Nonfarm Payrolls Preview: Three reasons for a downside surprise, triggering dollar buy opportunity by forexcrunch NFP forex trading

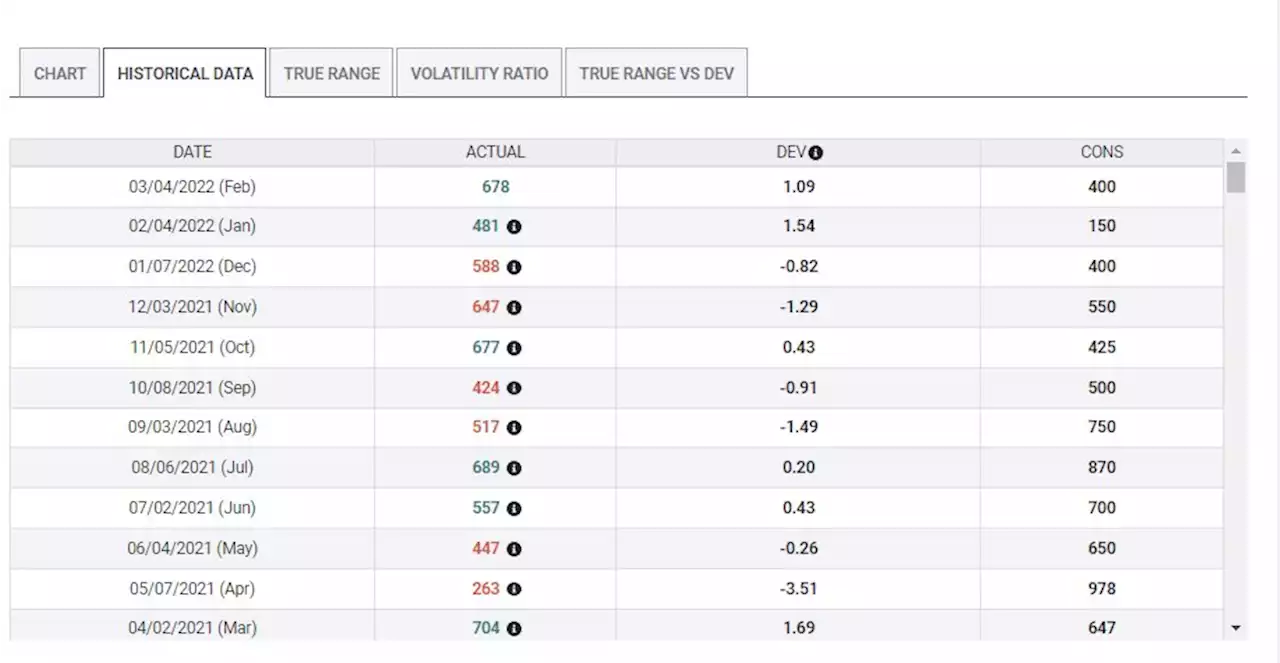

Economists expect an increase ofpositions in March, down from the impressive 678,000 recorded in February, but similar to 481,000 in January. Such substantial job gains are well beyond the pre-pandemic levels of roughly 200,000 and reflect a reopening recovery.After such outstanding increases, it makes sense to expect a deceleration, but has the consensus dropped far enough? There are additional reasons to expect a slowdown. Statistically, an increase beyond expectations would be rare.

In addition, higher costs, as a result of inflationary pressures seen prior to the war – and somewhat exacerbating them – may have also contributed to some hesitance. Has it likely been a wide phenomenon? Probably not, but enough to trigger a downside surprise. This jobs report is released on April 1 – the earliest possible date, and that implies there are few leading indicators coming ahead of it.

if the theory above is correct. Investors react first and think later. That initial drop and second thought may provide a buying opportunity on the greenback.Assuming the NFP is just disappointing – an increase of fewer than 400,000 jobs, but still a healthy figure – it would keep the Federal Reserve on course to raise interest rates by 50 bps in May.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

US March Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprisesHistorically, how impactful has the US jobs report been on gold’s valuation? In this article, we present results from a study in which we analyzed the

US March Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprisesHistorically, how impactful has the US jobs report been on gold’s valuation? In this article, we present results from a study in which we analyzed the

Read more »

AUD/USD steadies around 0.7500 ahead of US NFP and Caixin Manufacturing PMIThe AUD/USD pair is oscillating in a range of 0.7456-0.7537 the whole week as investors are waiting for the release of the US Nonfarm Payrolls and Cai

AUD/USD steadies around 0.7500 ahead of US NFP and Caixin Manufacturing PMIThe AUD/USD pair is oscillating in a range of 0.7456-0.7537 the whole week as investors are waiting for the release of the US Nonfarm Payrolls and Cai

Read more »

Gold Price Analysis: XAU/USD advances into $1940s as Russo-European energy tensions riseEven though the White House’s announcement of a historic crude oil reserve release has triggered downside in global oil markets, contributing to a mod

Gold Price Analysis: XAU/USD advances into $1940s as Russo-European energy tensions riseEven though the White House’s announcement of a historic crude oil reserve release has triggered downside in global oil markets, contributing to a mod

Read more »

Buy Dollar General for Consistency and Dollar Tree for High-Risk, High-Reward, Jim Cramer SaysInvestors who value consistency should buy Dollar General while risk-takers should purchase Dollar Tree, the “Mad Money” host said Thursday.

Buy Dollar General for Consistency and Dollar Tree for High-Risk, High-Reward, Jim Cramer SaysInvestors who value consistency should buy Dollar General while risk-takers should purchase Dollar Tree, the “Mad Money” host said Thursday.

Read more »

Why DeFi Hedge Fund Managers Should Not Charge Fees on DeFi Option Vaults | HackerNoonDeFi Options vaults have become a billion-dollar opportunity. However, whether DeFi options vaults should charge fees to investors?

Why DeFi Hedge Fund Managers Should Not Charge Fees on DeFi Option Vaults | HackerNoonDeFi Options vaults have become a billion-dollar opportunity. However, whether DeFi options vaults should charge fees to investors?

Read more »

Bitcoin suddenly dives to $46K as attention focuses on large CME futures gapsThe presage of a pullback seems to be materializing for Bitcoin. Earlier this week, analysts expected some price correction before a potential surge of BTC towards the $50K.

Bitcoin suddenly dives to $46K as attention focuses on large CME futures gapsThe presage of a pullback seems to be materializing for Bitcoin. Earlier this week, analysts expected some price correction before a potential surge of BTC towards the $50K.

Read more »