Rising interest rates have left banks laden with low-interest bonds that can’t be sold in a hurry without losses. So if too many customers tap their deposits at once, it risks a vicious cycle.

have sent US bank stocks diving and tongues wagging across the industry: could this be the start of a much bigger problem?high-flying California lenders was an unusually fickle base of depositors who yanked money quickly.

The immediate risk for many banks may not be existential, according to analysts, but it could still be painful. Rather than facing a major run on deposits, banks will be forced to compete harder for them by offering higher interest payments to savers. That would erode what banks earn on lending, slashing earnings.Small- and mid-sized banks, where funding is usually less diversified, may come under particular pressure, forcing them to sell more stock and dilute current investors.

SVB announced the stock offering as its clients — firms backed by venture capital — withdrew deposits after burning through their funding. The lender liquidated substantially all of the securities available for sale in its portfolio and updated a forecast for the year to include a sharper decline in net interest income.

US bank stocks also came under pressure this week after KeyCorp warned about the mounting pressure to reward savers. The regional lender lowered its forecast for growing net interest income in the current fiscal year to 1 per cent to 4 per cent, down from 6 per cent to 9 per cent, because of the “competitive pricing environment.” Its stock fell 7 per cent on Thursday.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

ASX set to open up 0.25 percent following mixed results on Wall StreetCommSec’s Tom Piotrowski says the Australian share market is set to open up by 0.25 per cent which is 'at odds” following the US markets. “We had the second iteration of Jerome Powell's testimony in congress overnight … he did qualify the fact that the desire to raise rates more aggressively would have to be accompanied by stronger economic news,” he told Sky News Australia. “That’s why the jobs data of the day was prominent because this is the private measure of jobs growth – it was much stronger than what the market had expected. “Another measure, which looks at job openings, showed that for every American looking for a job, there are almost two available. “This just gives you an indication of the strength of the US job market”. Presented by CommSec.

ASX set to open up 0.25 percent following mixed results on Wall StreetCommSec’s Tom Piotrowski says the Australian share market is set to open up by 0.25 per cent which is 'at odds” following the US markets. “We had the second iteration of Jerome Powell's testimony in congress overnight … he did qualify the fact that the desire to raise rates more aggressively would have to be accompanied by stronger economic news,” he told Sky News Australia. “That’s why the jobs data of the day was prominent because this is the private measure of jobs growth – it was much stronger than what the market had expected. “Another measure, which looks at job openings, showed that for every American looking for a job, there are almost two available. “This just gives you an indication of the strength of the US job market”. Presented by CommSec.

Read more »

Powell says ‘no decision’ made yet to speed up rate rising pace“Inflation is coming down, but it’s very high,” the Federal Reserve chairman said in a second day of Congressional testimony.

Powell says ‘no decision’ made yet to speed up rate rising pace“Inflation is coming down, but it’s very high,” the Federal Reserve chairman said in a second day of Congressional testimony.

Read more »

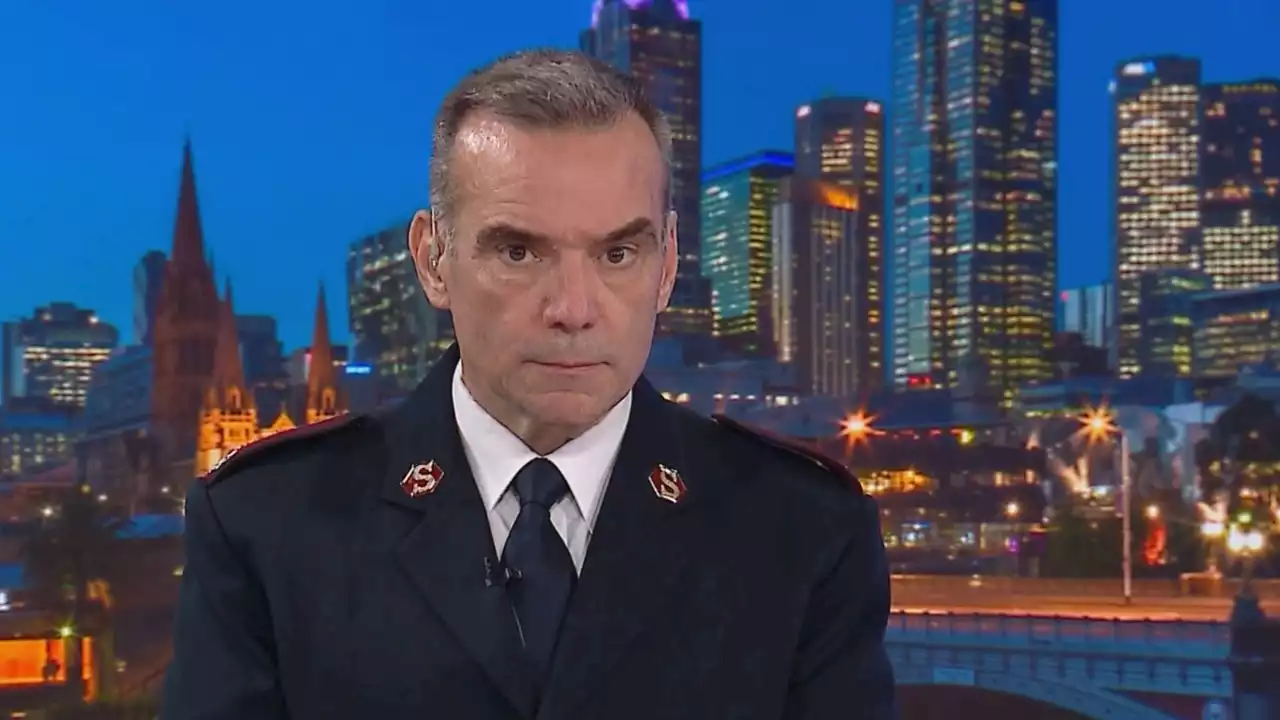

Increase demand for The Salvation Army’s assistance amidst rising of cost of livingThe Salvation Army's Commanding Officer Brendan Nottle says there has been an 'increase in demand' across the nation for the assistance of The Salvation Army amidst the rising cost of living in Australia. 'We run a cafe here in Melbourne which provides free meals and it's open during the evening and I was shocked to actually see the number of people coming in wearing high vis gear,' Mr Nottle told Sky News host Chris Kenny. 'So, they're clearly employed but struggling to make ends meet. 'And that's a phenomenon that is new to us, normally we're dealing with people that are homeless or at risk of homelessness.'

Increase demand for The Salvation Army’s assistance amidst rising of cost of livingThe Salvation Army's Commanding Officer Brendan Nottle says there has been an 'increase in demand' across the nation for the assistance of The Salvation Army amidst the rising cost of living in Australia. 'We run a cafe here in Melbourne which provides free meals and it's open during the evening and I was shocked to actually see the number of people coming in wearing high vis gear,' Mr Nottle told Sky News host Chris Kenny. 'So, they're clearly employed but struggling to make ends meet. 'And that's a phenomenon that is new to us, normally we're dealing with people that are homeless or at risk of homelessness.'

Read more »

Rising temperatures in tropics to lead to lower coffee yields and higher prices, study suggestsClimate crisis to deliver ‘ongoing systemic shocks’ to production as hot conditions become more frequent, researchers say

Rising temperatures in tropics to lead to lower coffee yields and higher prices, study suggestsClimate crisis to deliver ‘ongoing systemic shocks’ to production as hot conditions become more frequent, researchers say

Read more »

Live: Wall Street up, ASX to follow after Federal Reserve chairman Jerome Powell eases hawkish rates messageAustralian shares to open higher, following Wall Street. Follow the day's financial news and insights from our specialist business reporters on our live blog.

Live: Wall Street up, ASX to follow after Federal Reserve chairman Jerome Powell eases hawkish rates messageAustralian shares to open higher, following Wall Street. Follow the day's financial news and insights from our specialist business reporters on our live blog.

Read more »