The United States (US) Bureau of Economic Analysis (BEA) will release the high-impact core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s (Fed) preferred inflation gauge, on Friday at 12:30 GMT.

The core Personal Consumption Expenditures Price Index is seen rising 0.2% MoM and 2.7% YoY in July. Markets fully price in an interest-rate cut by the US Federal Reserve in September. A hotter-than-expected PCE inflation data could rescue the US Dollar ahead of next week’s Nonfarm Payrolls. The United States Bureau of Economic Analysis will release the high-impact core Personal Consumption Expenditures Price Index, the Federal Reserve’s preferred inflation gauge, on Friday at 12:30 GMT.

The 14-day Relative Strength Index stays firm well above 50, justifying the major’s bullish potential.” “Acceptance above the 13-month high of 1.1202 is needed on a daily closing basis to challenge the 1.1250 psychological level. Alternatively, a sustained break below the abovementioned 23.6% Fibo support at 1.1107 could open up the downside toward the 38.2% Fibo level of the same advance, aligned at 1.1045.

Economicindicator SEO Unitedstates

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

5 top money moves to consider before the Federal Reserve's first rate cut since 2020As soon as the Fed starts lowering interest rates, many types of consumer loans and savings products will be impacted. Here's how to make the most of it.

5 top money moves to consider before the Federal Reserve's first rate cut since 2020As soon as the Fed starts lowering interest rates, many types of consumer loans and savings products will be impacted. Here's how to make the most of it.

Read more »

5 top money moves to consider before the Federal Reserve's first rate cut since 2020As soon as the Fed starts lowering interest rates, many types of consumer loans and savings products will be impacted. Here’s how to make the most of it.

5 top money moves to consider before the Federal Reserve's first rate cut since 2020As soon as the Fed starts lowering interest rates, many types of consumer loans and savings products will be impacted. Here’s how to make the most of it.

Read more »

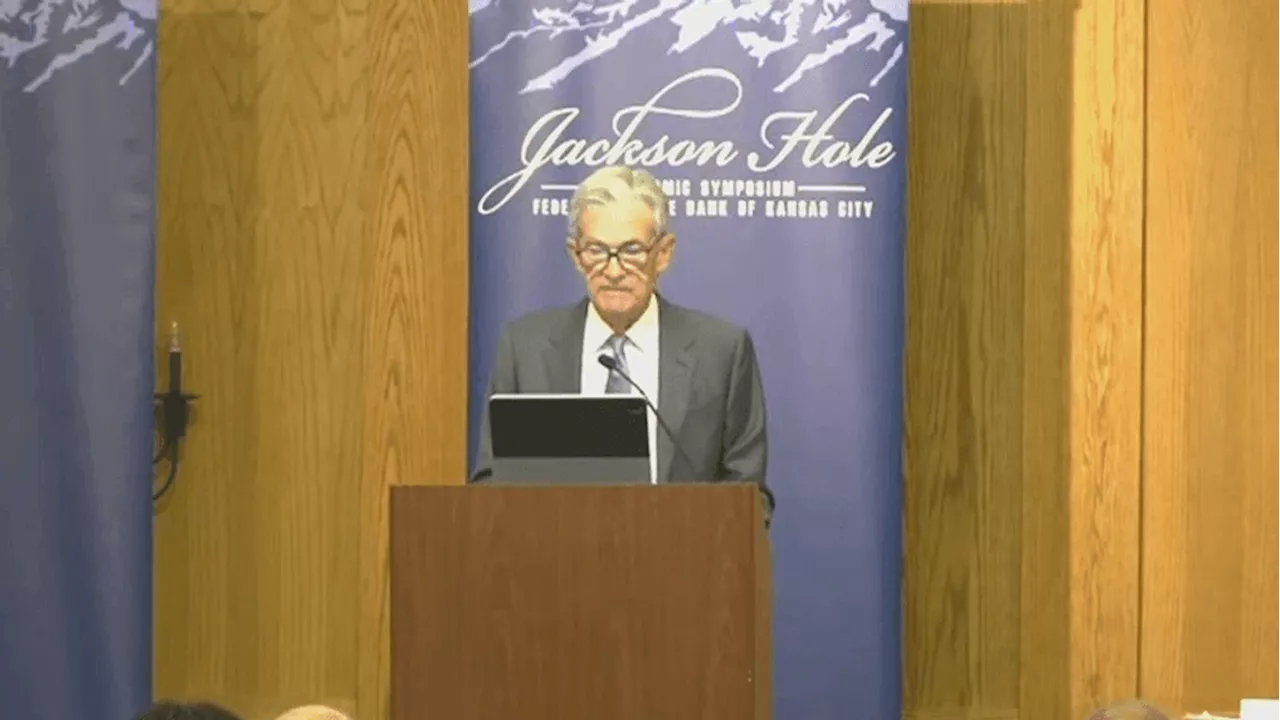

Federal Reserve chair: 'Time has come' to cut interest ratesWith inflation nearly defeated and the job market cooling, the Federal Reserve is prepared to start cutting its key interest rate from its current 23-year high.

Federal Reserve chair: 'Time has come' to cut interest ratesWith inflation nearly defeated and the job market cooling, the Federal Reserve is prepared to start cutting its key interest rate from its current 23-year high.

Read more »

Federal Reserve Chair Jerome Powell says 'the time has come' to cut interest ratesWith inflation nearly defeated and the job market cooling, the Federal Reserve is prepared to start cutting its key interest rate from its current 23-year high, Chair Jerome Powell said Friday.

Federal Reserve Chair Jerome Powell says 'the time has come' to cut interest ratesWith inflation nearly defeated and the job market cooling, the Federal Reserve is prepared to start cutting its key interest rate from its current 23-year high, Chair Jerome Powell said Friday.

Read more »

Treasury yields rally as Federal Reserve signals readiness for September rate cutThe U.S. 10-year Treasury rose on Thursday as dovish minutes from the latest Fed meeting bolstered expectations of an interest rate cut next month.

Treasury yields rally as Federal Reserve signals readiness for September rate cutThe U.S. 10-year Treasury rose on Thursday as dovish minutes from the latest Fed meeting bolstered expectations of an interest rate cut next month.

Read more »

Treasury yields rally as Federal Reserve signals readiness for September rate cutThe U.S. 10-year Treasury rose on Thursday as dovish minutes from the latest Fed meeting bolstered expectations of an interest rate cut next month.

Treasury yields rally as Federal Reserve signals readiness for September rate cutThe U.S. 10-year Treasury rose on Thursday as dovish minutes from the latest Fed meeting bolstered expectations of an interest rate cut next month.

Read more »