Bill Ackman's Pershing Square Capital Management proposes a merger with Howard Hughes Holdings, offering shareholders $85 per share in cash.

Bill Ackman, CEO of Pershing Square Capital Management, proposed a merger between his firm and Howard Hughes Holdings at the Delivering Alpha conference in NYC on September 28th, 2023. Ackman offered current holders of the real estate company $85 a share.

'While we are pleased with the substantial business progress Howard Hughes Holdings has made over the more than 14 years since it went public, we, like other long-term shareholders and this board, have been displeased with the Company's stock price performance,' Ackman wrote. He proposed forming a new subsidiary of Pershing, which currently owns about 38% of Howard Hughes, that would merge with the real estate developer based in The Woodlands, Texas. 'Stockholders would have the option of receiving more than a majority of their merger consideration in cash at $85.00 per share – representing a premium of 38.3% to the unaffected stock price and a premium of 18.4% to the closing price this past Friday – and the balance in stock of the post-merger company,' said the letter. Howard Hughes shares jumped 11% to $79.67 a share in premarket trading on the news. CNBC was reaching out to the company for comment. Pershing first invested in Howard Hughes in November 2010 in a $250 million rights offering at $47.62 per share. Over the last 14 years, Pershing's investment produced a 35% total return, or a mere 2.2% compound annual return, Ackman said. The company has also paid zero dividends since its inception, he added. 'The Company's stock price performance is obviously extremely disappointing, particularly in light of the high regard we have for this board and the Company's superb management team led by David O'Reilly and the nearly one thousand employees who work at Howard Hughes, many of whom I have gotten to know over the last more than decade,' Ackman wrote in the letter. Under the proposed deal, Ackman said Howard Hughes would remain unchanged and continue to be managed by the current leadership team led by CEO David O'Reilly. 'We do not intend to make any changes to the HHC organization, its employees, or its long-term strategy,' Ackman said. 'We would expect all HHH current employees to remain employed as a result of the Transaction.

MERGER HOWARD HUGHES PERSHING SQUARE BILL ACKMAN REAL ESTATE

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Pershing Square Takes UMG Delisting a Step CloserBill Ackman's investment firm, Pershing Square Holdings, is moving to delist from the Euronext Amsterdam exchange. This follows similar calls from Ackman for Universal Music Group (UMG) to delist. The move is part of a planned wind-down of a fund used to acquire UMG shares.

Pershing Square Takes UMG Delisting a Step CloserBill Ackman's investment firm, Pershing Square Holdings, is moving to delist from the Euronext Amsterdam exchange. This follows similar calls from Ackman for Universal Music Group (UMG) to delist. The move is part of a planned wind-down of a fund used to acquire UMG shares.

Read more »

Bill Ackman's Pershing Square offers to take over real estate developer Howard Hughes for $85 a shareAckman proposed forming a new subsidiary of Pershing, which currently owns about 38% of Howard Hughes, that would merge with the company.

Bill Ackman's Pershing Square offers to take over real estate developer Howard Hughes for $85 a shareAckman proposed forming a new subsidiary of Pershing, which currently owns about 38% of Howard Hughes, that would merge with the company.

Read more »

Howard Hughes' Former Miami Property Lists for $55.5 MillionA historic California home once owned by eccentric billionaire Howard Hughes has been listed for sale at $55.5 million. The 7,850-square-foot property, built in 1910, boasts original features and has been meticulously restored while maintaining its historic charm.

Howard Hughes' Former Miami Property Lists for $55.5 MillionA historic California home once owned by eccentric billionaire Howard Hughes has been listed for sale at $55.5 million. The 7,850-square-foot property, built in 1910, boasts original features and has been meticulously restored while maintaining its historic charm.

Read more »

Howard Hughes Estate Lists for $55.5 Million in Coconut GroveA Florida estate with historical ties to aviation legend Howard Hughes has hit the market for $55.5 million.

Howard Hughes Estate Lists for $55.5 Million in Coconut GroveA Florida estate with historical ties to aviation legend Howard Hughes has hit the market for $55.5 million.

Read more »

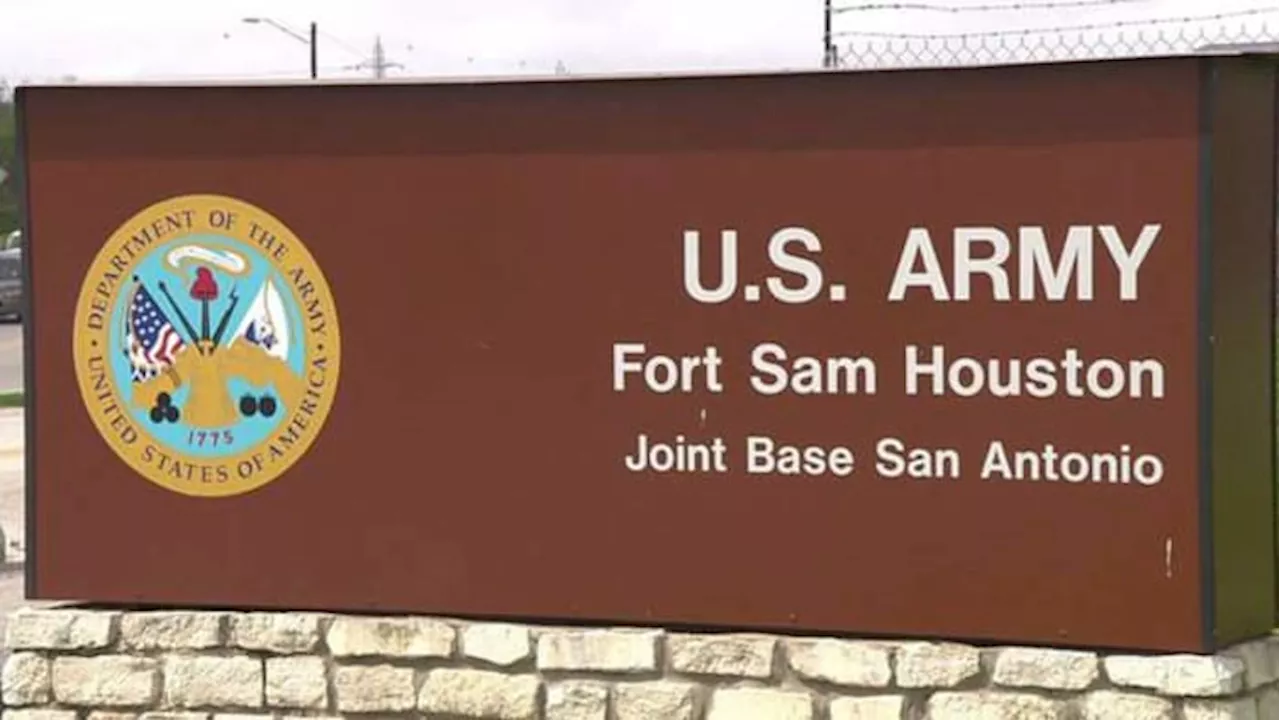

Army North Brings Holiday Cheer to Pershing Elementary Students with Toy DriveU.S. Army North personnel participate in an annual toy drive for Pershing Elementary School students in San Antonio, Texas.

Army North Brings Holiday Cheer to Pershing Elementary Students with Toy DriveU.S. Army North personnel participate in an annual toy drive for Pershing Elementary School students in San Antonio, Texas.

Read more »

US Army North Brings Holiday Cheer to Pershing Elementary Students with Annual Toy DriveThe US Army North spreads holiday cheer to students at Pershing Elementary with their annual toy drive.

US Army North Brings Holiday Cheer to Pershing Elementary Students with Annual Toy DriveThe US Army North spreads holiday cheer to students at Pershing Elementary with their annual toy drive.

Read more »