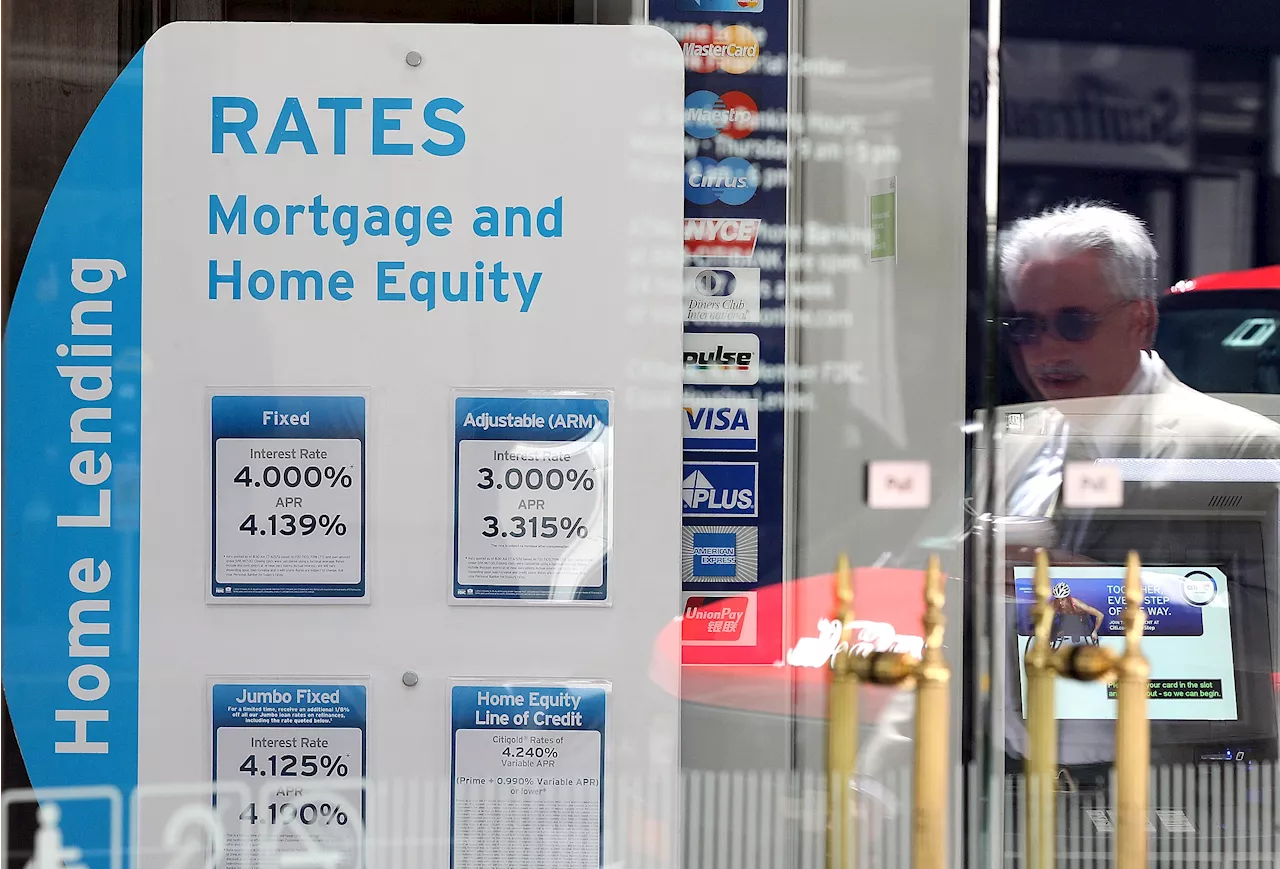

With home prices expected to rise in 2024, buyers might want to bite the bullet on higher mortgage rates and buy a home now, experts say.

But if you're trying to decide between buying now or waiting, remember that there's no guarantee that rates or home prices will get cheaper in 2024.Worse yet for buyers, mortgage rates could keep rising for the rest of 2023.

Buyers have some agency when first purchasing a home though. With the real estate market softening due to high mortgage rates in late 2022 and early 2023, home prices have become"negotiable, even if they are not posted as such online," says Erin Sykes, chief economist at Nest Seekers International.These price increases reflect a chronic lack of supply, as the U.S. has a deficit of about 3.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bankers See Mortgage Costs Tumbling Next YearMortgage lenders anticipate rates will fall in 2024 and the price of homes will remain high.

Bankers See Mortgage Costs Tumbling Next YearMortgage lenders anticipate rates will fall in 2024 and the price of homes will remain high.

Read more »

DC Reveals First Look at DC Power 2024 AnthologyDC Power 2024 will be available on January 30, 2024.

DC Reveals First Look at DC Power 2024 AnthologyDC Power 2024 will be available on January 30, 2024.

Read more »

FOMC to first cut rates in Q3 2024FOMC could cut rates in Q3 2024 if unfolding trends hold, according to economists at ANZ Bank. Policy is now restrictive enough to get inflation back

FOMC to first cut rates in Q3 2024FOMC could cut rates in Q3 2024 if unfolding trends hold, according to economists at ANZ Bank. Policy is now restrictive enough to get inflation back

Read more »

BTC price models hint at $130K target after 2024 Bitcoin halvingThe latest readings from several BTC price models demand Bitcoin hit $130,000 by late 2025 after its next halving.

BTC price models hint at $130K target after 2024 Bitcoin halvingThe latest readings from several BTC price models demand Bitcoin hit $130,000 by late 2025 after its next halving.

Read more »

2024 Nissan Leaf Eligible For $3,750 Tax Credit, Reducing Starting Price To $24,390The 2024 Nissan Leaf meets the battery component requirements of the Inflation Reduction Act

2024 Nissan Leaf Eligible For $3,750 Tax Credit, Reducing Starting Price To $24,390The 2024 Nissan Leaf meets the battery component requirements of the Inflation Reduction Act

Read more »

2024 Lexus RC adds a color, a wheel, and $100 to the priceGet in-depth info on the 2023 Lexus RC F including prices, specs, reviews, options, safety and reliability ratings.

2024 Lexus RC adds a color, a wheel, and $100 to the priceGet in-depth info on the 2023 Lexus RC F including prices, specs, reviews, options, safety and reliability ratings.

Read more »