Starting January 1, nine states implemented income tax cuts, hoping to increase spending and attract new residents. The move was met with mixed reactions, with some praising its economic potential while others worry about the impact on public services.

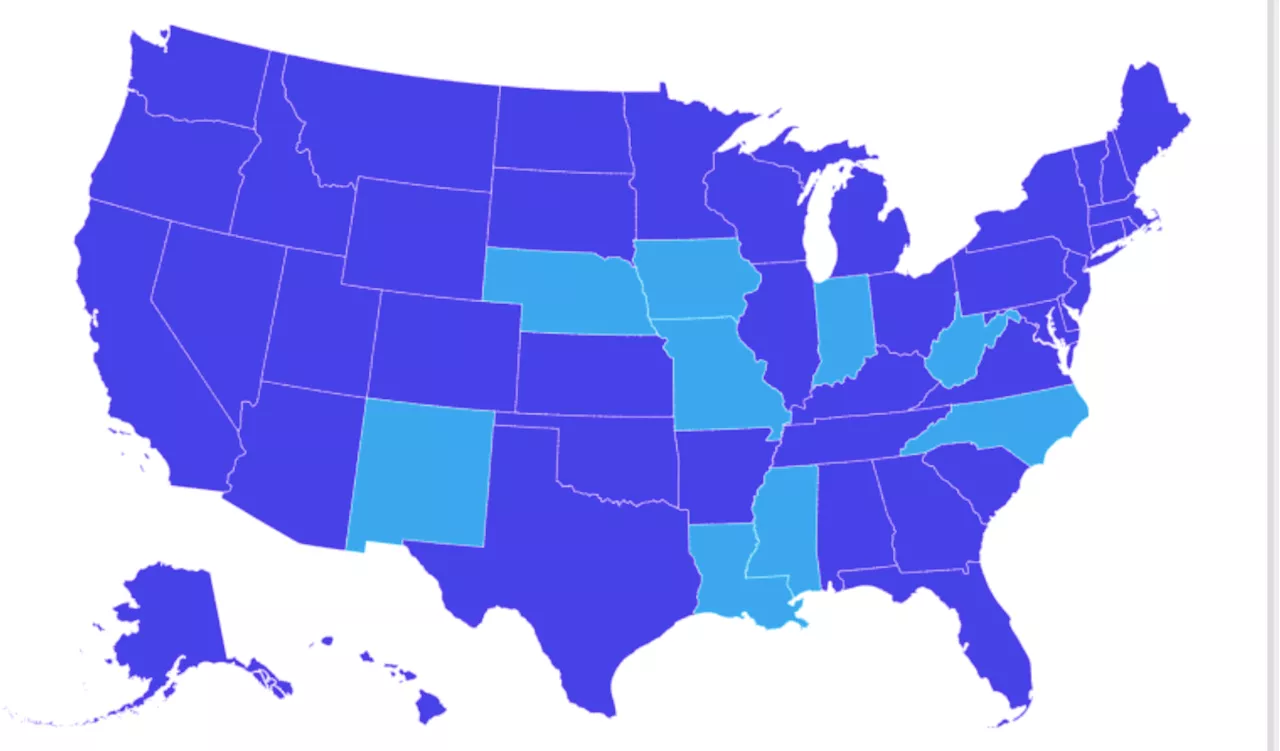

Nine states across the country have lowered their income tax rate as of January 1, in a move that, at least on paper, should allow residents to have more money to spend on goods and services. Indiana, Iowa, Louisiana, Mississippi, Missouri, Nebraska, New Mexico, North Carolina, and West Virginia all implemented income tax cuts as of the new year, two states embracing flat rates, according to the Washington-based think tank Tax Foundation.

Another state, South Carolina, has made a temporary income tax reduction permanent as of the same date. Newsweek contacted the Tax Foundation for comment by email on Friday. Income tax cuts are expected to be popular among benefiting residents and could potentially make the states which have implemented them more appealing to Americans looking to move to cheaper places—a strategy that has served Texas and Florida (which have no state individual income tax) well for decades. Many of the states that have implemented cuts on January 1 have done so as part of long-term plans to reduce the tax burden on their residents, backed by sufficient revenues in the past few years. But Democrats in some of these states—many of which are controlled by the GOP—have expressed concerns over the impact these cuts could have on publicly-funded services. Indiana, which already had a flat individual income tax rate, lowered from 3.05 percent in 2024 to 3 percent as of January 1 under its biennial budget bill. The cut is part of the state's goal to lower its flat individual income tax rate to 2.9 percent by January 1, 2027. In Iowa, the individual income tax rate has gone from a graduated-rate tax of 5.7 percent last year to a flat 3.8 percent as of the beginning of the year. As in Indiana's case, the change is also part of a multiyear plan to curb fiscal expenses for its residents.Louisiana has lowered its income tax rate from 4.25 percent to 3 percent under HB2; Mississippi has reduced its flat individual income tax from

INCOME TAX TAX CUTS STATE BUDGETS ECONOMY MOVING

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Nine States to Cut Income Taxes in 2025Nine states are set to reduce their individual income tax rates in 2025, continuing a trend of state-level tax cuts that began during the pandemic. The Tax Foundation attributes this to states recognizing the importance of a competitive tax code. However, the Institute on Taxation and Economic Policy warns that this 'anti-tax playbook' could eventually harm public services.

Nine States to Cut Income Taxes in 2025Nine states are set to reduce their individual income tax rates in 2025, continuing a trend of state-level tax cuts that began during the pandemic. The Tax Foundation attributes this to states recognizing the importance of a competitive tax code. However, the Institute on Taxation and Economic Policy warns that this 'anti-tax playbook' could eventually harm public services.

Read more »

After backing Trump, low-income voters hope he doesn’t slash their benefitsVoters in the struggling Pennsylvania city of New Castle backed Donald Trump hoping he’d curb inflation. But he’ll be under pressure to cut federal spending.

After backing Trump, low-income voters hope he doesn’t slash their benefitsVoters in the struggling Pennsylvania city of New Castle backed Donald Trump hoping he’d curb inflation. But he’ll be under pressure to cut federal spending.

Read more »

New Mexico's oil income investments now surpass personal income tax revenueFor the first time, New Mexico’s investment income is expected to surpass its revenue from personal income taxes. A new financial forecast Monday says New Mexico will bring in a record-setting $13.6 billion in general fund income for the fiscal year that runs from July 2025 to June 2026.

New Mexico's oil income investments now surpass personal income tax revenueFor the first time, New Mexico’s investment income is expected to surpass its revenue from personal income taxes. A new financial forecast Monday says New Mexico will bring in a record-setting $13.6 billion in general fund income for the fiscal year that runs from July 2025 to June 2026.

Read more »

Blue State Exodus: Americans Flee Democrat-Run States for Red StatesNew Census data reveals a mass exodus from Democrat-controlled states, with residents moving to Republican-controlled states. This trend is attributed to economic factors, including job growth and lower cost of living, favoring red states.

Blue State Exodus: Americans Flee Democrat-Run States for Red StatesNew Census data reveals a mass exodus from Democrat-controlled states, with residents moving to Republican-controlled states. This trend is attributed to economic factors, including job growth and lower cost of living, favoring red states.

Read more »

Winter Weather Warnings Issued for Nine States Ahead of ChristmasHeavy snow, gusty winds, and ice threaten travel across the US. Residents in Colorado, South Dakota, Alaska, Oregon, and Wyoming are advised to exercise caution amid hazardous winter conditions.

Winter Weather Warnings Issued for Nine States Ahead of ChristmasHeavy snow, gusty winds, and ice threaten travel across the US. Residents in Colorado, South Dakota, Alaska, Oregon, and Wyoming are advised to exercise caution amid hazardous winter conditions.

Read more »

Heavy Snow, High Winds and Icy Roads Hit Nine StatesWinter weather advisories remain in effect for nine states as heavy snowfall, high winds, and icy conditions threaten to disrupt holiday travel.

Heavy Snow, High Winds and Icy Roads Hit Nine StatesWinter weather advisories remain in effect for nine states as heavy snowfall, high winds, and icy conditions threaten to disrupt holiday travel.

Read more »