It's no secret that NFT lending has gained some traction in recent times. Why? Well, lenders can earn without selling their assets, and borrowers can earn without owning it.

. When NFT owners temporarily swap their tokens for other crypto or fiat, they spread their investments across a variety of assets. NFT lending could serve as a supplement to a sound risk management strategy as long as loan deadlines are adequately managed.NFT lending provides a way for people to invest in NFTs without buying them outright, thus limiting their financial risks to the period of the loan.

Unlike P2P NFT lending, what’s being monitored here is not a deadline but the health factor of the NFT loan – essentially, the difference in collateralized market value and outstanding loan amount. As soon as the health factor falls below a threshold, the asset is typically transferred to the protocol. Depending on the platform, the NFT owner may be afforded a grace period to repay their loan to claim the NFT back.

In addition, the NFDP can be traded on a secondary market; ownership of the digital asset can switch hands easily, providing a more flexible way for users to exit an investment or leverage their current NFDP asset.NFT rentals are slightly different from the conventional lending models as the main aim for renters isn’t interest but the perks associated with the NFT, be it community or club

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

The Ultimate Guide to NFT Royalties and NFT Marketplaces in 2023 | CoinMarketCapThe future for NFTs may be uncertain but definitely exciting. 🔥 Expect a consensus on royalties and marketplace leaders to emerge!

The Ultimate Guide to NFT Royalties and NFT Marketplaces in 2023 | CoinMarketCapThe future for NFTs may be uncertain but definitely exciting. 🔥 Expect a consensus on royalties and marketplace leaders to emerge!

Read more »

Black farmers worry new approach on 'race neutral' lending leaves them in the shadowsSome Black farmers worry the USDA's new approach on 'race neutral' lending will leave them behind — after lawsuits led by white farmers stymied a race-targeted program.

Black farmers worry new approach on 'race neutral' lending leaves them in the shadowsSome Black farmers worry the USDA's new approach on 'race neutral' lending will leave them behind — after lawsuits led by white farmers stymied a race-targeted program.

Read more »

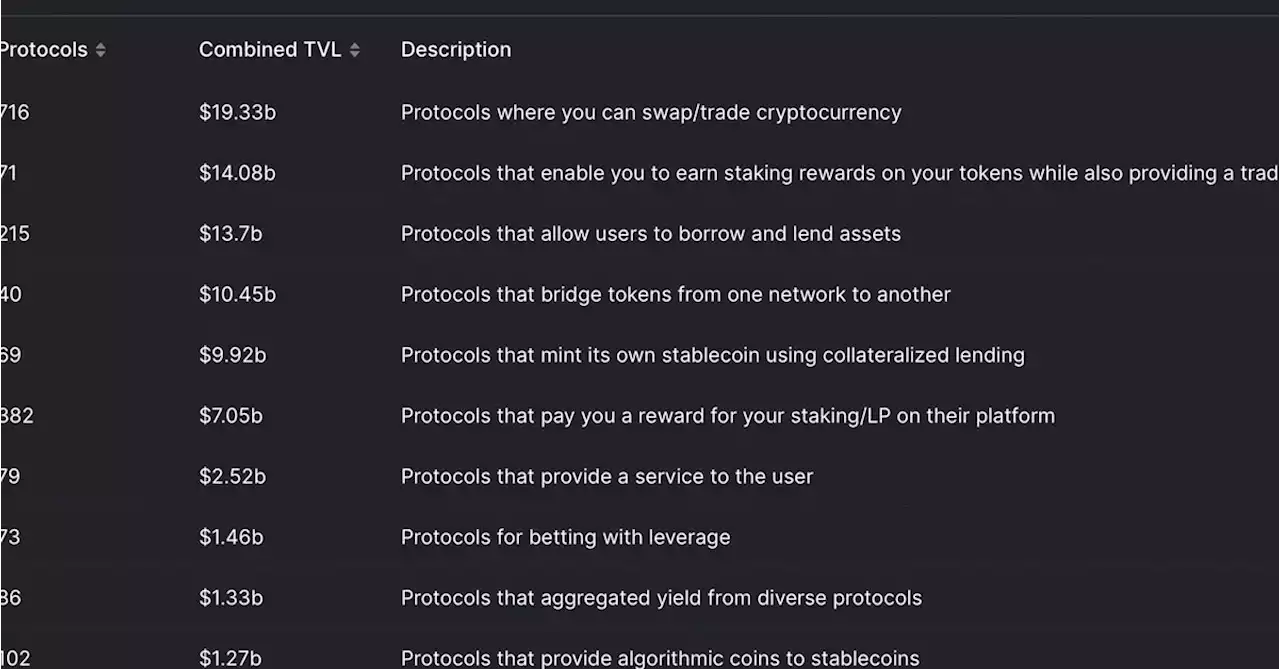

Liquid Staking Replaces DeFi Lending as Second-Largest Crypto SectorEthereum's impending Shanghai upgrade, which will reduce the risk of staking, has galvanized investor interest in liquid staking solutions, reports godbole17.

Liquid Staking Replaces DeFi Lending as Second-Largest Crypto SectorEthereum's impending Shanghai upgrade, which will reduce the risk of staking, has galvanized investor interest in liquid staking solutions, reports godbole17.

Read more »

Euro zone lending growth slows again amid downturnEuro zone bank lending fell again in January while cash and liquid deposits declined for the first time ever as rapid central bank rate hikes took their toll, European Central Bank data showed on Monday.

Euro zone lending growth slows again amid downturnEuro zone bank lending fell again in January while cash and liquid deposits declined for the first time ever as rapid central bank rate hikes took their toll, European Central Bank data showed on Monday.

Read more »

Liquid Staking Takes DeFi By Storm With $240 Million Lido Inflow, Apparently From Justin SunLiquid Staking Takes DeFi By Storm With $240 Million Lido Inflow, Apparently From Justin Sun by ninabambysheva

Liquid Staking Takes DeFi By Storm With $240 Million Lido Inflow, Apparently From Justin SunLiquid Staking Takes DeFi By Storm With $240 Million Lido Inflow, Apparently From Justin Sun by ninabambysheva

Read more »

Cardano's Most Hyped NFT Project Announces Integration With The Sandbox (SAND)Cardano NFT project and Sandbox (SAND) join forces in latest partnership CardanoADA CardanoCommunity SAND $SAND $ADA ADA Web3 SandFam NFT

Cardano's Most Hyped NFT Project Announces Integration With The Sandbox (SAND)Cardano NFT project and Sandbox (SAND) join forces in latest partnership CardanoADA CardanoCommunity SAND $SAND $ADA ADA Web3 SandFam NFT

Read more »