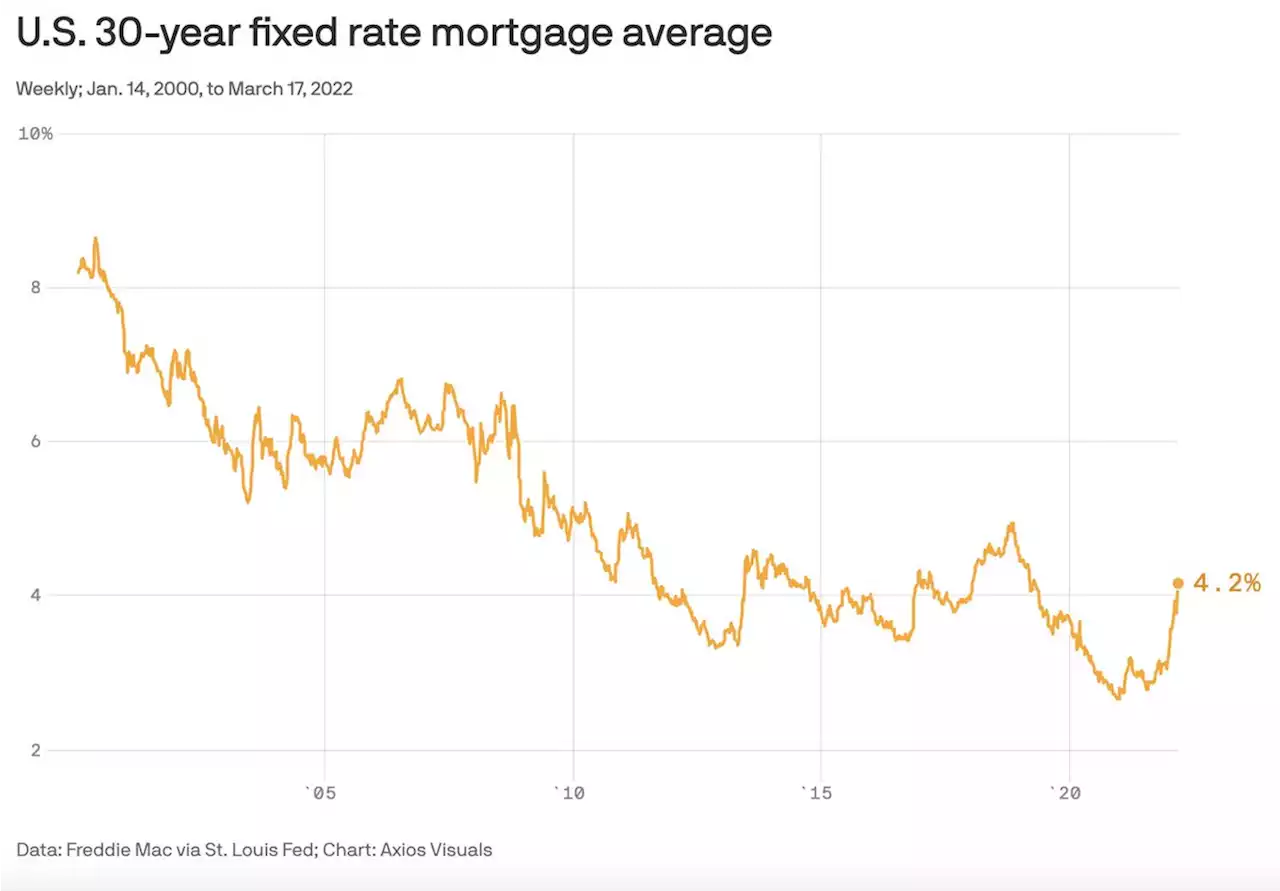

With rates at their highest point since 2019, some buyers are turning to adjustable-rate mortgages for affordability.

Looking at the math, that means a buyer who puts 10% down on a $400,000 home and finances the remainder with a 30-year loan at today's rates will have a monthly payment of $1,752. But the initial rate on a 5/1-year ARM would be $1,555 — a savings of about $2,400 annually.

The resurgence in interest in ARMs may raise questions about whether the housing market is echoing some of the trends of 2006, when home prices surged as buyers snapped up properties and lenders opened their wallets to provide loans. But financial experts say there are some differences between today's pandemic housing boom and 2006, such as banks' stricter lending standards.

on Thursday. Since year-start, about 6.3 million households have been pushed out of the home-buying market, including 2 million millennial buyers, NAR said. NAR said it expects rates will climb even higher, ending the year at 4.3%. Lending standards are stricter today than during the 2006 housing bubble, Rugg noted. In the housing run-up more than a decade ago, some lenders handed out so-calledor mortgages that required little or no documentation of income.

"Banks will make sure you qualify for that, and there are caps on rate changes," noted Melissa Cohn, the regional vice president of William Raveis Mortgage."It's a whole different marketplace."

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Mortgage rates top 4% in U.S. for first time since 2019At the current 30-year average, the monthly payment on a $300,000 loan would be $1,460.

Mortgage rates top 4% in U.S. for first time since 2019At the current 30-year average, the monthly payment on a $300,000 loan would be $1,460.

Read more »

Mortgage rates rise above 4% for the first time since 2019Mortgage rates climbed past 4% for the first time since May 2019. The 30-year fixed-rate mortgage averaged 4.16% in the week ending March 17, up from 3.85% the week before, according to Freddie Mac.

Mortgage rates rise above 4% for the first time since 2019Mortgage rates climbed past 4% for the first time since May 2019. The 30-year fixed-rate mortgage averaged 4.16% in the week ending March 17, up from 3.85% the week before, according to Freddie Mac.

Read more »

San Antonio's USAA Bank hit with $140 million fine, its third federal penalty since 2019Regulators said the bank failed to report thousands of suspicious financial transactions by customers. SanAntonio SATX SanAntonioTX usaa Veterans Military Banking Finance

San Antonio's USAA Bank hit with $140 million fine, its third federal penalty since 2019Regulators said the bank failed to report thousands of suspicious financial transactions by customers. SanAntonio SATX SanAntonioTX usaa Veterans Military Banking Finance

Read more »

Mortgage rates are over 4%The last time it happened, the median price for a home was just $277,000

Mortgage rates are over 4%The last time it happened, the median price for a home was just $277,000

Read more »

Mortgage rates rise above 4% for the first time since 2019Mortgage rates climbed past 4% for the first time since May 2019. The 30-year fixed-rate mortgage averaged 4.16% in the week ending March 17, up from 3.85% the week before, according to Freddie Mac.

Mortgage rates rise above 4% for the first time since 2019Mortgage rates climbed past 4% for the first time since May 2019. The 30-year fixed-rate mortgage averaged 4.16% in the week ending March 17, up from 3.85% the week before, according to Freddie Mac.

Read more »

Here's what the Fed's rate hike means for borrowers, savers and homeownersAfter holding rates near rock bottom for two years, the Fed is finally boosting its benchmark. Here's what that means for you.

Here's what the Fed's rate hike means for borrowers, savers and homeownersAfter holding rates near rock bottom for two years, the Fed is finally boosting its benchmark. Here's what that means for you.

Read more »