Oil prices jumped more than $1 a barrel as President Biden's administration imposed new sanctions on Russia's energy sector. The move aims to pressure Moscow over its war in Ukraine. While positive trade data from China failed to lift market sentiment, U.S. stocks experienced a fourth losing week in five, reflecting concerns over interest rate cuts.

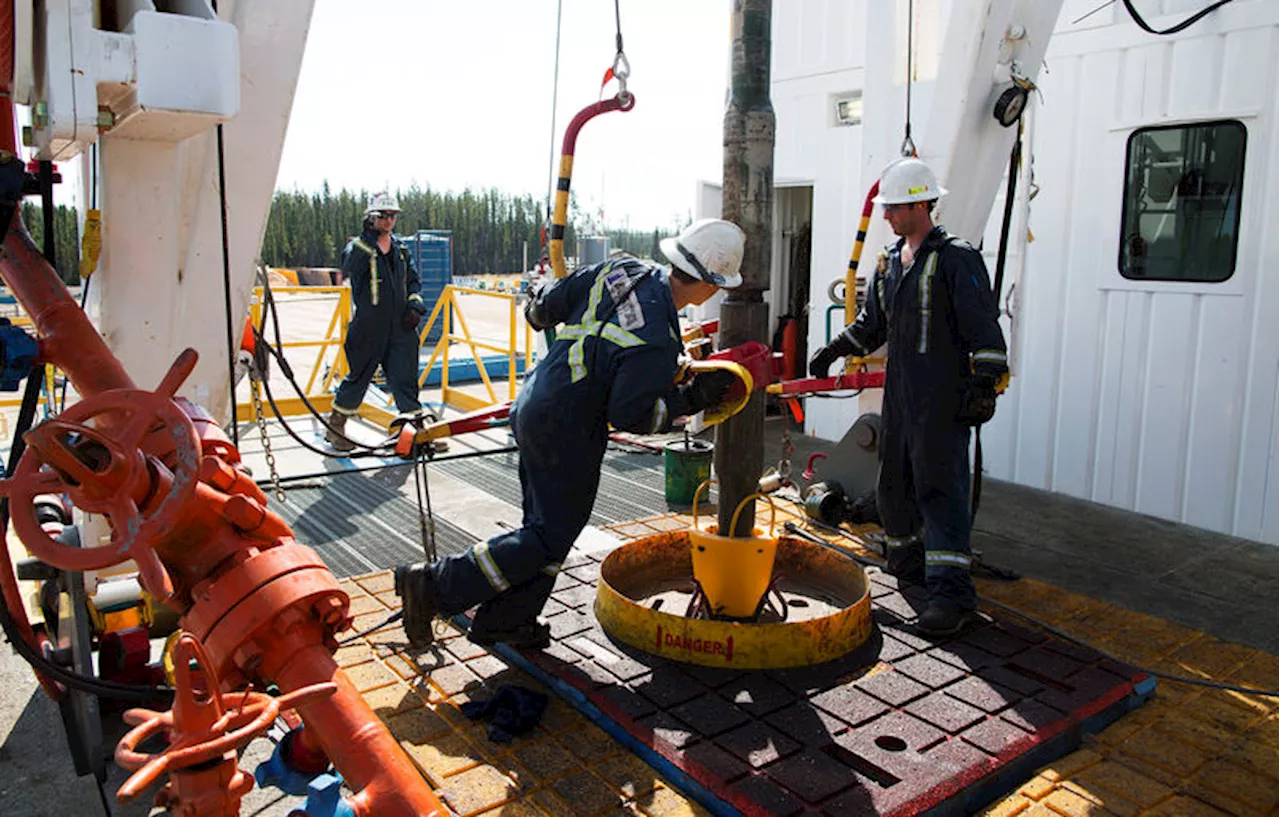

Oil prices surged more than $1 a barrel after President Joe Biden’s administration expanded sanctions against Russia’s critically important energy sector over its war in Ukraine. The Biden administration said the sanctions announced Friday were the most significant to date against Moscow’s oil and liquefied natural gas sectors, drivers of Russia’s economy. U.S. benchmark crude oil surged $1.50 to $78.07 per barrel, while Brent crude, the international standard, rose $1.44 to $81.20 per barrel.

Exports rose 10.7% from a year earlier. Economists had forecast they would grow about 7%. Imports rose 1% year-on-year. Analysts had expected them to shrink about 1.5%. With exports outpacing imports, China’s trade surplus grew to $104.84 billion. But the upbeat data failed to boost the region's stocks. Hong Kong’s Hang Seng dropped 1.3% to 18,820.46, while the Shanghai Composite lost 0.5% to 3,154.37. “Adding to the skittish sentiment is the uncertainty over how Asian economies, especially China, will fare under the shadow of the incoming Trump administration’s ‘America First’ trade policies,” Stephen Innes of SPI Asset Management said in a commentary.On Friday, the S&P 500 tumbled 1.5% to 5,827.04, ending its fourth losing week in the last five. The Dow Jones Industrial Average dropped 1.6% to 41,938.45, and the Nasdaq composite sank 1.6% to 19,161.63. Stocks took their cues from the bond market, where yields leaped to crank up the pressure after a report said U.S. employers added many more jobs to their payrolls last month than economists expected. Such strength in hiring is of course good news for workers looking for jobs. But it could also keep upward pressure on inflation by. That in turn could dissuade the Federal Reserve from delivering the cuts to interest rates that Wall Street loves. Lower rates can not only goose the economy but also boost prices for investments. The Fed has already indicated it’s likely to ease rates fewer times this year than it earlier expected because of worries about higher inflation. That’s in part because some officials are taking seriously the possibility o

RUSSIA ENERGY OIL PRICES BIDEN CHINA

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Oil prices jump as U.S. imposes sweeping sanctions against Russia oil industryThe U.S. Treasury Department is targeting more than 180 Russian tankers.

Oil prices jump as U.S. imposes sweeping sanctions against Russia oil industryThe U.S. Treasury Department is targeting more than 180 Russian tankers.

Read more »

Oil Prices Surge to $75 Amid Global Demand and Production CutsOil prices climbed above $75 per barrel for the first time since October, driven by robust global demand, production cuts by OPEC and Russia, and potential reductions in Iranian oil exports. While the announcement of a possible national economic emergency declaration by President Trump to impose new tariffs initially led to a pullback from the $75 mark, oil prices remain supported by strong fundamentals. The American Petroleum Institute (API) reported a significant drop in crude oil inventories, coupled with increases in gasoline and distillate supplies. Despite this, concerns about reduced gasoline demand due to an impending snowstorm and the potential impact of rising dollar strength on oil prices persist.

Oil Prices Surge to $75 Amid Global Demand and Production CutsOil prices climbed above $75 per barrel for the first time since October, driven by robust global demand, production cuts by OPEC and Russia, and potential reductions in Iranian oil exports. While the announcement of a possible national economic emergency declaration by President Trump to impose new tariffs initially led to a pullback from the $75 mark, oil prices remain supported by strong fundamentals. The American Petroleum Institute (API) reported a significant drop in crude oil inventories, coupled with increases in gasoline and distillate supplies. Despite this, concerns about reduced gasoline demand due to an impending snowstorm and the potential impact of rising dollar strength on oil prices persist.

Read more »

Lower prices dim expectations for Alaska oil earnings in coming years, revenue forecast saysNorth Slope production is expected to start rising in a few years, but revenues to the treasury will decline through the end of the decade, according to the state’s forecast

Lower prices dim expectations for Alaska oil earnings in coming years, revenue forecast saysNorth Slope production is expected to start rising in a few years, but revenues to the treasury will decline through the end of the decade, according to the state’s forecast

Read more »

Oil prices inch lower ahead of Fed meeting, China data dump in focusOil prices inch lower ahead of Fed meeting, China data dump in focus

Oil prices inch lower ahead of Fed meeting, China data dump in focusOil prices inch lower ahead of Fed meeting, China data dump in focus

Read more »

Lower prices dim expectations for Alaska oil earnings in coming years, revenue forecast saysThe report says North Slope production will rise in a few years, but state oil revenue will decline through the end of the decade.

Lower prices dim expectations for Alaska oil earnings in coming years, revenue forecast saysThe report says North Slope production will rise in a few years, but state oil revenue will decline through the end of the decade.

Read more »

Oil prices inch lower ahead of Fed meeting, soft Chinese economic data weighsOil prices inch lower ahead of Fed meeting, soft Chinese economic data weighs

Oil prices inch lower ahead of Fed meeting, soft Chinese economic data weighsOil prices inch lower ahead of Fed meeting, soft Chinese economic data weighs

Read more »