A new report reveals that Americans earning the median income need to allocate 41.8% of their salary to purchase a median-priced home. This burden is even higher in certain cities, particularly in California, where some metros require upwards of 67% of income for homeownership. Factors like strict zoning laws, high construction costs, and strong job markets contribute to these affordability challenges.

Nationwide, Americans earning the median income need to spend 41.8% of their salary on housing to afford to own a median-priced home,. Redfin 's calculations assume a 6.72% mortgage rate and 15% down payment, and use household income data from the U.S. Census Bureau for 2023, adjusted for 2024 wage growth.And in certain metros, that burden is even higher.

Here's a closer look at each. Note that city rankings are based on the 50 largest U.S. metros, while national figures reflect the broader housing market through November 2024.Feeling out of the loop? We'll catch you up on the Chicago news you need to know. Sign up for the weekly, especially in its largest metros.

In contrast, Pittsburgh is the the most affordable metro, according to Redfin's data, with a median-priced home costing just 25.3% of the local median income. Expert instructors will teach you how to get started, practical uses, tips for effective prompt-writing and mistakes to avoid. Sign up now and use coupon code EARLYBIRD for an introductory discount of 30% off $67 Self-made millionaire: 3 money moves to avoid to build a successful relationship

Housing Affordability Median Income Homeownership California Real Estate Redfin

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

East Cleveland now has the lowest median family income in U.S.The lowest income in the United States for cities with a population of at least 5,000 is $37,500 and it can be found in Ohio.

East Cleveland now has the lowest median family income in U.S.The lowest income in the United States for cities with a population of at least 5,000 is $37,500 and it can be found in Ohio.

Read more »

Can Your Salary Handle the Cost of Living?This article examines the relationship between median income and the cost of living in the United States. It highlights that only a small percentage of the largest counties have median incomes sufficient to support a family of three after essential expenses. Despite high median incomes in some areas, families often have limited disposable income. The article discusses the trade-offs of living in high-cost areas versus locations with lower living expenses, considering factors like career opportunities and salary potential.

Can Your Salary Handle the Cost of Living?This article examines the relationship between median income and the cost of living in the United States. It highlights that only a small percentage of the largest counties have median incomes sufficient to support a family of three after essential expenses. Despite high median incomes in some areas, families often have limited disposable income. The article discusses the trade-offs of living in high-cost areas versus locations with lower living expenses, considering factors like career opportunities and salary potential.

Read more »

Massive Income Gap Widens Between Philadelphia's Wealthiest and Poorest NeighborhoodsNew Census Bureau data reveals a significant disparity in median household income between Philadelphia's wealthiest and poorest neighborhoods. While Fishtown/Northern Liberties enjoys a median income surpassing $113,000, areas like Fairhill and East Germantown struggle with incomes at least $100,000 lower. The report highlights a growing wealth gap, with some neighborhoods experiencing explosive income growth while others face stagnation or decline.

Massive Income Gap Widens Between Philadelphia's Wealthiest and Poorest NeighborhoodsNew Census Bureau data reveals a significant disparity in median household income between Philadelphia's wealthiest and poorest neighborhoods. While Fishtown/Northern Liberties enjoys a median income surpassing $113,000, areas like Fairhill and East Germantown struggle with incomes at least $100,000 lower. The report highlights a growing wealth gap, with some neighborhoods experiencing explosive income growth while others face stagnation or decline.

Read more »

Electric Car Range Surges: Median Reaches Record High of 283 MilesThe U.S. Department of Energy (DOE) reports that the median range for Model Year 2024 electric vehicles (EVs) has reached a record high of 283 miles per charge, a significant increase from previous years.

Electric Car Range Surges: Median Reaches Record High of 283 MilesThe U.S. Department of Energy (DOE) reports that the median range for Model Year 2024 electric vehicles (EVs) has reached a record high of 283 miles per charge, a significant increase from previous years.

Read more »

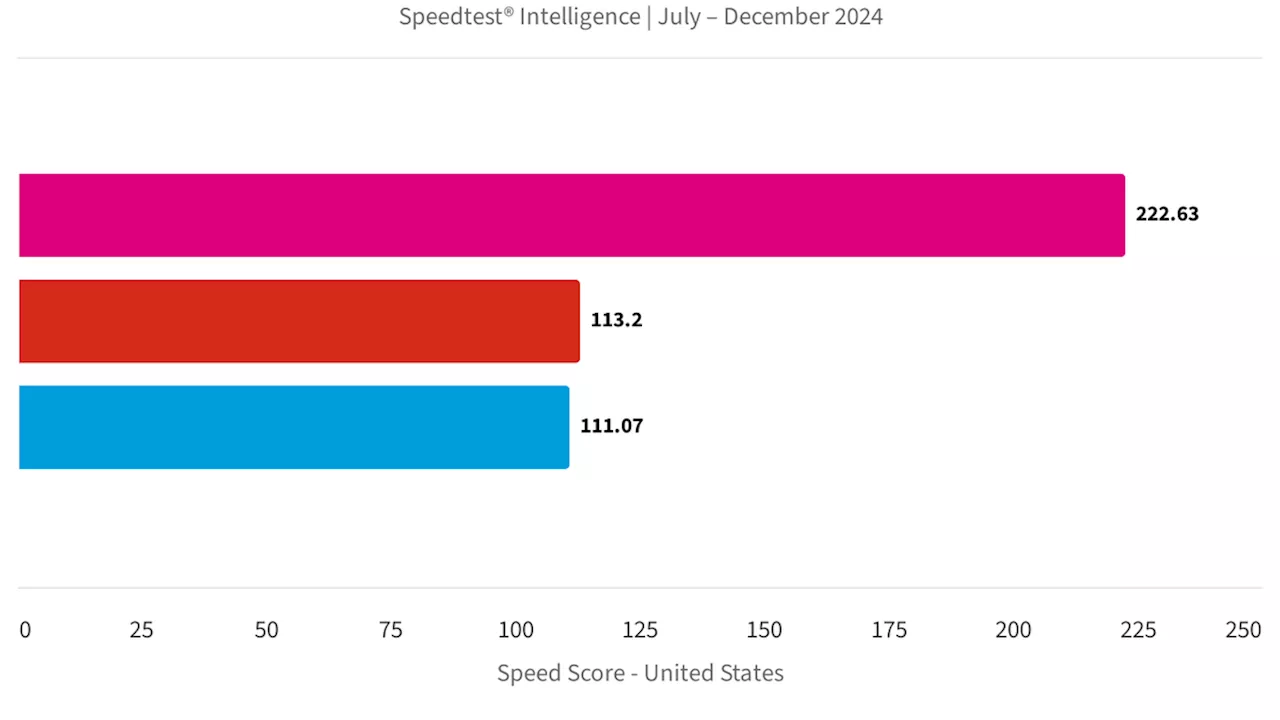

T-Mobile Remains Fastest US Carrier With a Median Download Speed of 212.77 MbpsT-Mobile continues to hold the title of the fastest carrier in the United States, achieving a median download speed of 212.77 Mbps. This speed advantage comes from its early investment in a 5G network bolstered by mid-band frequencies acquired through the Sprint merger. T-Mobile also boasts the lowest latency among major US carriers at 49 ms. The carrier excelled in 5G download speeds, thanks to the deployment of ultrafast mmWave technology.

T-Mobile Remains Fastest US Carrier With a Median Download Speed of 212.77 MbpsT-Mobile continues to hold the title of the fastest carrier in the United States, achieving a median download speed of 212.77 Mbps. This speed advantage comes from its early investment in a 5G network bolstered by mid-band frequencies acquired through the Sprint merger. T-Mobile also boasts the lowest latency among major US carriers at 49 ms. The carrier excelled in 5G download speeds, thanks to the deployment of ultrafast mmWave technology.

Read more »

Math Achievement Gap Widens in MassachusettsA new poll reveals a stark divide in math performance among Massachusetts students based on income. Low-income parents are less likely to report their child as 'doing well' in math compared to their higher-income counterparts. The poll also highlights disparities in access to advanced math courses, algebra, and outside math support for low-income students.

Math Achievement Gap Widens in MassachusettsA new poll reveals a stark divide in math performance among Massachusetts students based on income. Low-income parents are less likely to report their child as 'doing well' in math compared to their higher-income counterparts. The poll also highlights disparities in access to advanced math courses, algebra, and outside math support for low-income students.

Read more »