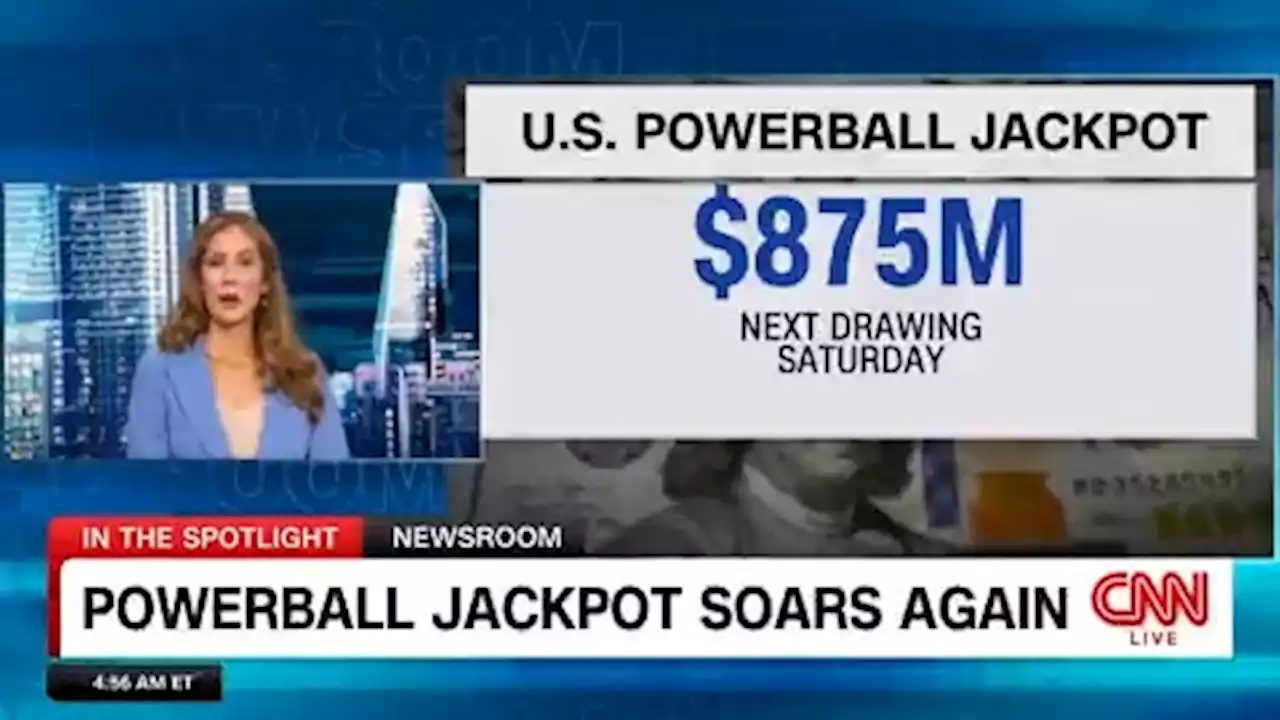

The Powerball jackpot jumped to $875 million. Here's what to expect for taxes if you score the winning ticket.

Winners need to plan for a hefty upfront federal withholding. The IRS requires a mandatory 24% withholding for winnings of more than $5,000.

"That's exactly what happens with the lottery," he said. "The 24% [withholding] is not the only tax bill" because the highest federal tax bracket includes another 13%.for 2023, millions from the lottery still pushes the winner into the 37% bracket. But the 37% rate doesn't apply to all of your taxable income. For 2023, single filers will pay $174,238.25, plus 37% of the amount over $578,125. As for married couples filing together, the total owed is $186,601.50, plus 37% of the amount above $693,750.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Powerball jackpot jumps to $875 million; next drawing SaturdayA $750 million Powerball jackpot is up for grabs on Wednesday night.

Powerball jackpot jumps to $875 million; next drawing SaturdayA $750 million Powerball jackpot is up for grabs on Wednesday night.

Read more »

Powerball jackpot grows to an estimated $875 million after no winner in Wednesday’s drawingThere have now been 36 consecutive Powerball drawings without a big winner.

Powerball jackpot grows to an estimated $875 million after no winner in Wednesday’s drawingThere have now been 36 consecutive Powerball drawings without a big winner.

Read more »

Powerball jackpot grows to an estimated $875 million after no winner in Wednesday's drawing | CNNThe Powerball grand prize is growing once again after no winning jackpot tickets were sold for Wednesday’s drawing.

Powerball jackpot grows to an estimated $875 million after no winner in Wednesday's drawing | CNNThe Powerball grand prize is growing once again after no winning jackpot tickets were sold for Wednesday’s drawing.

Read more »

Powerball jackpot reaches $875 million after no winner WednesdayAlthough no one won the jackpot, two tickets in Florida and Indiana matched five numbers to win $1 million each.

Powerball jackpot reaches $875 million after no winner WednesdayAlthough no one won the jackpot, two tickets in Florida and Indiana matched five numbers to win $1 million each.

Read more »

Powerball jackpot climbs to $875 million for Saturday after no winner in latest drawing🤑🤑🤑 The Powerball jackpot has soared to an estimated $875 million.

Powerball jackpot climbs to $875 million for Saturday after no winner in latest drawing🤑🤑🤑 The Powerball jackpot has soared to an estimated $875 million.

Read more »