Mortgage demand continues to drop as interest rates climb higher.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances increased to 6.91% last week from 6.69% the previous week.

Real estate agents Rosa Arrigo, center, and Elisa Rosen, right, work an open house in West Hempstead, New York.Mortgage rates shot higher last week, as stronger economic data stoked more fear that the Federal Reserve will not lower interest rates anytime soon. In turn, mortgage demand dropped to the lowest level since the end of February.

As a result, mortgage applications to refinance a home loan, which are most sensitive to rate changes, decreased by 7% last week from the previous week, seasonally adjusted. Application volume was 45% lower than the same week one year ago.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Today’s mortgage rates for May 30, 2023Looking for the most up-to-date mortgage rates to empower your purchasing or refinancing decisions? We’ve got you covered

Today’s mortgage rates for May 30, 2023Looking for the most up-to-date mortgage rates to empower your purchasing or refinancing decisions? We’ve got you covered

Read more »

Mortgage rate lock: What it is and when to lockWhile interest rates change all the time, a mortgage rate lock ensures the rate on your mortgage stays the same, from the initial quote to closing.

Mortgage rate lock: What it is and when to lockWhile interest rates change all the time, a mortgage rate lock ensures the rate on your mortgage stays the same, from the initial quote to closing.

Read more »

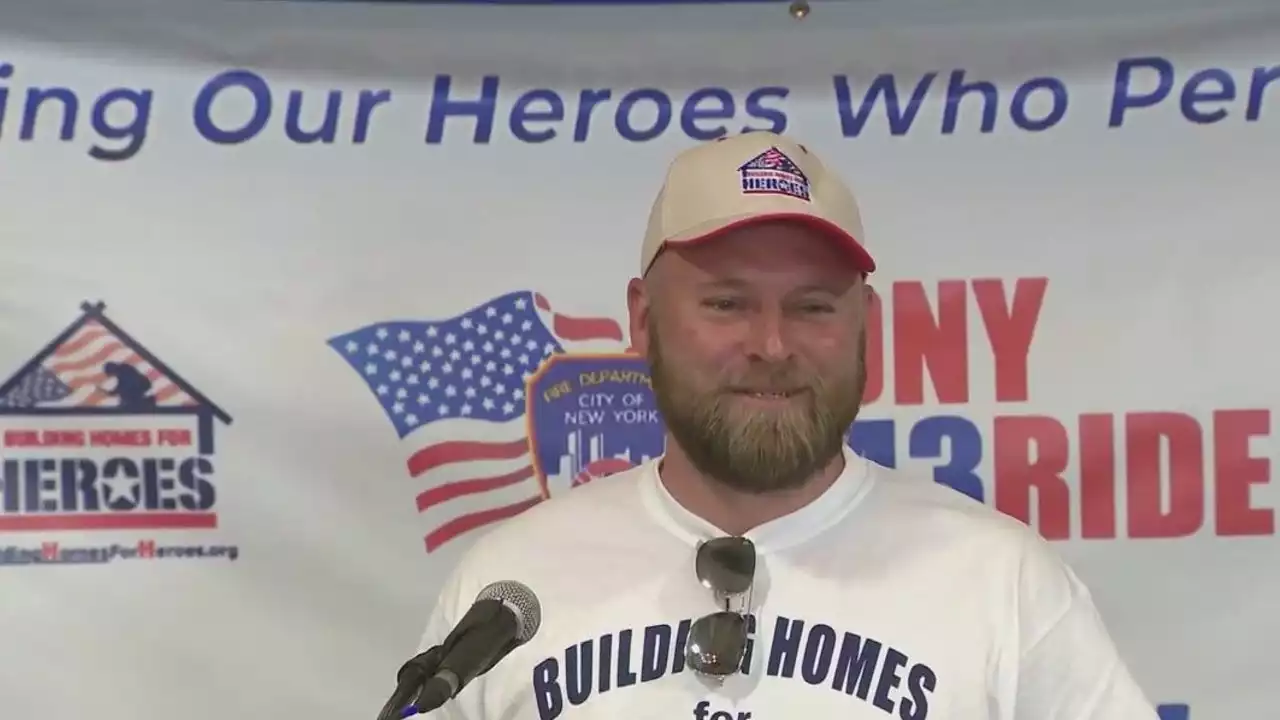

Injured veteran receives mortgage-free Connecticut home for his serviceRetired U.S. Army Specialist Evan Marcy, the son of a 9/11 first responder, was injured while on deployment in Afghanistan in 2009.

Injured veteran receives mortgage-free Connecticut home for his serviceRetired U.S. Army Specialist Evan Marcy, the son of a 9/11 first responder, was injured while on deployment in Afghanistan in 2009.

Read more »

Bronx native Army veteran Evan Marcy to receive mortgage-free home from Building Homes for HeroesA hero who fought for this country, made painful personal sacrifices and, along the way, earned a Purple Heart and other honors will receive a heartwarming gift. DaveCarlinTV has the story from the Morrisania section of the Bronx.

Bronx native Army veteran Evan Marcy to receive mortgage-free home from Building Homes for HeroesA hero who fought for this country, made painful personal sacrifices and, along the way, earned a Purple Heart and other honors will receive a heartwarming gift. DaveCarlinTV has the story from the Morrisania section of the Bronx.

Read more »

Today’s lowest mortgage rate? 10- and 15-year terms | May 30, 2023Borrowers should take advantage of the lower interest rates of today’s short-term loans before likely future increases.

Today’s lowest mortgage rate? 10- and 15-year terms | May 30, 2023Borrowers should take advantage of the lower interest rates of today’s short-term loans before likely future increases.

Read more »

Home prices jump again in March amid low supply, competitive marketU.S. home prices climbed again in March, suggesting the housing market is stabilizing amid high mortgage rates, limited inventory and steep competition.

Home prices jump again in March amid low supply, competitive marketU.S. home prices climbed again in March, suggesting the housing market is stabilizing amid high mortgage rates, limited inventory and steep competition.

Read more »