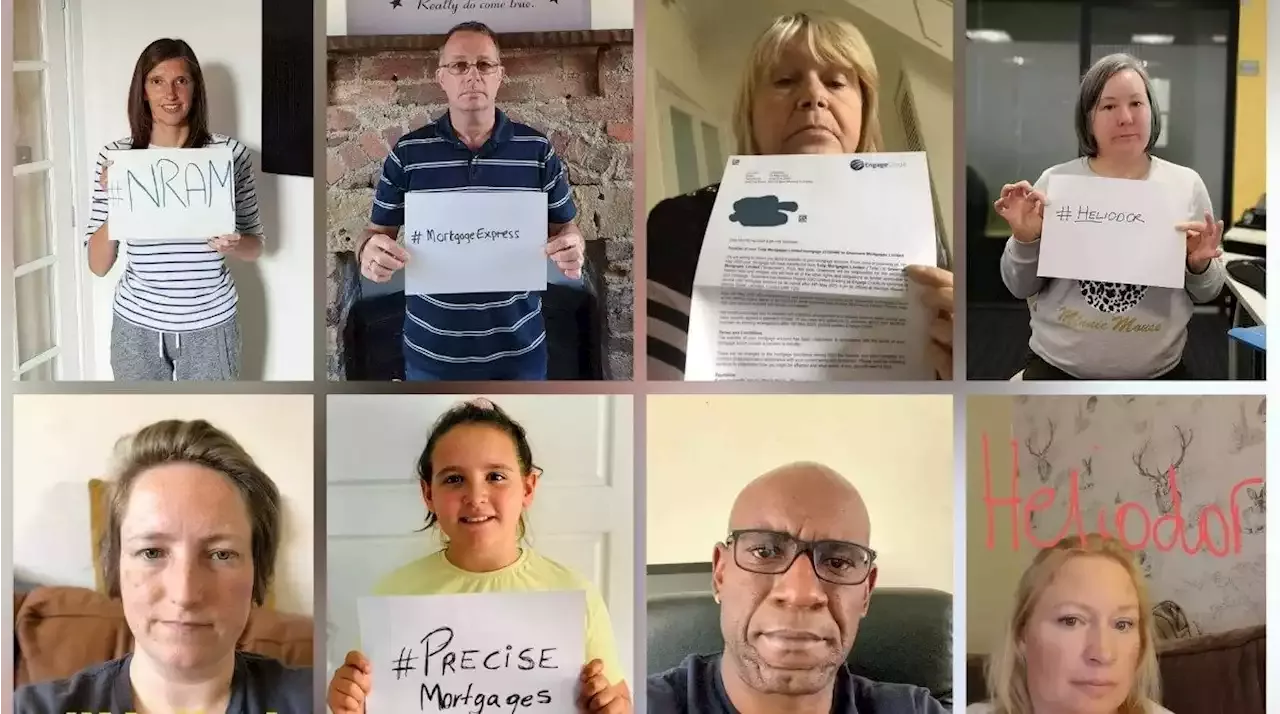

A full-time carer has revealed he is now relying on charities to get by after his mortgage payments soar from £400 a month to £970 Lee Sapsford is part of the mortgageprison campaign group, which has almost 200,000 members in a similar position

Lee Sapsford, 51, has an interest-only mortgage for his semi-detached home in Essex which he bought with his wife Lucy, 50, in 2007 for £150,000. Their current outstanding balance is £154,000.

The couple usually rely on charities to pay their £970-a-month mortgage. They are currently on a three-month mortgage holiday – an agreement you might be able to make with your lender that allows you temporarily to stop or reduce your monthly mortgage – which caps their payments at £400.“I don’t know what we’ll do,” Mr Sapsford told. “I’m £300 short really. There’s another charity I’m thinking of asking to help us but it isn’t guaranteed.

When they took out their loan in 2007 it was with Southern Pacific Mortgage Loans, owned by the US investment bank Lehman Brothers, which went bust during the 2008 financial crisis.” who took out unfavourable high-interest or interest-only mortgages with lenders before the 2008 global financial crisis or shortly afterwards – before lending restrictions were tightened.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

When the next £300 DWP cost of living payment is dueTo those who are eligible, the DWP is preparing to issue its next cost of living payment in the autumn which will hopefully go some way to helping those continuing to face financial pressure

Read more »

Three large UK lenders cut mortgage rates\n\t\t\tKeep abreast of significant corporate, financial and political developments around the world.\n\t\t\tStay informed and spot emerging risks and opportunities with independent global reporting, expert\n\t\t\tcommentary and analysis you can trust.\n\t\t

Read more »

More big lenders join major banks in dropping mortgage rates as competition returns to marketMore mortgage lenders have announced cuts to their fixed rate deals in the latest signal that the market may be improving for borrowers CallumCMason reports:

More big lenders join major banks in dropping mortgage rates as competition returns to marketMore mortgage lenders have announced cuts to their fixed rate deals in the latest signal that the market may be improving for borrowers CallumCMason reports:

Read more »

London house moves driven by need - estate agentThe majority of people moving in London are either downsizing or leaving their local area altogether.

London house moves driven by need - estate agentThe majority of people moving in London are either downsizing or leaving their local area altogether.

Read more »

Cabinet Minister Backs Lee Anderson Over 'F*** Off Back To France' Migrants JibeJustice secretary Alex Chalk said the comment was 'not bigotry at all'.

Cabinet Minister Backs Lee Anderson Over 'F*** Off Back To France' Migrants JibeJustice secretary Alex Chalk said the comment was 'not bigotry at all'.

Read more »