If you liked the chip maker in January, you should like it now. The stock hasn't had such a low forward price/earnings ratio since the price was a lot lower.

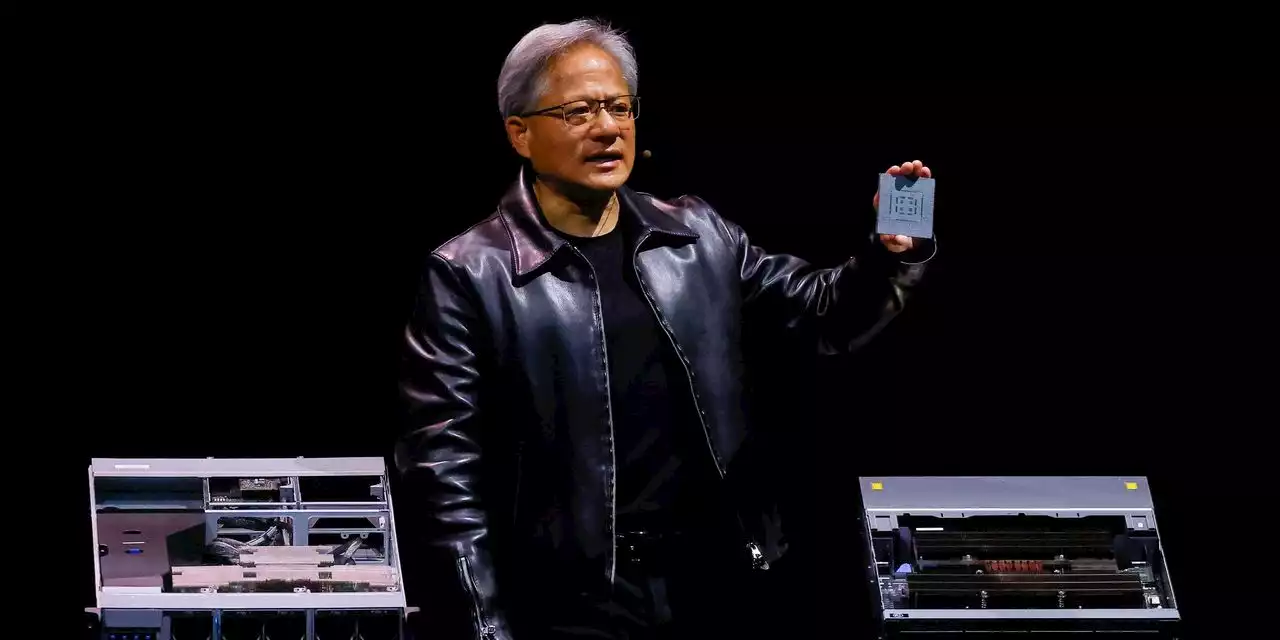

Shares in Nvidia have surged this year, buoying the entire stock market and lifting the S&P 500 and Nasdaq indexes as the chip maker became a key way to play the frenzy over artificial intelligence. Despite the gains, the latest earnings for the company mean that its valuation based on a critical metric has actually become more reasonable.

This is the math. Nvidia’s latest results, and particularly its outlook, were so good that analysts have significantly ramped up their forecasts for the company’s future earnings, which makes its forward P/E suddenly look much more attractive. As of July 31, the consensus call among analysts surveyed by FactSet was for earnings of $7.95 a share in fiscal 2024 and $11.53 in fiscal 2025.

As a result, the stock looks cheaper. Much cheaper. Nvidia was trading at a forward P/E of 33.8 on Friday, down from above 43 before its earnings and at the lowest level since Jan. 5.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

This Company Is Nvidia’s AI Chip Partner—and Its Stock Is SoaringSK Hynix has long been a major player in the boom-and-bust world of memory chips, but it hasn’t historically been viewed as an industry pioneer.

This Company Is Nvidia’s AI Chip Partner—and Its Stock Is SoaringSK Hynix has long been a major player in the boom-and-bust world of memory chips, but it hasn’t historically been viewed as an industry pioneer.

Read more »

1 Stock to Buy, 1 Stock to Sell This Week: Salesforce, Dollar GeneralStocks Analysis by Investing.com (Jesse Cohen) covering: Salesforce Inc, Dollar General Corporation. Read Investing.com (Jesse Cohen)'s latest article on Investing.com

1 Stock to Buy, 1 Stock to Sell This Week: Salesforce, Dollar GeneralStocks Analysis by Investing.com (Jesse Cohen) covering: Salesforce Inc, Dollar General Corporation. Read Investing.com (Jesse Cohen)'s latest article on Investing.com

Read more »

Nvidia Supply Concerns Ease, but Long-Term Challenges RemainQuestions persist regarding artificial-intelligence demand and geopolitics.

Nvidia Supply Concerns Ease, but Long-Term Challenges RemainQuestions persist regarding artificial-intelligence demand and geopolitics.

Read more »

Nvidia Plans to Buy Back Billions in Stock. Other Companies Could Join in Soon.Buybacks can often be a key ingredient to stock market returns for investors.

Nvidia Plans to Buy Back Billions in Stock. Other Companies Could Join in Soon.Buybacks can often be a key ingredient to stock market returns for investors.

Read more »

Mike Pence dredges up Vivek Ramaswamy's past January 6 statements: 'A stain on American history'Vivek Ramaswamy has appeared to contradict himself multiple times when it comes to whether the storming of the U.S. Captiol on Janaury 6 was justified.

Mike Pence dredges up Vivek Ramaswamy's past January 6 statements: 'A stain on American history'Vivek Ramaswamy has appeared to contradict himself multiple times when it comes to whether the storming of the U.S. Captiol on Janaury 6 was justified.

Read more »

Wall St Week Ahead Historically stormy month of September may test US stock rallyU.S. stock investors are bracing for a potentially volatile September as the market faces key economic data reports, a Federal Reserve meeting and worries over a possible government shutdown during a month of historically muted equity performance.

Wall St Week Ahead Historically stormy month of September may test US stock rallyU.S. stock investors are bracing for a potentially volatile September as the market faces key economic data reports, a Federal Reserve meeting and worries over a possible government shutdown during a month of historically muted equity performance.

Read more »