For the first time in a while, MicroStrategy, the largest corporate Bitcoin holder, has refrained from buying or trading Bitcoin. This unexpected move has sparked speculation and debate within the crypto community.

MicroStrategy, the largest corporate holder of Bitcoin (BTC), has made a surprising move that has sent ripples through the cryptocurrency community. For the first time in a while, MicroStrategy refrained from buying or trading Bitcoin last week. This unexpected development has left many investors puzzled, given the company's longstanding pattern of accumulating Bitcoin.

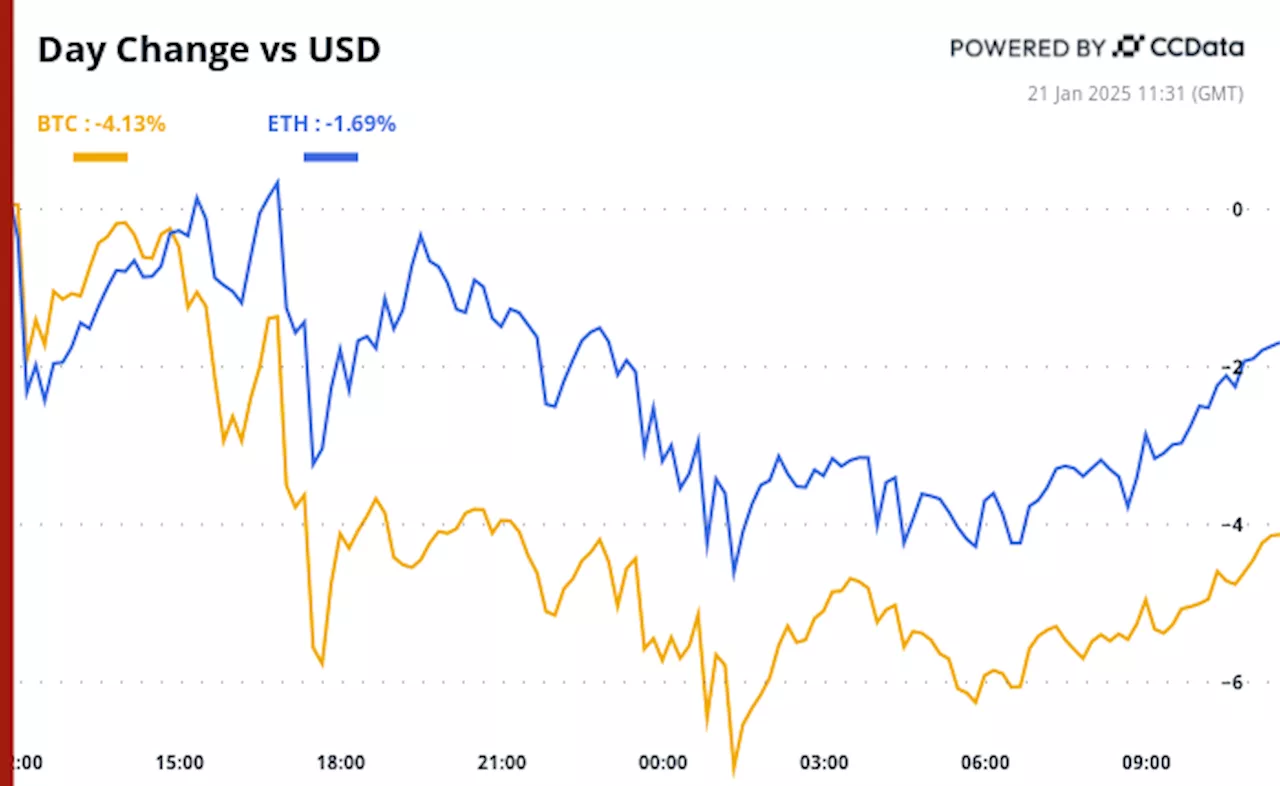

Michael Saylor, CEO of MicroStrategy, shed light on this decision, stating that the company opted not to sell any shares of its class A common stock under its at-the-market equity offering program. MicroStrategy has been utilizing this program since the first quarter of 2024 to sell shares of its MSTR stock at market price, raising capital. Saylor clarified that unlike previous weeks, MicroStrategy also chose not to purchase additional Bitcoin for its holdings. Since August 2020, when the company embraced digital assets, MicroStrategy has been on an aggressive Bitcoin accumulation spree. Therefore, this decision to hold back on buying more Bitcoin, particularly during a price dip, is significant and has sparked considerable interest among investors.As of February 2, 2025, MicroStrategy's Bitcoin stash stands at an impressive 471,107 BTC. The cumulative cost of this acquisition amounts to approximately $30.4 billion, acquired at an average price of $64,511 per BTC. Saylor's update has generated mixed reactions within the crypto community. Some view it favorably, praising MicroStrategy's transparency and commitment to holding Bitcoin. Others, however, argue that the company's actions might reflect a bearish sentiment towards Bitcoin, especially considering the recent price volatility. They wonder why, with a dip in Bitcoin's price, the largest accumulator of the digital asset chose to remain inactive. Bitcoin has been exhibiting fluctuating price movements, dipping as low as $91,242.89 in early trading hours. However, it quickly recovered and surged to $99,397.65, with many market participants expecting it to once again breach the $100,000 level.

MICROSTRATEGY BITCOIN CRYPTOCURRENCY INVESTING MICHAEL SAYLOR WEB3

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Crypto Daybook Americas: Bitcoin (BTC) Defends $100K as MicroStrategy Weighs Share IncreaseThe day ahead in crypto: Jan. 21, 2025

Crypto Daybook Americas: Bitcoin (BTC) Defends $100K as MicroStrategy Weighs Share IncreaseThe day ahead in crypto: Jan. 21, 2025

Read more »

MicroStrategy Grabs Another $1.1 Billion Bitcoin as Crypto Market Tremors From AI DisruptionMicroStrategy continues its Bitcoin buying spree, acquiring $1.1 billion worth, marking its 12th consecutive purchase. Bitcoin price dips over 5% as the crypto market reacts to DeepSeek's open-source AI model, impacting tech giants like Nvidia and Microsoft.

MicroStrategy Grabs Another $1.1 Billion Bitcoin as Crypto Market Tremors From AI DisruptionMicroStrategy continues its Bitcoin buying spree, acquiring $1.1 billion worth, marking its 12th consecutive purchase. Bitcoin price dips over 5% as the crypto market reacts to DeepSeek's open-source AI model, impacting tech giants like Nvidia and Microsoft.

Read more »

MicroStrategy's Bitcoin Gambit: A Masterclass in Crypto ManiaThis article delves into Michael Saylor's audacious strategy with MicroStrategy, positioning the company as a frontrunner in harnessing the power of bitcoin volatility. It explores how Saylor's company has become a beacon for both traditional finance and the fervent bitcoin community, leveraging the cryptocurrency's fluctuations to fuel its explosive growth.

MicroStrategy's Bitcoin Gambit: A Masterclass in Crypto ManiaThis article delves into Michael Saylor's audacious strategy with MicroStrategy, positioning the company as a frontrunner in harnessing the power of bitcoin volatility. It explores how Saylor's company has become a beacon for both traditional finance and the fervent bitcoin community, leveraging the cryptocurrency's fluctuations to fuel its explosive growth.

Read more »

Trump's Crypto Agenda: Bitcoin Surge, Regulatory Promises, and a 'Crypto Ball'Bitcoin skyrockets as the cryptocurrency community eagerly awaits Donald Trump's policies. Trump, once skeptical, has embraced cryptocurrencies, promising to make the U.S. the 'crypto capital' of the world. He plans to establish a crypto advisory council, create a strategic bitcoin reserve, and enact regulations favorable to the industry.

Trump's Crypto Agenda: Bitcoin Surge, Regulatory Promises, and a 'Crypto Ball'Bitcoin skyrockets as the cryptocurrency community eagerly awaits Donald Trump's policies. Trump, once skeptical, has embraced cryptocurrencies, promising to make the U.S. the 'crypto capital' of the world. He plans to establish a crypto advisory council, create a strategic bitcoin reserve, and enact regulations favorable to the industry.

Read more »

Crypto Daybook Americas: Crypto Daybook Americas: Bitcoin (BTC) Rebounds as DeepSeek Concerns Wane, AI Tokens RegroupThe day ahead in crypto: Jan. 28, 2025

Crypto Daybook Americas: Crypto Daybook Americas: Bitcoin (BTC) Rebounds as DeepSeek Concerns Wane, AI Tokens RegroupThe day ahead in crypto: Jan. 28, 2025

Read more »

MicroStrategy's $1.1 Billion Bitcoin Purchase Sends Price DownMicroStrategy, the world's largest corporate bitcoin holder, continues its buying spree, acquiring another 11,000 BTC for ~$1.1 billion. This latest purchase, made at ~$101,191 per bitcoin, brings MicroStrategy's total holdings to 461,000 BTC, valued at $29.3 billion. Interestingly, the announcement triggered a price drop for bitcoin, a recurring pattern following MicroStrategy's previous purchases. Despite the immediate dip, bitcoin has historically recovered within days.

MicroStrategy's $1.1 Billion Bitcoin Purchase Sends Price DownMicroStrategy, the world's largest corporate bitcoin holder, continues its buying spree, acquiring another 11,000 BTC for ~$1.1 billion. This latest purchase, made at ~$101,191 per bitcoin, brings MicroStrategy's total holdings to 461,000 BTC, valued at $29.3 billion. Interestingly, the announcement triggered a price drop for bitcoin, a recurring pattern following MicroStrategy's previous purchases. Despite the immediate dip, bitcoin has historically recovered within days.

Read more »