Despite anticipation of interest rate cuts from the Federal Reserve to lower mortgage rates, home buyers are now facing even higher rates. This unexpected surge follows a brief period where mortgage rates were declining, reaching their lowest point in over two years.

After waiting years for interest rate cuts from the Federal Reserve , in the hopes that they would aid in lowering mortgage rates , home buyers are now facing even higher mortgage rates .

This comes after mortgage rates were dropping, hitting their lowest point in over two years. But after aWhat does the jobs report have to do with mortgage rates? The September jobs report showed significant job growth, which led investors to believe the economy was gaining strength. In response to that, they decided to sell safer things like bonds and instead buy stocks, which made theThough this type of ripple effect isn't uncommon, it's a stark difference from the last time the Fed slashed interest rates in 2020, which resulted in a quick decline in mortgage rates.

A similar situation to the current climate happened back in 2019. The Fed made multiple dramatic interest rate cuts and short-term lending rates dropped butsuit, mostly due to economic growth expectations and fluctuations in the 10-year treasury bond yield. Another example is the 2008 financial crisis, when the Fed cut rates so aggressively they were almost at zero, but mortgage rates still didn’t fall and that had to do with the housing market crisis and lender’s concerns about credit risk.

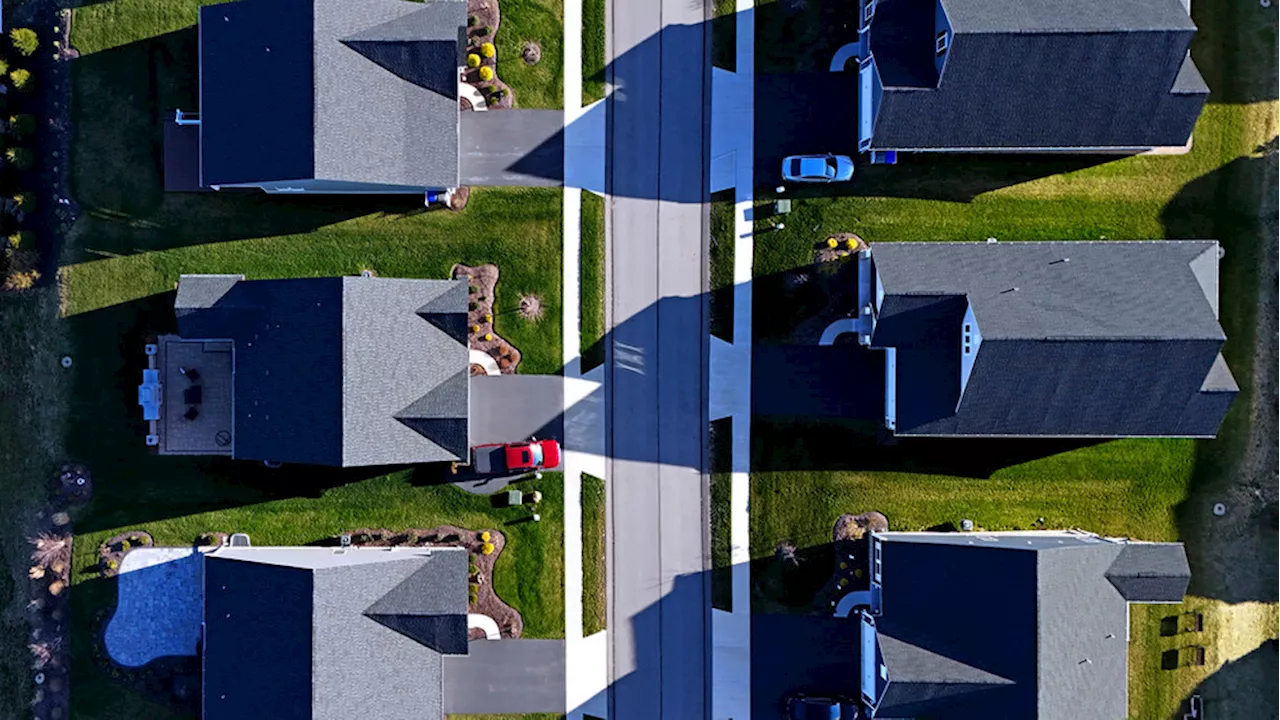

potential buyers are being priced out and homeowners aren't willing to let go of the low interest rates they got in 2020 and 2021, causing a stagnation in the housing market.found just 2.5% of U.S. homes changed hands this year, which is the lowest rate in decades. Experts say the Fed is supposed to make another rate cut in November, but we shouldn’t expect mortgage rates to drop by much.we’ll likely see rates drop in 2025, but not back to those record lows we saw a few years ago.

Real Estate Mortgage Rates Federal Reserve Interest Rates Housing Market Economic Growth

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Mortgage Rates Could Rise After Federal Reserve's CutDespite the Federal Reserve's interest rate cut, mortgage rates may not see significant drops. Experts predict a potential rise before further decline.

Mortgage Rates Could Rise After Federal Reserve's CutDespite the Federal Reserve's interest rate cut, mortgage rates may not see significant drops. Experts predict a potential rise before further decline.

Read more »

Auto sales still lag despite Federal Reserve interest rate cutsSAN ANTONIO- The federal reserve may have cut interest rates by half a percent, but that might not be enough to get an avalanche of car buyers into local dealer

Auto sales still lag despite Federal Reserve interest rate cutsSAN ANTONIO- The federal reserve may have cut interest rates by half a percent, but that might not be enough to get an avalanche of car buyers into local dealer

Read more »

How closely do mortgage interest rates tend to follow the Fed's rate decisions?The Federal Reserve doesn't set mortgage rates, but its interest rate decisions may influence them.

How closely do mortgage interest rates tend to follow the Fed's rate decisions?The Federal Reserve doesn't set mortgage rates, but its interest rate decisions may influence them.

Read more »

Will Mortgage Rates Drop in October Without a Fed Meeting?The Federal Reserve recently cut interest rates, sparking hope for lower mortgage rates. While experts acknowledge the Fed's influence on borrowing costs, they emphasize that mortgage rates are not directly tied to the federal funds rate and can fluctuate independently. Despite the absence of a Fed meeting in October, some predict continued declines in mortgage rates.

Will Mortgage Rates Drop in October Without a Fed Meeting?The Federal Reserve recently cut interest rates, sparking hope for lower mortgage rates. While experts acknowledge the Fed's influence on borrowing costs, they emphasize that mortgage rates are not directly tied to the federal funds rate and can fluctuate independently. Despite the absence of a Fed meeting in October, some predict continued declines in mortgage rates.

Read more »

New home sales fell 4.7% in August despite mortgage rates coming downPolitical News and Conservative Analysis About Congress, the President, and the Federal Government

New home sales fell 4.7% in August despite mortgage rates coming downPolitical News and Conservative Analysis About Congress, the President, and the Federal Government

Read more »

Housing market's struggles continue despite lower interest rates for a mortgageThe housing market’s struggles continued last month as sales dipped in August with higher mortgage rates and expensive asking prices limiting sales.

Housing market's struggles continue despite lower interest rates for a mortgageThe housing market’s struggles continued last month as sales dipped in August with higher mortgage rates and expensive asking prices limiting sales.

Read more »