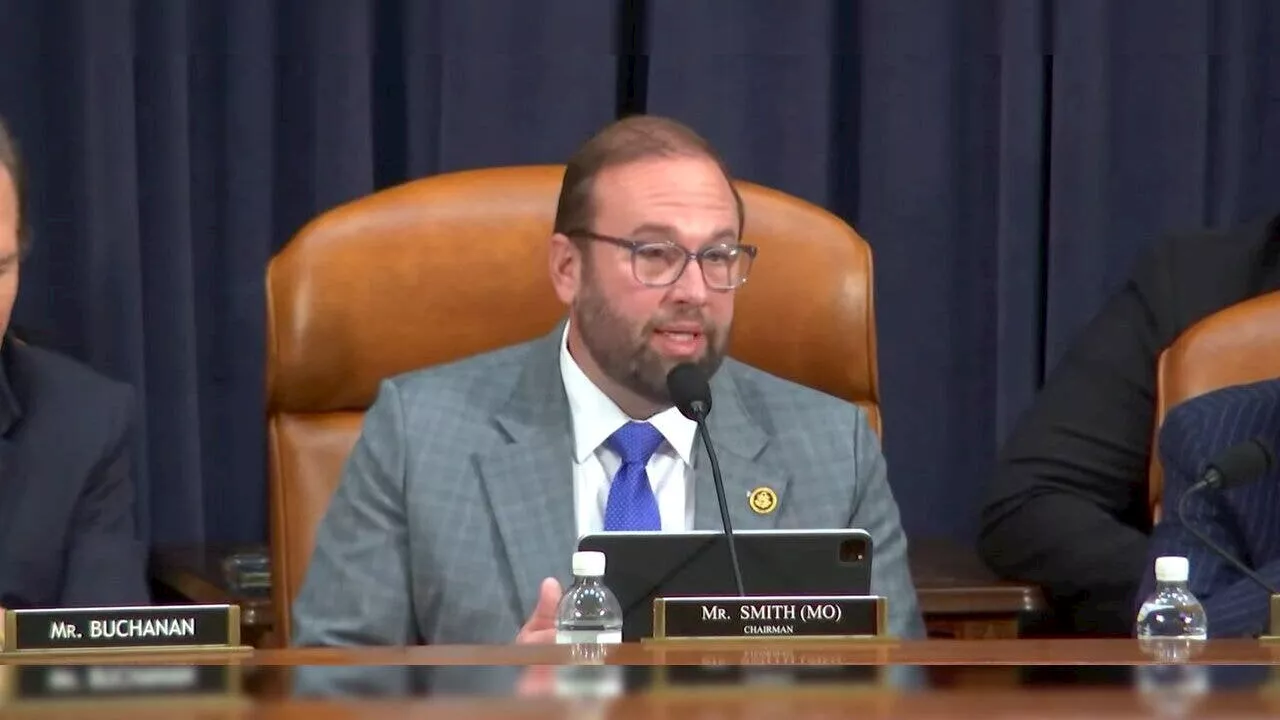

Republicans Warn of China-High Tax Rates for U.S. Small Businesses if Trump Cuts ExpireHouse Republicans sounded the alarm on Tuesday about the potential for millions of U.S. small businesses to face a top tax rate higher than that in communist China if President Trump's expiring tax cuts are allowed to lapse. The hearing highlighted a key debate in the new Congress as lawmakers grapple with the future of Trump's tax legacy and the potential impact on the American economy.

Republicans Warn of China-High Tax Rates for U.S. Small Businesses if Trump Cuts ExpireHouse Republicans sounded the alarm on Tuesday about the potential for millions of U.S. small businesses to face a top tax rate higher than that in communist China if President Trump's expiring tax cuts are allowed to lapse. The hearing highlighted a key debate in the new Congress as lawmakers grapple with the future of Trump's tax legacy and the potential impact on the American economy.

Read more »

House Republicans push to extend Trump tax cuts amid Democratic pushbackHouse Republicans are pushing for extensions of the 2017 tax cuts enacted by President-elect Donald Trump. Here’s what to know.

House Republicans push to extend Trump tax cuts amid Democratic pushbackHouse Republicans are pushing for extensions of the 2017 tax cuts enacted by President-elect Donald Trump. Here’s what to know.

Read more »

Republicans Target Medicaid for Deep Cuts if Trump Returns to PowerWith the potential for a Republican-controlled Congress and Donald Trump's return to the White House, there are serious concerns about the future of Medicaid. Republicans have signaled their intent to dramatically reshape the program through funding cuts and regulatory changes.

Republicans Target Medicaid for Deep Cuts if Trump Returns to PowerWith the potential for a Republican-controlled Congress and Donald Trump's return to the White House, there are serious concerns about the future of Medicaid. Republicans have signaled their intent to dramatically reshape the program through funding cuts and regulatory changes.

Read more »