This article provides practical advice for individuals in their 30s who are facing financial challenges such as tax debt, high-interest loans, and living paycheck to paycheck. It emphasizes the importance of taking immediate action to address tax obligations, explores strategies for managing debt, and encourages readers to seek career opportunities for financial growth.

You have your work cut out for you, but I have no doubt in your ability to fix your money problems and get your finances in order. You're in your mid-30s. You owe taxes. You can barely pay back your loans. You have no retirement savings. You're living paycheck to paycheck. How can you get your financial life in order and start to build a plan so that someday you may buy a house and have enough money to retire? Your top priority is tackling your tax debt .

Don't ignore the IRS' notices or delay any further, as penalty charges and interest add up quickly. Contact the IRS to discuss your options, including a potential payment plan. A payment plan will not remove any penalty and interest charges, but it will provide structure and a path forward to paying your tax debt. (Can’t call right away? Decide on a date and time to pick up the phone.) The risk of other difficulties with the IRS will go down the sooner you address your late tax payments. If you are dealing with high-interest or predatory loans (with an interest rate of 40% or higher), research ways to pay off those loans quickly if your credit permits. Explore loans from local community banks or credit unions, which often extend more flexible loan terms, making refinancing easier and more affordable. Opening an account with one of these institutions may allow you to consolidate by paying off the predatory lender first and then repaying the bank or credit union at a lower interest rate. If your debt is extreme and you can no longer afford to pay your bills, you may qualify for bankruptcy. While a serious step with significant consequences, bankruptcy can offer you a fresh start. If you do go through the process, don’t take it lightly. This is the time to become diligent about. Learn to budget effectively and reflect honestly on the factors contributing to your financial challenges. In the future, consider working with an ADHD-informed Certified Financial Planner® for tailored support. Especially at your age, explore career opportunities to increase your income to avoid reliving the financial troubles of your past. Find a career path that aligns with your passions and strengths and contributes to your financial goals. More income will put you on a path toward saving for a house and becoming financially independent. You can do this.

Financial Advice Debt Management Tax Debt Bankruptcy Career Opportunities

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Actor Jessica Owens Reveals Continued Financial Struggles Despite Hollywood SuccessActor Jessica Owens opens up about the challenges of making ends meet in Hollywood, even after achieving success in films and television. Despite his on-screen presence, Owens admits to ongoing financial difficulties, highlighting the unpredictable nature of the entertainment industry.

Actor Jessica Owens Reveals Continued Financial Struggles Despite Hollywood SuccessActor Jessica Owens opens up about the challenges of making ends meet in Hollywood, even after achieving success in films and television. Despite his on-screen presence, Owens admits to ongoing financial difficulties, highlighting the unpredictable nature of the entertainment industry.

Read more »

Financial Struggles and Love Amidst UncertaintyA woman reflects on her current financial challenges, including a low-paying job and mounting bills. She also shares her love story with her husband, emphasizing the unexpected hurdles they've overcome together.

Financial Struggles and Love Amidst UncertaintyA woman reflects on her current financial challenges, including a low-paying job and mounting bills. She also shares her love story with her husband, emphasizing the unexpected hurdles they've overcome together.

Read more »

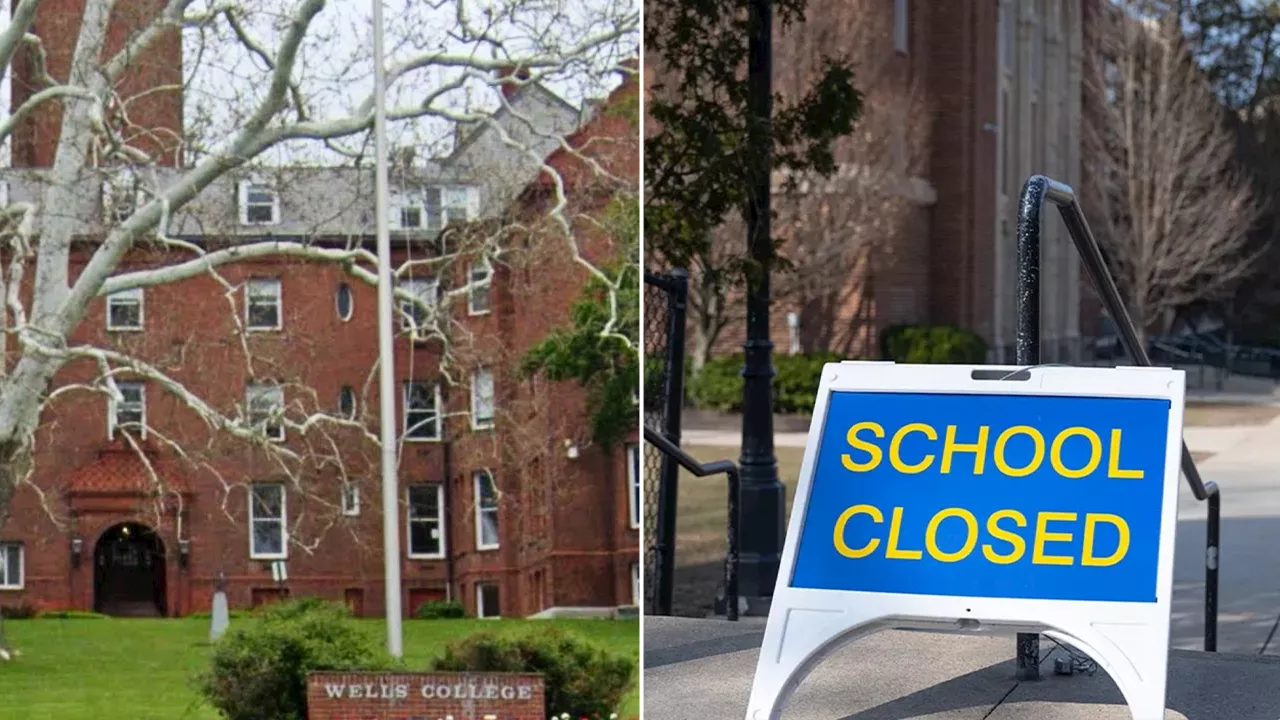

College Closures Looming: Enrollment Cliff and Financial Struggles Threaten Higher EducationThe rising cost of college in the United States, coupled with declining enrollment rates, is leading to a wave of closures. Experts warn of a looming 'enrollment cliff' with colleges facing financial instability and potential shutdowns. Low-income students and even those with means are opting out of traditional higher education, seeking alternatives to the increasingly expensive path.

College Closures Looming: Enrollment Cliff and Financial Struggles Threaten Higher EducationThe rising cost of college in the United States, coupled with declining enrollment rates, is leading to a wave of closures. Experts warn of a looming 'enrollment cliff' with colleges facing financial instability and potential shutdowns. Low-income students and even those with means are opting out of traditional higher education, seeking alternatives to the increasingly expensive path.

Read more »

Texas Veteran Involved in New Orleans Attack, Facing Financial StrugglesShamsud-Din Jabbar, a Texas-born U.S. citizen and Army veteran, is accused of carrying out an attack in New Orleans. Authorities discovered potential IEDs in his vehicle and the French Quarter. Financial records reveal Jabbar's severe financial difficulties prior to the incident.

Texas Veteran Involved in New Orleans Attack, Facing Financial StrugglesShamsud-Din Jabbar, a Texas-born U.S. citizen and Army veteran, is accused of carrying out an attack in New Orleans. Authorities discovered potential IEDs in his vehicle and the French Quarter. Financial records reveal Jabbar's severe financial difficulties prior to the incident.

Read more »

Sharon Stone's philosophy to stay positive after near-fatal brain bleed, financial strugglesSharon Stone is 'choosing' to be happy 24 years after a near-fatal blain bleed. At the Golden Globe Awards on Sunday night, the 'Casino' actress explained how she views the world.

Sharon Stone's philosophy to stay positive after near-fatal brain bleed, financial strugglesSharon Stone is 'choosing' to be happy 24 years after a near-fatal blain bleed. At the Golden Globe Awards on Sunday night, the 'Casino' actress explained how she views the world.

Read more »

Washington Post Lays Off 100 Employees Amidst Financial StrugglesThe Washington Post announced layoffs affecting 100 employees in its business division, reflecting the newspaper's ongoing financial difficulties. The cuts follow subscriber cancellations and staff dissatisfaction related to owner Jeff Bezos' decision to block an endorsement of Vice President Kamala Harris.

Washington Post Lays Off 100 Employees Amidst Financial StrugglesThe Washington Post announced layoffs affecting 100 employees in its business division, reflecting the newspaper's ongoing financial difficulties. The cuts follow subscriber cancellations and staff dissatisfaction related to owner Jeff Bezos' decision to block an endorsement of Vice President Kamala Harris.

Read more »