Oil prices are facing downward pressure due to concerns about tariffs and potential impact on global demand. President Trump's comments about pressuring OPEC to lower prices add further complexity. While Libyan protests briefly threatened oil exports, the situation has stabilized. However, looming US tariffs on Canadian and Mexican goods remain a major concern, with potential implications for both crude oil and refined product prices. Technical analysis suggests a possible double bottom pattern for Brent crude oil, but the market outlook remains uncertain until the tariff situation and geopolitical risks are resolved.

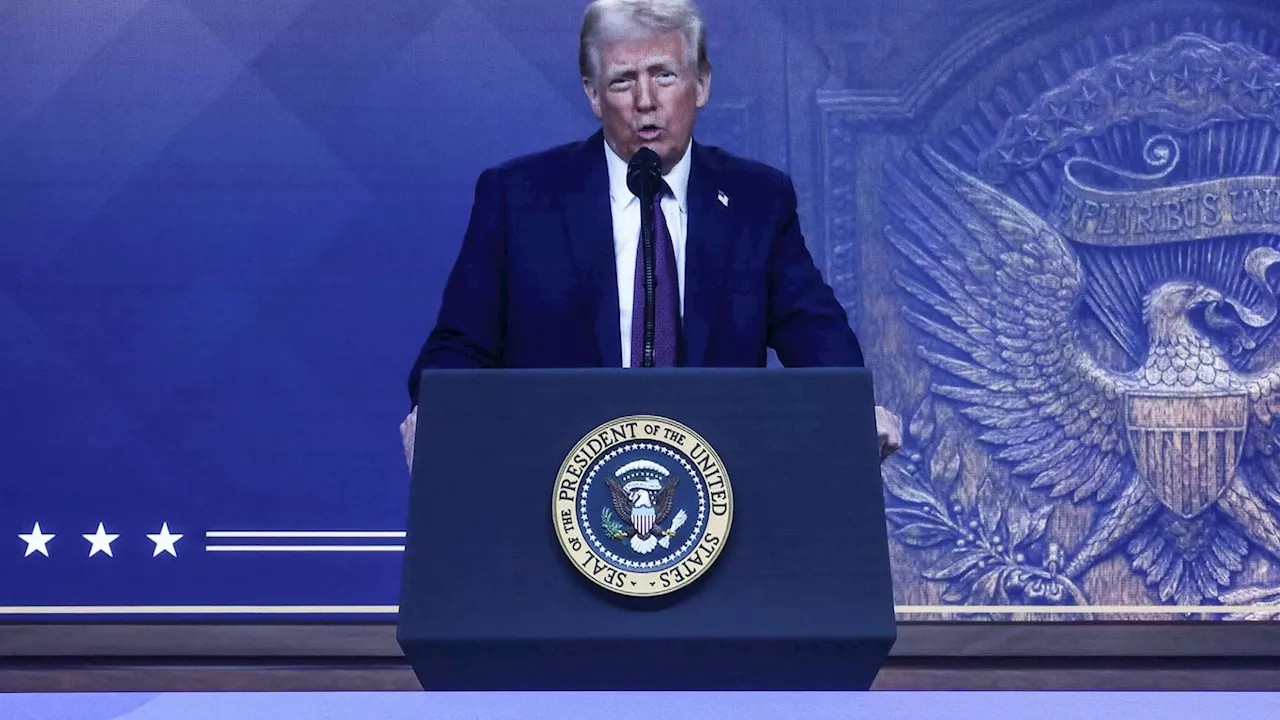

Oil prices are facing continuous challenges to gain significant upward momentum. Persistent uncertainties surrounding tariffs and their potential impact on global demand are keeping market participants on edge. Adding to the complexity, US President Trump's recent comments about pressuring OPEC to lower prices have placed the oil cartel in a difficult position.

While oil prices saw a temporary boost yesterday due to news of Libyan protesters threatening to disrupt crude oil exports from two terminals, the situation quickly stabilized. The Libyan National Oil Corporation reported that operations resumed normally after discussions with the protesters, alleviating the initial concerns.However, the looming threat of tariffs remains a significant factor. Markets anticipate President Trump to impose a 25% tariff on all goods from Canada and Mexico, effective February 1st. This move, if implemented, could significantly impact US oil imports, as Canada is the largest supplier, providing approximately half of US oil imports, while Mexico contributes another substantial amount. Tariffs could also affect refined products like gasoline and increase transportation costs. Adding to the uncertainty, there appears to be a disagreement between President Trump and Treasury Secretary Scott Bessent regarding the implementation of tariffs. While Bessent favors a gradual approach, starting with a 5% tariff, President Trump has expressed support for tariffs on individual products and items.This uncertainty surrounding tariffs is exacerbating market anxieties, as participants grapple with the potential implications for global growth. While tariffs could potentially lead to higher oil and refined product prices, they also raise concerns about a potential slowdown in economic activity. Furthermore, the recent data from the Energy Information Administration (EIA) showing a rise in US crude inventories by 3.5 million barrels to 415.1 million barrels in the week ended January 24th, could further weigh on oil prices.However, the EIA data also revealed an increase in total US oil demand last week, offering a glimmer of hope. Looking ahead, the market awaits significant US dollar news to close the week, but the outcome of the tariff situation and geopolitical risks remain the dominant factors to watch. From a technical analysis perspective, Brent crude oil has reached a crucial support level, where a previous strong upward move initiated after a consolidation phase. Analyzing the four-hour chart reveals a double bottom pattern at the key support level of 76.35. For this pattern to play out, oil prices need to close above the previous swing high of 77.57, potentially propelling prices toward the psychologically significant 80.00 per barrel mark.The current oil market presents a classic dilemma for participants, as fundamental and technical outlooks appear to diverge. This discrepancy makes it challenging to navigate the market, and clarity on the tariff situation is crucial for a more defined path forward

OIL PRICES TARIFFS OPEC GLOBAL DEMAND US DOLLAR TECHNICAL ANALYSIS BRENT CRUDE OIL

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

WTI Oil Price Declines Amid Trump's Calls for OPEC to Lower PricesWest Texas Intermediate (WTI) crude oil fell to $74.10 on Friday morning as US President Donald Trump urged Saudi Arabia and OPEC to reduce oil prices. Trump's request, made during his speech at the World Economic Forum in Davos, Switzerland, comes amid concerns over his proposed tariffs and energy policies. Adding to the downward pressure, US crude inventories fell for the ninth consecutive week, dropping by 1.017 million barrels. The market is closely watching Trump's policy announcements and the release of the preliminary US S&P Global Purchasing Managers Index for January.

WTI Oil Price Declines Amid Trump's Calls for OPEC to Lower PricesWest Texas Intermediate (WTI) crude oil fell to $74.10 on Friday morning as US President Donald Trump urged Saudi Arabia and OPEC to reduce oil prices. Trump's request, made during his speech at the World Economic Forum in Davos, Switzerland, comes amid concerns over his proposed tariffs and energy policies. Adding to the downward pressure, US crude inventories fell for the ninth consecutive week, dropping by 1.017 million barrels. The market is closely watching Trump's policy announcements and the release of the preliminary US S&P Global Purchasing Managers Index for January.

Read more »

WTI Oil Prices Decline Despite Rising Demand and OPEC Output CutsWest Texas Intermediate (WTI) oil prices continue to fall despite bullish factors like increased energy demand and OPEC production cuts. Although OPEC+ output decreased in December, primarily due to UAE supply cuts, WTI remains around $72.90 per barrel. The Biden administration's plans to impose further sanctions on Russia and ban new offshore oil and gas development add to the market complexity.

WTI Oil Prices Decline Despite Rising Demand and OPEC Output CutsWest Texas Intermediate (WTI) oil prices continue to fall despite bullish factors like increased energy demand and OPEC production cuts. Although OPEC+ output decreased in December, primarily due to UAE supply cuts, WTI remains around $72.90 per barrel. The Biden administration's plans to impose further sanctions on Russia and ban new offshore oil and gas development add to the market complexity.

Read more »

Oil Prices Rise on Inventory Draw and OPEC Production CutsOil prices climbed on Wednesday, extending a rally fueled by U.S. inventory data and expectations of declining OPEC production. Traders are also betting on strong demand driven by cold weather in the U.S. and Europe.

Oil Prices Rise on Inventory Draw and OPEC Production CutsOil prices climbed on Wednesday, extending a rally fueled by U.S. inventory data and expectations of declining OPEC production. Traders are also betting on strong demand driven by cold weather in the U.S. and Europe.

Read more »

Trump Blames Saudi Arabia and OPEC for Fueling Ukraine War Through High Oil PricesFormer U.S. President Donald Trump claimed that Saudi Arabia and OPEC are responsible for escalating the war in Ukraine due to their role in driving up oil prices. He stated that the conflict would cease if these organizations significantly reduced crude prices. Trump addressed the World Economic Forum, stating that he would request Saudi Arabia and OPEC to lower oil costs, asserting that a price decrease would instantly end the Russia-Ukraine war.

Trump Blames Saudi Arabia and OPEC for Fueling Ukraine War Through High Oil PricesFormer U.S. President Donald Trump claimed that Saudi Arabia and OPEC are responsible for escalating the war in Ukraine due to their role in driving up oil prices. He stated that the conflict would cease if these organizations significantly reduced crude prices. Trump addressed the World Economic Forum, stating that he would request Saudi Arabia and OPEC to lower oil costs, asserting that a price decrease would instantly end the Russia-Ukraine war.

Read more »

Trump Urges OPEC to Cut Oil Prices to Cripple Russia's War FundingPresident Trump calls on OPEC to reduce oil prices to pressure Russia into ending its war in Ukraine. He believes lower oil prices would significantly impact Russia's war funding and force Vladimir Putin to negotiate.

Trump Urges OPEC to Cut Oil Prices to Cripple Russia's War FundingPresident Trump calls on OPEC to reduce oil prices to pressure Russia into ending its war in Ukraine. He believes lower oil prices would significantly impact Russia's war funding and force Vladimir Putin to negotiate.

Read more »

WTI falls below $74.00 as Trump reiterates call for OPEC+ to reduce Oil pricesWest Texas Intermediate (WTI) Oil price has reversed the gains made in the previous session, trading around $73.90 per barrel during Monday's Asian trading hours.

WTI falls below $74.00 as Trump reiterates call for OPEC+ to reduce Oil pricesWest Texas Intermediate (WTI) Oil price has reversed the gains made in the previous session, trading around $73.90 per barrel during Monday's Asian trading hours.

Read more »