Inflation and rising home prices continue to erode Americans’ buying power, and rising borrowing costs add to the challenge of buying a home.

While rates are expected to climb in the long term, the next few weeks will be unpredictable as financial markets continue to churn. Meanwhile, inflation and escalating home prices continue to erode Americans’ buying power, putting the dream of homeownership increasingly out of reach for many.Many buyers jumped into the market earlier in the pandemic, and existing owners rushed to refinance, taking advantage of rates that were sliding.

An extra $100 to $200 on a mortgage payment typically wouldn’t be a primary deterrent for buyers, according to Susan Stewart, chief executive of. But that may be meaningful when taken together with other costs — such as for food and fuel — that are rising with inflation. “If somebody sits down and does a budget and says, OK, these are all my expenses today, which ones are going to increase? And when you pile that on, is that going to affect my ability to buy a home?” said Stewart, whose firm is based in San Antonio. “Cash flow-wise it might. Down payment-wise, it might.”

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

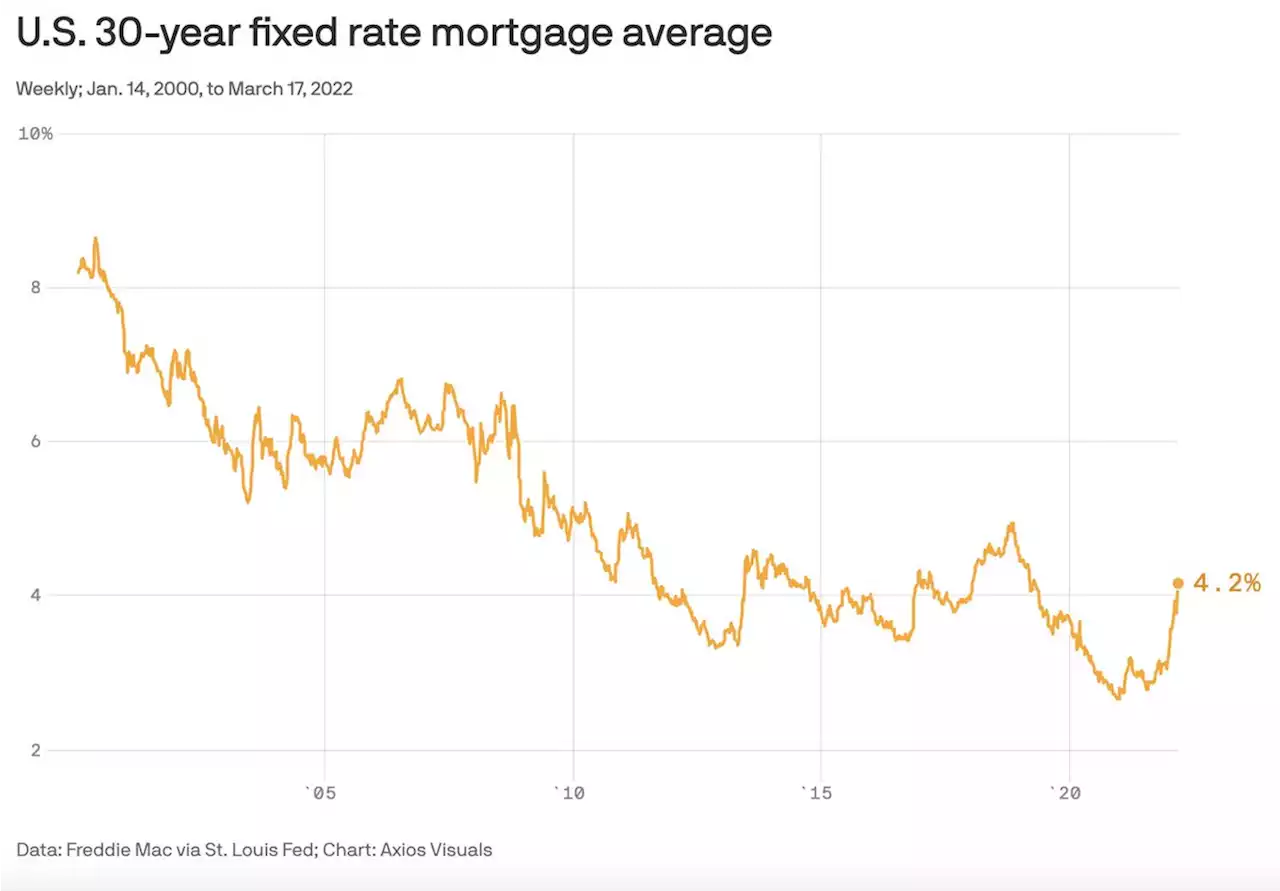

Mortgage rates top 4% in U.S. for first time since 2019At the current 30-year average, the monthly payment on a $300,000 loan would be $1,460.

Mortgage rates top 4% in U.S. for first time since 2019At the current 30-year average, the monthly payment on a $300,000 loan would be $1,460.

Read more »

Mortgage rates rise above 4% for the first time since 2019Mortgage rates climbed past 4% for the first time since May 2019. The 30-year fixed-rate mortgage averaged 4.16% in the week ending March 17, up from 3.85% the week before, according to Freddie Mac.

Mortgage rates rise above 4% for the first time since 2019Mortgage rates climbed past 4% for the first time since May 2019. The 30-year fixed-rate mortgage averaged 4.16% in the week ending March 17, up from 3.85% the week before, according to Freddie Mac.

Read more »

Mortgage rates are over 4%The last time it happened, the median price for a home was just $277,000

Mortgage rates are over 4%The last time it happened, the median price for a home was just $277,000

Read more »

Average U.S. mortgage rates rise; 30-year loan breaches 4%Average long-term U.S. mortgage rates rose this week as the key 30-year loan vaulted over 4% for the first time since May 2019.

Average U.S. mortgage rates rise; 30-year loan breaches 4%Average long-term U.S. mortgage rates rose this week as the key 30-year loan vaulted over 4% for the first time since May 2019.

Read more »

Average U.S. mortgage rates rise; 30-year loan breaches 4%Average long-term U.S. mortgage rates rose this week as the key 30-year loan vaulted over 4% for the first time since May 2019.

Average U.S. mortgage rates rise; 30-year loan breaches 4%Average long-term U.S. mortgage rates rose this week as the key 30-year loan vaulted over 4% for the first time since May 2019.

Read more »

What it means for you when the Fed raises interest ratesWhat does it mean when the Fed raises interest rates? Here's our explanation on the impact, from inflation to student loans to mortgages.

What it means for you when the Fed raises interest ratesWhat does it mean when the Fed raises interest rates? Here's our explanation on the impact, from inflation to student loans to mortgages.

Read more »