A look at the day ahead in European and global markets from Wayne Cole.

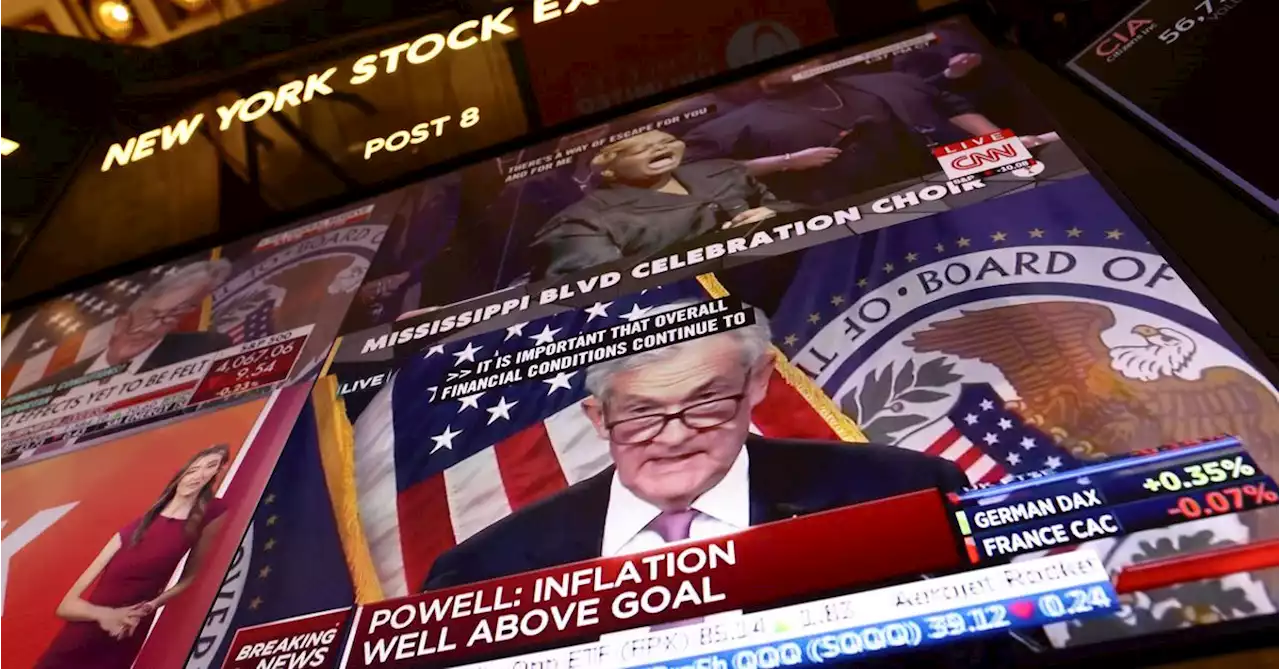

Wall Street must be hoping Federal Reserve Chair Jerome Powell would speak in public every day. Given a chance to react hawkishly to the bumper January payrolls report, Powell demurred and chose to stay boringly balanced on the rate outlook., he would do the same again.

He reiterated the "disinflationary process" was under way, but it would likely take a "significant" period of time and if the data kept coming in stronger than expected, the Fed would have to do more on rates. Hardly earth shattering stuff, but for markets these days if Powell is not all-out in-your-face hawkish, then he's dovish. There's no middle ground. Wall Street duly rallied while Treasury yields and the dollar have eased a little, with futures priced for just two more hikes to 5.0-5.25%.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Morning Bid: Market to ChatGPT: what's Powell gotta say?A look at the day ahead in European and global markets from Ankur Banerjee

Morning Bid: Market to ChatGPT: what's Powell gotta say?A look at the day ahead in European and global markets from Ankur Banerjee

Read more »

Morning Bid: Powell's state of the unionA look at the day ahead in U.S. and global markets from Mike Dolan.

Morning Bid: Powell's state of the unionA look at the day ahead in U.S. and global markets from Mike Dolan.

Read more »

Morning Bid: Powell has spoken: bullish or bearish?A look at the day ahead in Asian markets from Jamie McGeever.

Morning Bid: Powell has spoken: bullish or bearish?A look at the day ahead in Asian markets from Jamie McGeever.

Read more »

Morning Bid: Hot airA look at the day ahead in European and global markets from Anshuman Daga

Morning Bid: Hot airA look at the day ahead in European and global markets from Anshuman Daga

Read more »

Morning Bid: Rates start to biteA look at the day ahead in Asian markets from Jamie McGeever.

Morning Bid: Rates start to biteA look at the day ahead in Asian markets from Jamie McGeever.

Read more »

USD/CAD rebounds firmly from 1.3400 as anxiety soars ahead of Fed Powell/BoC Macklem speechUSD/CAD has sensed buying interest after a drop to near the round-level support at 1.3400 in the early European session. The Loonie asset has recovere

USD/CAD rebounds firmly from 1.3400 as anxiety soars ahead of Fed Powell/BoC Macklem speechUSD/CAD has sensed buying interest after a drop to near the round-level support at 1.3400 in the early European session. The Loonie asset has recovere

Read more »