Pro Research: Wall Street sees bright future for First Solar

) stands out as a beacon of innovation and resilience. As the world increasingly turns towards sustainable energy solutions, First Solar's unique position in the solar panel manufacturing sector has captured the attention of investors and industry analysts alike. With a focus on thin-film photovoltaic technology, First Solar has carved out a niche that promises growth and stability even as the broader market faces challenges.

BMO Capital Markets has recently reiterated its "Outperform" rating for First Solar, highlighting the company's disciplined approach to maintaining average selling prices amidst weak global spot module prices. The firm also anticipates long-term positivity on global solar tracker demand, suggesting a favorable outlook for First Solar despite increased price competition among market leaders.

Despite broader economic concerns, such as potential interest rate hikes and recession fears, the solar energy industry is expected to enjoy secular growth. Analysts anticipate that the clean tech sector, particularly high-quality firms like First Solar, could outperform in the coming years, driven by strong policy support and attractive renewables economics.First Solar's commitment to innovation is evident in its upcoming product launches, such as the anticipated CuRe technology in 2024.

Goldman Sachs also highlights risks related to module oversupply and higher module costs, as well as trade policy uncertainties that could impact pricing and supply chains.First Solar's competitive advantage lies in its status as the only vertically integrated domestic manufacturer in the solar module space. This advantage is expected to grow with the increasing domestic content requirements under the IRA.

InvestingPro data also highlights an impressive revenue growth of 27.28% over the last twelve months as of Q1 2024, which is further underscored by a quarterly revenue growth of 44.83% in Q1 2024. This growth trajectory is a testament to First Solar's strategic market position and its ability to capitalize on the increasing demand for renewable energy solutions. Additionally, the company's gross profit margin of 43.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Pro Research: Wall Street eyes Alphabet's robust growth potentialPro Research: Wall Street eyes Alphabet's robust growth potential

Pro Research: Wall Street eyes Alphabet's robust growth potentialPro Research: Wall Street eyes Alphabet's robust growth potential

Read more »

Pro Research: Wall Street eyes HP Inc's shifting landscapePro Research: Wall Street eyes HP Inc's shifting landscape

Pro Research: Wall Street eyes HP Inc's shifting landscapePro Research: Wall Street eyes HP Inc's shifting landscape

Read more »

Opinion: How to be pro-Palestinian, pro-Israeli and pro-IranianIran’s missile and drone attack on Israel over the weekend was a game-changing escalation that requires some game-changing rethinking on the part of Israel and its most important ally, the United States. I call it “the three-state solution.”

Opinion: How to be pro-Palestinian, pro-Israeli and pro-IranianIran’s missile and drone attack on Israel over the weekend was a game-changing escalation that requires some game-changing rethinking on the part of Israel and its most important ally, the United States. I call it “the three-state solution.”

Read more »

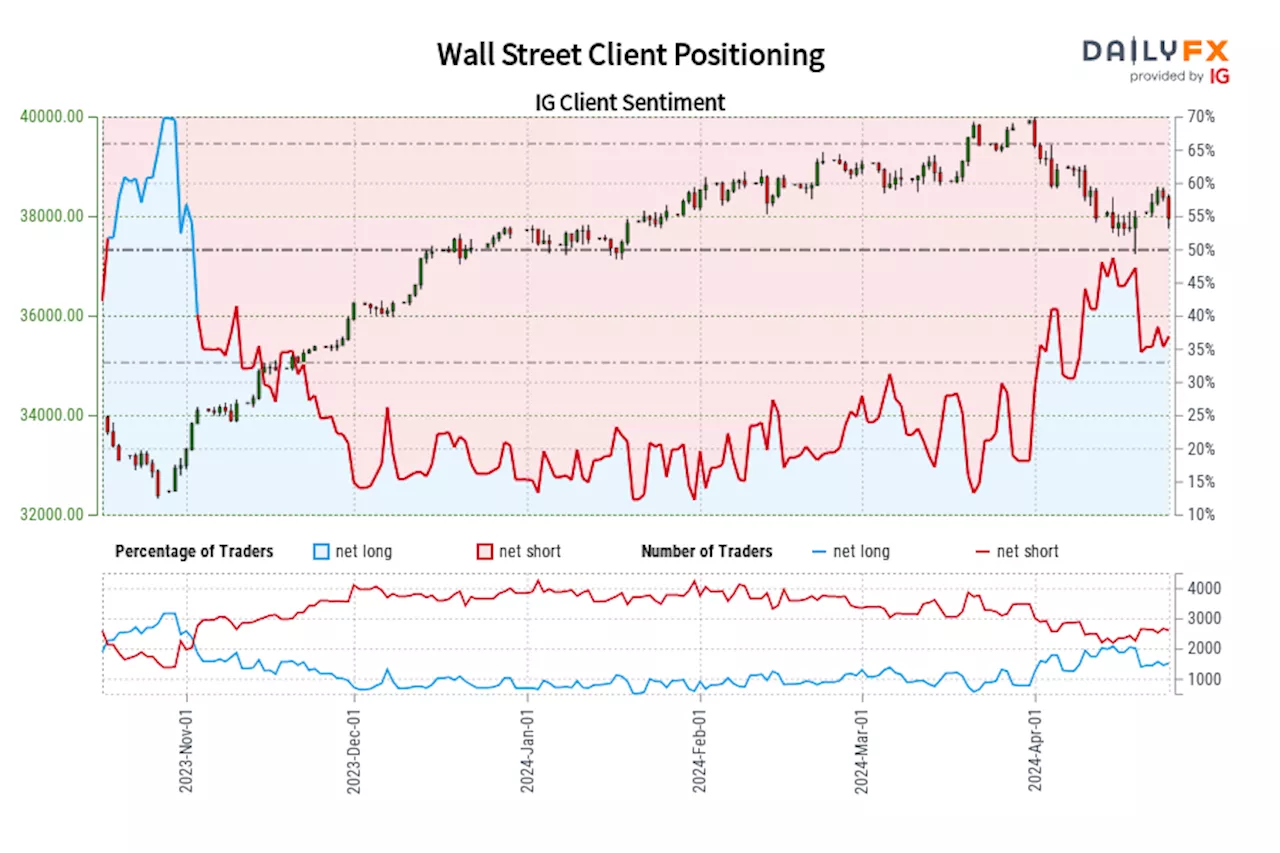

Wall Street IG Client Sentiment: Our data shows traders are now net-long Wall Street for the first time since Nov 02, 2023 when Wall Street traded near 33,825.70.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Wall Street-bearish contrarian trading bias.

Wall Street IG Client Sentiment: Our data shows traders are now net-long Wall Street for the first time since Nov 02, 2023 when Wall Street traded near 33,825.70.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Wall Street-bearish contrarian trading bias.

Read more »

Friday's analyst calls: Street reacts to Apple buybacks and Coinbase earningsThis is CNBC Pro's live coverage of Friday's analyst calls and Wall Street chatter.

Friday's analyst calls: Street reacts to Apple buybacks and Coinbase earningsThis is CNBC Pro's live coverage of Friday's analyst calls and Wall Street chatter.

Read more »

Thursday's analyst calls: Discount retailers upgraded, more good news for Carvana, tough outlook for CVSThis is CNBC Pro's live coverage of Thursday's analyst calls and Wall Street chatter.

Thursday's analyst calls: Discount retailers upgraded, more good news for Carvana, tough outlook for CVSThis is CNBC Pro's live coverage of Thursday's analyst calls and Wall Street chatter.

Read more »