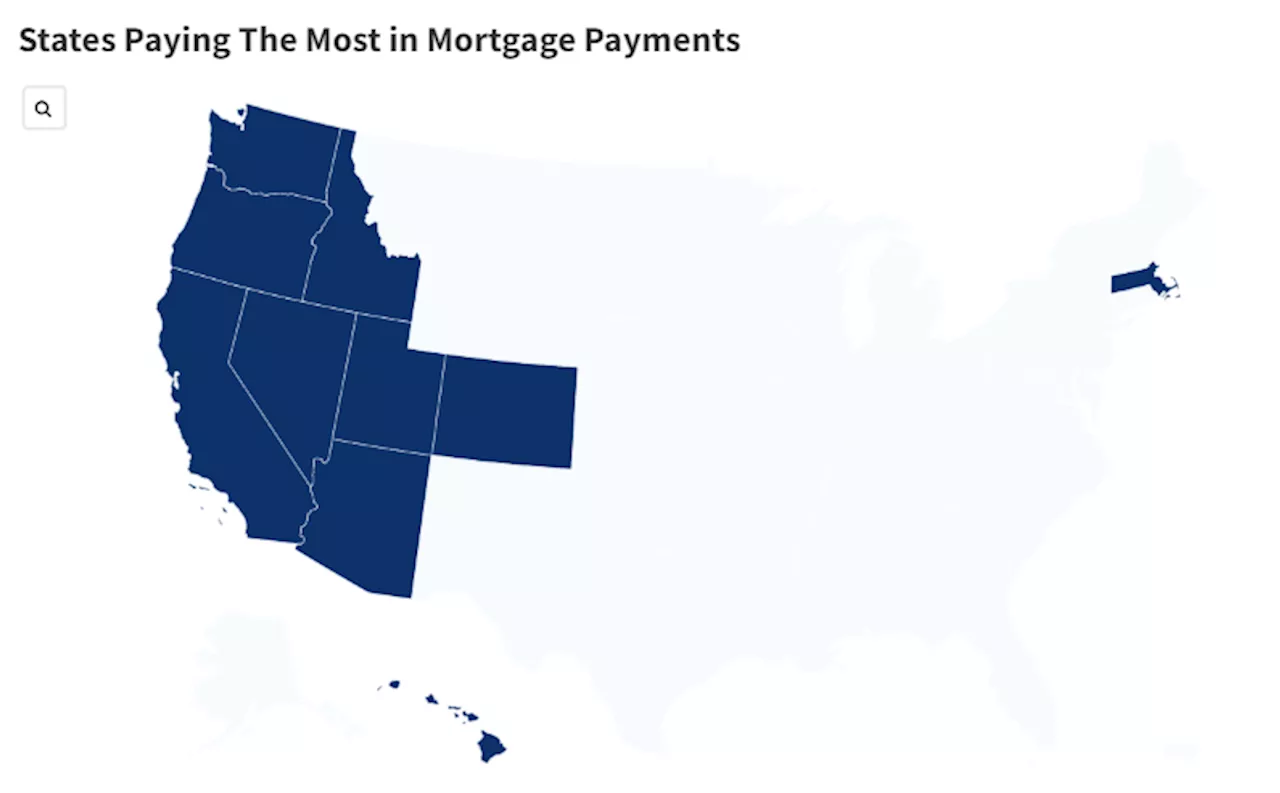

A new report highlights the stark differences in mortgage payments across the US, revealing an affordability crisis driven by high interest rates and elevated housing costs. The study identifies states with the highest mortgage burdens, often located in desirable areas with limited supply. Experts discuss the factors contributing to this crisis, including housing shortages, population influx, and investor activity. The report raises concerns about the long-term affordability of homeownership for many Americans.

Mortgage payments continue to be a burden for many Americans due to stubbornly high interest rates. Thirty-year fixed-rate mortgages have remained in the high 6 percent range, making homeownership a distant dream for millions. A new report by business accounting firm Avenues Financial reveals that the exact amount you pay for your mortgage can vary significantly depending on your location.

According to Zillow, the average interest rate on a 30-year fixed-rate mortgage rose seven basis points to 6.981 percent on Tuesday, while the average rate on a 15-year fixed-rate mortgage dropped two basis points to 6.06 percent. These rates contribute to the affordability crisis, pushing homeownership further out of reach.Avenues Financial analyzed data from the Bureau of Economic Analysis and the U.S. Census American Community Survey to determine the percentage of median income Americans allocate towards their mortgage payments. The study identified some states with the highest mortgage costs: Hawaii, California, Utah, Oregon, Idaho, Washington, Colorado, Nevada, Massachusetts, and Arizona. Hawaii homeowners, for example, spend an average of $4,638 per month on their mortgages, representing 95 percent of their median income. In California, the average monthly payment is $3,977, or 69 percent of the median income. Utah residents pay an average of $2,837, which is 60.7 percent of their median income.Experts offer various insights into the reasons behind these high costs. Nicole Jensen, CPA, points out that even though rental figures in most states with high median rental payments when compared to income are only slightly higher than the recommended 30 percent, lower-income renters may still find rentals unaffordable. Alex Beene, a financial literacy instructor at the University of Tennessee at Martin, observes a pattern of high mortgage payments in states near the West Coast, attributing it to desirable locations and an influx of new residents. Kevin Thompson, a finance expert and founder of 9i Capital, highlights housing shortages in states like Hawaii, California, and Massachusetts as a contributing factor. Alan Chang, a title and escrow expert, notes the popularity of Idaho as a destination for remote workers, driving up housing costs. Lawrence Yun, NAR Chief Economist and Senior Vice President of Research, emphasizes the role of local income and persistently high home prices in states like California and Hawaii.Looking ahead, the high cost of housing, coupled with increasing insurance costs, continues to pose a significant challenge for affordability. Thompson warns that high mortgage rates and limited inventory exacerbate the situation, making it increasingly difficult for first-time buyers to enter the market. There is growing discussion about potential government intervention to address the issue of large-scale investor purchases, which have further tightened supply and driven up prices.

Mortgage Payments Affordability Crisis High Interest Rates Housing Costs Homeownership West Coast Rental Market Government Intervention

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bill Cosby Faces Foreclosure on Manhattan Mansion Over $16 Million in Delinquent Mortgage PaymentsDisgraced comedian Bill Cosby and his wife, Camille, are facing foreclosure on their Upper East Side mansion due to a defaulted mortgage. Court records reveal that the couple owes over $16 million in principal, interest, and late charges on a $17.5 million loan. This is not the first time they have missed mortgage payments, with previous defaults in 2023.

Bill Cosby Faces Foreclosure on Manhattan Mansion Over $16 Million in Delinquent Mortgage PaymentsDisgraced comedian Bill Cosby and his wife, Camille, are facing foreclosure on their Upper East Side mansion due to a defaulted mortgage. Court records reveal that the couple owes over $16 million in principal, interest, and late charges on a $17.5 million loan. This is not the first time they have missed mortgage payments, with previous defaults in 2023.

Read more »

5 Ways to Save on Your Mortgage Payments This January, According to ExpertsThe mortgage scene is unpredictable right now, with rates significantly higher than the pandemic lows. This article outlines five strategies from leading mortgage professionals to reduce monthly payments in 2025, starting this January.

5 Ways to Save on Your Mortgage Payments This January, According to ExpertsThe mortgage scene is unpredictable right now, with rates significantly higher than the pandemic lows. This article outlines five strategies from leading mortgage professionals to reduce monthly payments in 2025, starting this January.

Read more »

California Homeowners Delaying Mortgage Payments Could See Huge Increase in BillsCalifornia homeowners delaying mortgage payments due to wildfires face increased bills as forbearance ends.

California Homeowners Delaying Mortgage Payments Could See Huge Increase in BillsCalifornia homeowners delaying mortgage payments due to wildfires face increased bills as forbearance ends.

Read more »

Mortgage Rates Remain High Despite Fed Rate CutsMortgage rates have defied expectations and climbed higher despite the Federal Reserve's aggressive rate cuts aimed at stimulating the economy. Experts explain the factors driving this trend, including the bond market's influence, lingering inflation concerns, and global economic uncertainty. They offer insights into the potential future trajectory of mortgage rates and advise borrowers to exercise patience.

Mortgage Rates Remain High Despite Fed Rate CutsMortgage rates have defied expectations and climbed higher despite the Federal Reserve's aggressive rate cuts aimed at stimulating the economy. Experts explain the factors driving this trend, including the bond market's influence, lingering inflation concerns, and global economic uncertainty. They offer insights into the potential future trajectory of mortgage rates and advise borrowers to exercise patience.

Read more »

Thailand Eyes Digital Asset Payments for Tourists, but Challenges RemainThailand's finance minister, Pichai Chunhavajira, expressed optimism about wider digital asset adoption but acknowledged the country's unpreparedness. He proposed allowing tourists to use local exchanges for property purchases, highlighting a potential pilot program in Phuket. However, hurdles include limited access for foreigners to local payment platforms, new tax reforms, and a market shifting towards institutional focus.

Thailand Eyes Digital Asset Payments for Tourists, but Challenges RemainThailand's finance minister, Pichai Chunhavajira, expressed optimism about wider digital asset adoption but acknowledged the country's unpreparedness. He proposed allowing tourists to use local exchanges for property purchases, highlighting a potential pilot program in Phuket. However, hurdles include limited access for foreigners to local payment platforms, new tax reforms, and a market shifting towards institutional focus.

Read more »

Mortgage Rates Surge, Dampening Demand in DecemberRising mortgage interest rates at the end of December contributed to a significant decline in mortgage application volume, particularly in the traditionally slower housing market season. The average 30-year fixed-rate mortgage rate increased to 6.97% from 6.89%, according to the Mortgage Bankers Association (MBA).

Mortgage Rates Surge, Dampening Demand in DecemberRising mortgage interest rates at the end of December contributed to a significant decline in mortgage application volume, particularly in the traditionally slower housing market season. The average 30-year fixed-rate mortgage rate increased to 6.97% from 6.89%, according to the Mortgage Bankers Association (MBA).

Read more »