Over the long run, 40% of stock-market gains come from dividends.

The “easy” gains of the early part of a bull market have been made, and stocks are more likely to move sideways. That means now is a good time to remember a frequently overlooked reality of investing: 40% of gains come from dividends over the long run.

Note that most of these names pay out more yield than certificates of deposit and offer the potential for capital appreciation as well, though there is risk to the downside, too, of course. Buckingham reasons that by now — given the maturity of end-markets — Verizon is similar to a low-growth utility. But it doesn’t trade like one, and it offers a much better yield. While Verizon has a forward p/e of 7.4, the S&P 500 Utilities Index trades for about 18 times forward earnings, and it pays out less than half of Verizon’s yield.

Energy stocks are a strong buy. Even though energy prices are likely to go up from here, the group has performed poorly this year. Insiders love the sector. Given the group’s potential for stock gains, it’s a good place to shop for yield. In June OKE insiders, mostly the CEO, bought $1.8 million worth of stock at prices up to $61 — a bullish signal because of the size.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

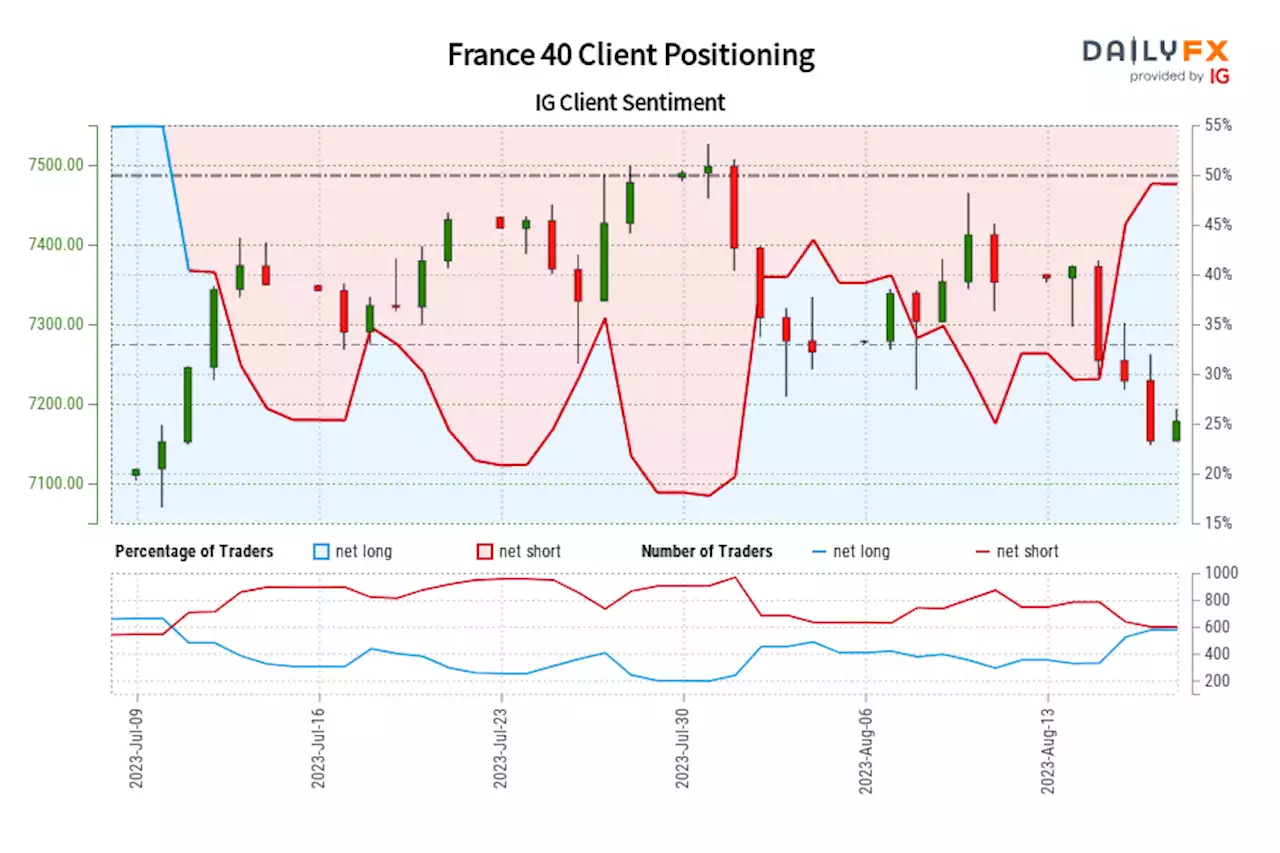

France 40 IG Client Sentiment: Our data shows traders are now net-long France 40 for the first time since Jul 11, 2023 when France 40 traded near 7,245.50.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger France 40-bearish contrarian trading bias.

France 40 IG Client Sentiment: Our data shows traders are now net-long France 40 for the first time since Jul 11, 2023 when France 40 traded near 7,245.50.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger France 40-bearish contrarian trading bias.

Read more »

WeWork announces 1-for-40 reverse stock split to regain compliance with NYSE listing rulesWeWork Inc. said Friday it will proceed with a 1-for-40 reverse stock split on Sept. 1, as the office-sharing company struggles to regain compliance with the...

WeWork announces 1-for-40 reverse stock split to regain compliance with NYSE listing rulesWeWork Inc. said Friday it will proceed with a 1-for-40 reverse stock split on Sept. 1, as the office-sharing company struggles to regain compliance with the...

Read more »

Farfetch Stock Is Down 40% as Results Trigger DowngradeKeyBanc Capital Markets analysts downgraded shares of the e-commerce company for luxury fashion to Sector Weight from Overweight.

Farfetch Stock Is Down 40% as Results Trigger DowngradeKeyBanc Capital Markets analysts downgraded shares of the e-commerce company for luxury fashion to Sector Weight from Overweight.

Read more »

WeWork moves ahead with 1-for-40 reverse stock split to maintain NYSE listingThe NYSE issued a notice to the workspace-sharing company in the spring after shares closed below an average of $1 over a 30-day trading span.

WeWork moves ahead with 1-for-40 reverse stock split to maintain NYSE listingThe NYSE issued a notice to the workspace-sharing company in the spring after shares closed below an average of $1 over a 30-day trading span.

Read more »

Essential Led Zeppelin: Their 40 greatest songs, rankedIn celebration of Robert Plant's 75th birthday, we revisit the tracks that capture the might and imagination of the most influential rock band of the 70s

Essential Led Zeppelin: Their 40 greatest songs, rankedIn celebration of Robert Plant's 75th birthday, we revisit the tracks that capture the might and imagination of the most influential rock band of the 70s

Read more »

America's wealthiest 10% responsible for 40% of US greenhouse gas emissions -- ScienceDailyA new study reveals that the wealthiest Americans, those whose income places them in the top 10% of earners, are responsible for 40% of the nation's total greenhouse gas emissions. The study links income, especially income derived from financial investments, to the emissions used in generating that income. The authors suggest that policymakers adopt taxes focused on shareholders and the carbon intensity of investment incomes in order to equitably meet the goal of keeping the global temperature to 1.5 C of warming.

America's wealthiest 10% responsible for 40% of US greenhouse gas emissions -- ScienceDailyA new study reveals that the wealthiest Americans, those whose income places them in the top 10% of earners, are responsible for 40% of the nation's total greenhouse gas emissions. The study links income, especially income derived from financial investments, to the emissions used in generating that income. The authors suggest that policymakers adopt taxes focused on shareholders and the carbon intensity of investment incomes in order to equitably meet the goal of keeping the global temperature to 1.5 C of warming.

Read more »