This article provides a comprehensive guide for homeowners navigating the process of rebuilding their homes after a fire. It covers crucial steps like hiring architects, obtaining building permits, securing financing, and understanding construction loan options.

A home completely destroyed, while the house behind it is untouched along Toyopa Street in Pacific Palisades on Monday, Jan. 13, 2025. High wind warnings are again in effect through Wednesday for large areas of Southern California. (Photo by David Crane, Los Angeles Daily News/SCNG)After the soot is cleared, one of the first things homeowners need to think about and to do is hire an architect.You cannot get a building permit until the house plans are approved by the city.

You cannot get plans approved without having an architect to design what you want. City, county and state officials said they Stating the obvious, you should interview several architects (ideally by referral only) and thoroughly check references. Go to see the architect’s work. Don’t take any shortcuts in your vetting process. Over the years I’ve heard my share of client complaints, mainly about contractors. Disputes about the work quality, flaky attendance and worse, like absconding with the homeowner’s deposit money, were the typical complaints. Some of my clients expressed regret for not checking references more thoroughly.California Contractors State License Board“I’ve seen plans cost $35,000 up to $1 million,” said Trapper Roderick, vice president, Roderick Builders. For the cost to construct, “It can be as cheap as $450 per foot to as much as $2,700. Mega-mansions are in the thousands (of dollars).”Roderick advises hiring architects and contractors to work alongside each other as the plans are being designed. Include an interior designer should you have that kind of money to spend.Now, consider what’s involved in construction financing, assuming you don’t have the liquid funds available to cover the cost of rebuilding.There are two types of construction loans. One finances the construction costs with an interest-only loan. Once the construction is completed, you must take out a regular mortgage. This is called construction-to-permanent financing or getting a take-out loan. For example, you could get a competitively priced Fannie Mae mortgage for the take-out loan. That said, we don’t know exactly where interest rates will be once your home is completed. The other program is called a one-time close or OTC loan. This is a combination construction loan (interest-only during the construction period) that rolls over to a 30-year permanent financing mortgage, requiring principal and interest payments. For example, say you took the OTC. It takes two years to complete the construction work, and then you have an amortized loan, which would need to be paid back within 28 years. Most construction lenders, but certainly not all, will not do an owner-occupied construction loan. They will only do this for investors. If you are moving back into the house after completion, that’s considered owner-occupied. The reason being is an owner-occupied mortgage is considered a consumer purpose mortgage. With that comes a lot of compliance requirements, meaning there is potential exposure from the consumer borrower and/or regulators from this complicated financing tool. Ask early about owner-occupancy. The investor construction loan is called a business purpose (construction) loan. It carries fewer regulations for construction lenders to worry about.How much a homeowner can borrow will vary by lender. It can be up to 80% loan-to-value. For example: With a copy of the plans in hand, an appraiser projects what the completed value will be. Say it is appraised at $2 million once completed. The maximum loan amount would be $1.6 million. Construction lenders will also do a health check on the construction costs. This is called loan-to-cost. The lender wants to make sure the costs are reasonable and in line with what a general contractor would charge. This is done in the event the lender would have to take over and complete the project, according to Paul Adrian at California Bank & Trust. “If there is a variance between a reasonable cost to build and the cost estimates, the lender will want to know why,” he said. Adrian thinks it’s a good idea to reach out to a lender for loan qualification ahead of time, so you know the loan amount for which you can qualify.“If the borrower can’t qualify for the loan, then maybe cut back on the size of the project,” Adrian told me. “There may be other solutions like co-signers, who can also help the borrower to qualify.” If you need some money for the upfront costs (remember your plans must be approved by the city before you can get any kind of construction loan credit decision), you might be able to look no further than your fire insurance payout. Even though the check is made out to you and your mortgage servicer, you might be able to use it on the new construction soft costs (engineering, plans, etc.)

Home Rebuilding Fire Damage Construction Loans Architect Hiring Building Permits Financing Options

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

L.A. fire updates: Fire victims seek answers about rebuilding, cleanup timelineNoah Haggerty is an environment, health and science reporter at the Los Angeles Times.

L.A. fire updates: Fire victims seek answers about rebuilding, cleanup timelineNoah Haggerty is an environment, health and science reporter at the Los Angeles Times.

Read more »

Cal Fire's Fire Hazard Severity Zone Map Shows California Fire RiskCal Fire's new Fire Hazard Severity Zone map allows Californians to search for an address and see the location's probability of being affected by fire. The map assesses fire hazard, rather than risk, based on the physical conditions that create a likelihood of fire behavior over a 30 to 50-year period. The map considers terrain, local weather, and fire history over 50 years. Areas are ranked as moderate, high, or very high fire severity. The map is effective as of April 1, 2024 and focuses on areas under state responsibility, excluding federal land like the Sierra Nevada Mountains and some parts of the Bay Area.

Cal Fire's Fire Hazard Severity Zone Map Shows California Fire RiskCal Fire's new Fire Hazard Severity Zone map allows Californians to search for an address and see the location's probability of being affected by fire. The map assesses fire hazard, rather than risk, based on the physical conditions that create a likelihood of fire behavior over a 30 to 50-year period. The map considers terrain, local weather, and fire history over 50 years. Areas are ranked as moderate, high, or very high fire severity. The map is effective as of April 1, 2024 and focuses on areas under state responsibility, excluding federal land like the Sierra Nevada Mountains and some parts of the Bay Area.

Read more »

Cal Fire's Fire Hazard Severity Zone Map Helps Californians Assess Fire RiskCal Fire's new Fire Hazard Severity Zone map allows residents to search for an address and see the location's probability of being affected by fire. This map focuses on fire hazard, not risk, and considers factors like terrain, weather, and fire history.

Cal Fire's Fire Hazard Severity Zone Map Helps Californians Assess Fire RiskCal Fire's new Fire Hazard Severity Zone map allows residents to search for an address and see the location's probability of being affected by fire. This map focuses on fire hazard, not risk, and considers factors like terrain, weather, and fire history.

Read more »

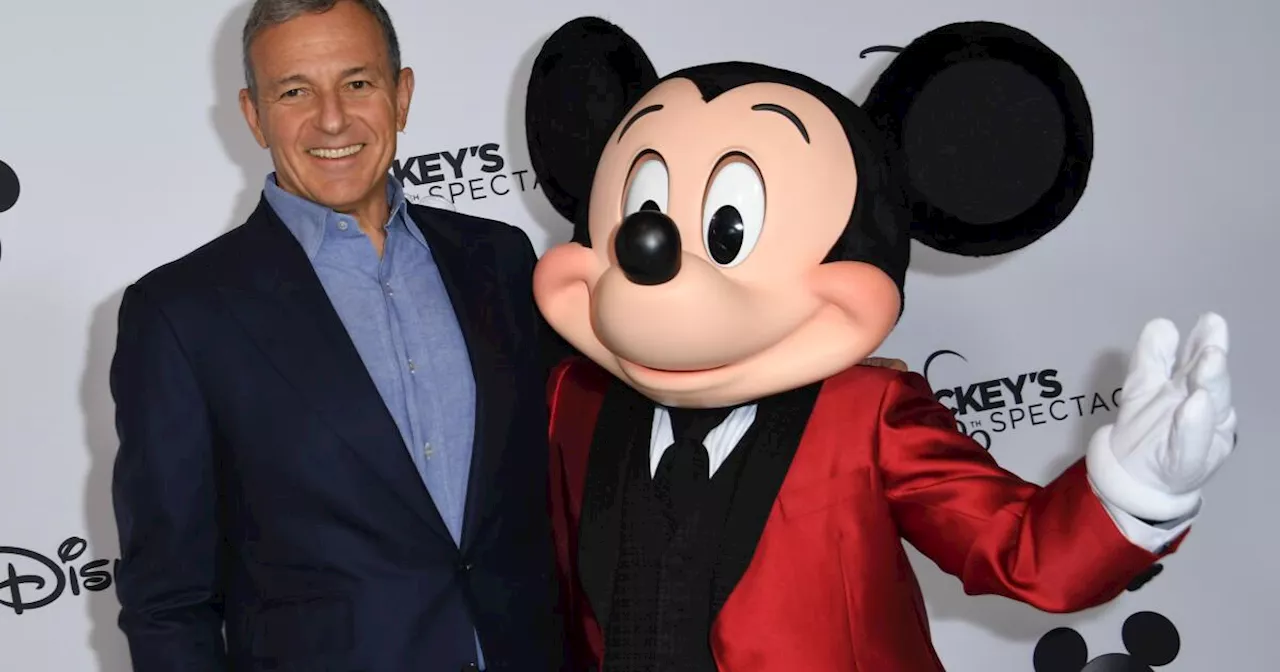

Disney donates $15 million to Los Angeles wildfire relief effortsThe Disney donation will support organizations providing essential services, recovery efforts and rebuilding support.

Disney donates $15 million to Los Angeles wildfire relief effortsThe Disney donation will support organizations providing essential services, recovery efforts and rebuilding support.

Read more »

Walt Disney Co., Paramount pledge money for fire relief and rebuildingDisney commits millions to relief organizations. Paramount Global promises $1 million to fire relief organizations.

Walt Disney Co., Paramount pledge money for fire relief and rebuildingDisney commits millions to relief organizations. Paramount Global promises $1 million to fire relief organizations.

Read more »

After Eaton Fire, L.A. Supervisor Kathryn Barger Leads Relief and Rebuilding EffortsL.A. County Supervisor Kathryn Barger is rallying support and resources for the devastated Altadena community in the aftermath of the Eaton fire, which has claimed lives, homes, and landmarks.

After Eaton Fire, L.A. Supervisor Kathryn Barger Leads Relief and Rebuilding EffortsL.A. County Supervisor Kathryn Barger is rallying support and resources for the devastated Altadena community in the aftermath of the Eaton fire, which has claimed lives, homes, and landmarks.

Read more »