Under a government agreement, King Charles III won't have to pay the U.K.'s standard 40% inheritance tax on the massive wealth he inherits from his mother, Queen Elizabeth II.

In 1993, Queen Elizabeth II and her heir, then-Prince Charles, reached a deal with the government in which they agreed to voluntarily pay taxes — but to be exempt from an inheritance tax. Mother and son are seen here in 2019 in London.Paul Edwards /WPA Pool / Getty Images

In 1993, Queen Elizabeth II and her heir, then-Prince Charles, reached a deal with the government in which they agreed to voluntarily pay taxes — but to be exempt from an inheritance tax. Mother and son are seen here in 2019 in London., but he won't have to pay the U.K.'s inheritance tax on the massive wealth he inherits from his late mother, Queen Elizabeth II. That's because of a deal the royals made with the government nearly 30 years ago.

Regular citizens must pay the standard inheritance tax rate of 40% on any part of an estate that's valued above a threshold of 325,000 pounds . There areBut under an agreement with the monarchy that then-Prime Minister John Major

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

People divided over King Charles III not having to pay any estate taxWhile some called the plans an 'absolute disgrace' others dismissed such complaints and suggested there is 'no appetite for a Republic.'

People divided over King Charles III not having to pay any estate taxWhile some called the plans an 'absolute disgrace' others dismissed such complaints and suggested there is 'no appetite for a Republic.'

Read more »

President Biden speaks with King Charles III for 1st time since queen’s deathPresident Biden and Charles last met in person in November at a climate summit. The two also met last June.

President Biden speaks with King Charles III for 1st time since queen’s deathPresident Biden and Charles last met in person in November at a climate summit. The two also met last June.

Read more »

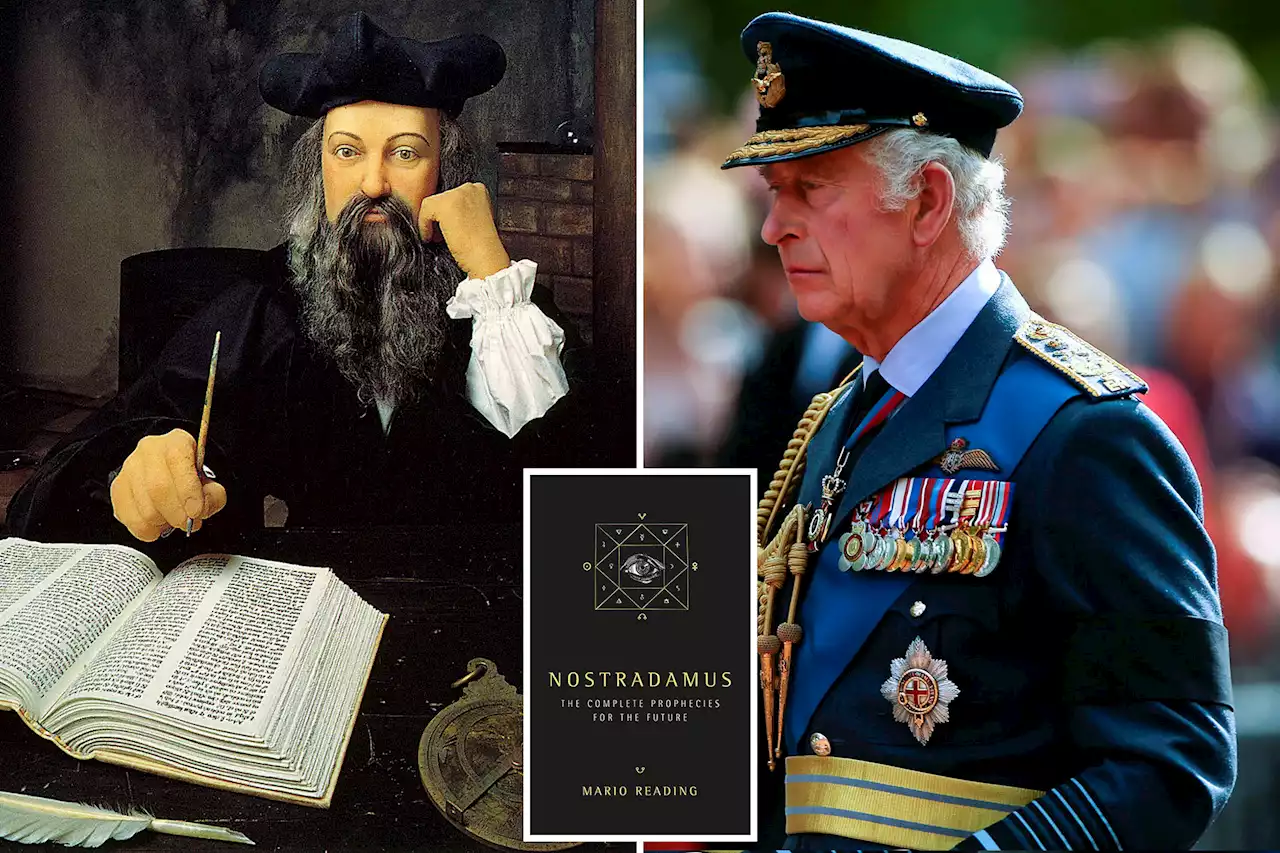

King Charles III to abdicate, this unexpected royal to rule instead: Nostradamus predictionTexts from Nostradamus have been interpreted to mean that a dark horse could soon replace the newly crowned king.

King Charles III to abdicate, this unexpected royal to rule instead: Nostradamus predictionTexts from Nostradamus have been interpreted to mean that a dark horse could soon replace the newly crowned king.

Read more »